Question: Chapter 4 Financial Statement Analysis Find The Backup Zone's return on equity for Years 1 and 2 using the owners' equity figure at the end

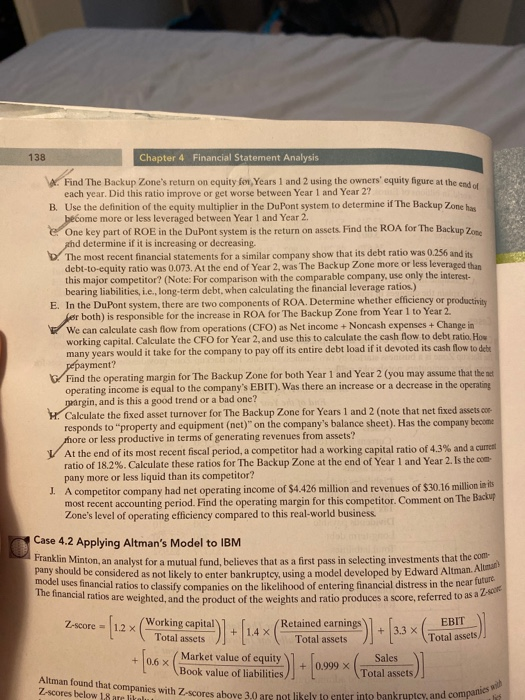

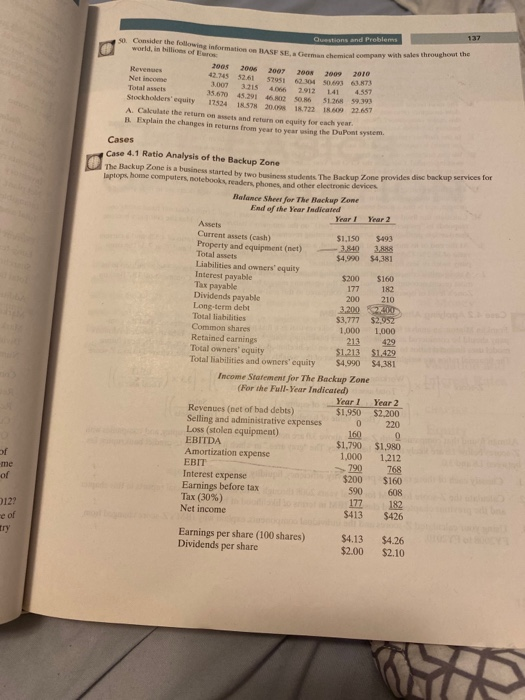

Chapter 4 Financial Statement Analysis Find The Backup Zone's return on equity for Years 1 and 2 using the owners' equity figure at the end each year. Did this ratio improve or get worse between Year 1 and Year 2? B. Use the definition of the equity multiplier in the DuPont system to determine if The Backup Zone become more or less leveraged between Year 1 and Year 2. e One key part of ROE in the DuPont system is the return on assets. Find the ROA for The Backup Zo and determine if it is increasing or decreasing. D. The most recent financial statements for a similar company show that its debt ratio was 0.256 and its debt-to-equity ratio was 0.073. At the end of Year 2, was The Backup Zone more or less leveraged than this major competitor? (Note: For comparison with the comparable company, use only the interest bearing liabilities, i.e., long-term debt, when calculating the financial leverage ratios.) E In the DuPont system, there are two components of ROA. Determine whether efficiency of productivity fer both) is responsible for the increase in ROA for The Backup Zone from Year 1 to Year 2 We can calculate cash flow from operations (CFO) as Net income Noncash expenses + Change in working capital. Calculate the CFO for Year 2, and use this to calculate the cash flow to debt ratio. How many years would it take for the company to pay off its entire debt load if it devoted its cash flow to del pepayment? Find the operating margin for The Backup Zone for both Year 1 and Year 2 (you may assume that the operating income is equal to the company's EBIT). Was there an increase or a decrease in the operating pargin, and is this a good trend or a bad one? W. Calculate the fixed asset turnover for The Backup Zone for Years 1 and 2 (note that net fixed assets.co responds to "property and equipment (net)" on the company's balance sheet). Has the company become more or less productive in terms of generating revenues from assets? V At the end of its most recent fiscal period, a competitor had a working capital ratio of 4,3% and a curtel ratio of 18.2%. Calculate these ratios for The Backup Zone at the end of Year 1 and Year 2. Is the con pany more or less liquid than its competitor? I. A competitor company had net operating income of $4.426 million and revenues of $30.16 million in its most recent accounting period. Find the operating margin for this competitor. Comment on The Backup Zone's level of operating efficiency compared to this real-world business Case 4.2 Applying Altman's Model to IBM Franklin Minton, an analyst for a mutual fund, believes that as a first pass in selecting investments that the com pany should be considered as not likely to enter bankrunty, using a model developed by Edward Altman. All model uses financial ratios to classify The financial hinancial ratios to classify companies on the likelihood of entering financial distress in the near mehnancial ratios are weighted, and the product of the weights and ratio produces a score, referred to rd Altman. Al eferred to as a Z. Retained earnings + 3.3 x Z-score - 1.2 (Working capital 1.. 1 Total assets) *11* Total assets Market value of equity Book value of liabilities/] 1 EBIT Total assets/ +0.6 x Book value of liab ( Sales Total assets/ Altman found that companies with Zscores above 303 Z-scores below 1 Z-scores above 3.0 are not likely to enter into bankruptcy and companic mpanies Questions and Problems so Consider the follow world, in billion information on BAS SEG i a n y with sales throughout the 2005 2006 y 2008 2009 2010 Revenues Net Income 57051 62304 50.00 63.873 3.007 335 4066 2912414557 Total assets 35.670 45.291 . 5 59.393 Stockholders equity 1754 17 20 18.722 I 922.657 A C ate the return on and return on equity for each year Explain the changes in returns from wear to year wing the DuPont system. Cases Case 4.1 Ratio Analysis of the Backup Zone The Backup Zone is a business started by Backup Zone provides disc backup Service Laptops home computers, notebooks readers ha nd other electronic devices Balance Sheet for The Rackup Zone End of the Year Indicated Yearl Year 2 Assets Current assets (cash) $1,150 $493 Property and equipment (net) 380 388 Total assets $4.990 $4,381 Liabilities and ownersequity Interest payable $200 $160 Thx payable 177 182 Dividends payable 200) 210 Long-term debt 3.200 2000 Total liabilities $3.777 $2.952 Common shares 1.000 1.000 Retained earnings 213 429 Total owners' equity $1.213 $1.429 Total liabilities and owners' equity $4.990 $4,381 Income Statement for The Backup Zone (For the Full-Year indicated) Yearl Year 2 Revenues (net of bad debts) $1,950 $2.200 Selling and administrative expenses 0 220 Loss (stolen equipment) 160 EBITDA $1.790 $1,980 Amortization expense 1,000 1,212 EBIT 790 768 Interest expenses $200 $160 Earnings before tax 590 608 Tax (30%) 182 Net income $413 $426 122 Earnings per share (100 shares) Dividends per share $4.13 $2.00 $4.26 $2.10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts