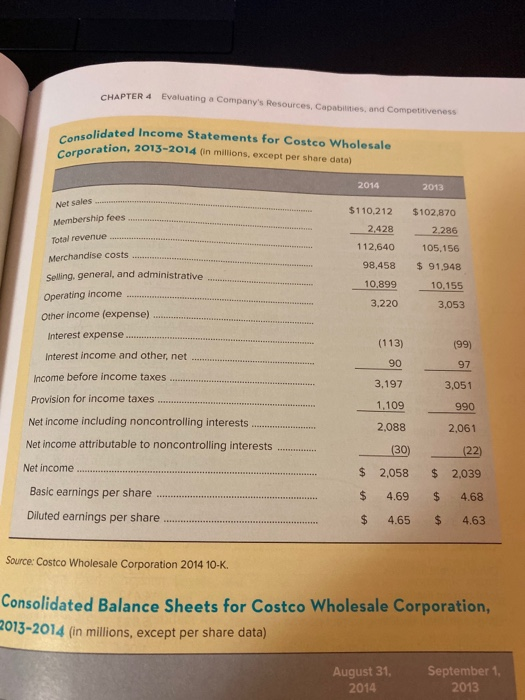

Question: CHAPTER 4 Evaluating a Company's Resources, Capabities, and Competitiveness Consolidated Income Statements for Costco Wholesale Corporation, 2013-2014 (in millions, except per share data) 2014 2013

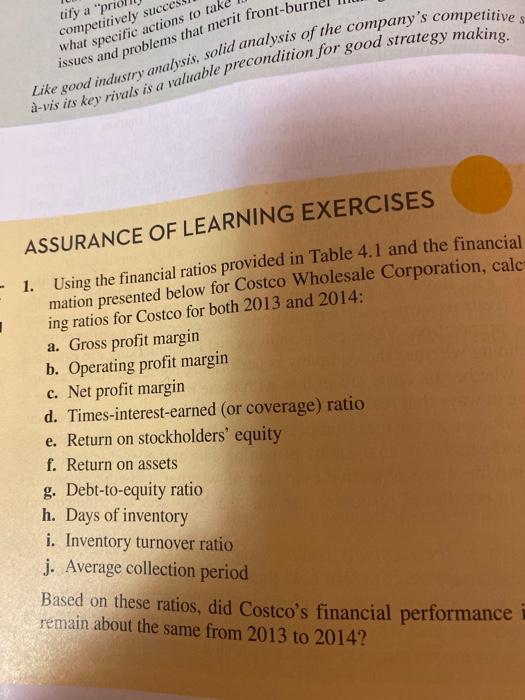

CHAPTER 4 Evaluating a Company's Resources, Capabities, and Competitiveness Consolidated Income Statements for Costco Wholesale Corporation, 2013-2014 (in millions, except per share data) 2014 2013 Net sales $110,212 $102,870 Membership fees 2,428 2,286 Total revenue 112,640 105,156 Merchandise costs 98,458 $ 91,948 Selling, general, and administrative 10.899 10,155 Operating income 3,220 3,053 Other income (expense) Interest expense (113) (99) Interest income and other, net 90 97 Income before income taxes 3,197 3,051 Provision for income taxes 1,109 990 Net income including noncontrolling interests 2,088 2,061 Net income attributable to noncontrolling interests (30) (22) .......... Net income $ 2,058 $ 2,039 Basic earnings per share %$4 4.69 %24 4.68 Diluted earnings per share 24 %24 4.65 4.63 Source: Costco Wholesale Corporation 2014 10-K. Consolidated Balance Sheets for Costco Wholesale Corporation, 2013-2014 (in millions, except per share data) August 31, 2014 September 1, 2013 tify a "pric competitively what specific actions to tak issues and problems that merit front-bu succes Like good industry analysis, solid analysis of the company's competitive s -vis its key rivals is a valuable precondition for good strategy making. ASSURANCE OF LEARNING EXERCISES 1. Using the financial ratios provided in Table 4.1 and the financial mation presented below for Costco Wholesale Corporation, calc ing ratios for Costco for both 2013 and 2014: a. Gross profit margin b. Operating profit margin c. Net profit margin d. Times-interest-earned (or coverage) ratio e. Return on stockholders' equity f. Return on assets g. Debt-to-equity ratio h. Days of inventory i. Inventory turnover ratio j. Average collection period Based on these ratios, did Costco's financial performance i remain about the same from 2013 to 2014

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts