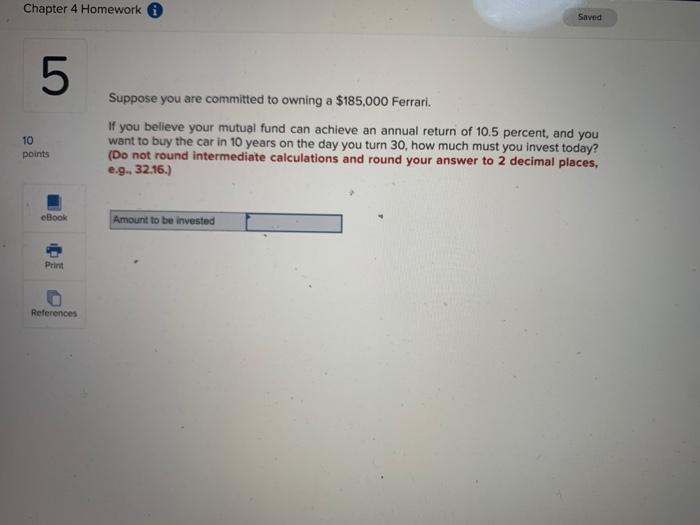

Question: Chapter 4 Homework i Saved 5 Suppose you are committed to owning a $185,000 Ferrari. If you believe your mutual fund can achieve an annual

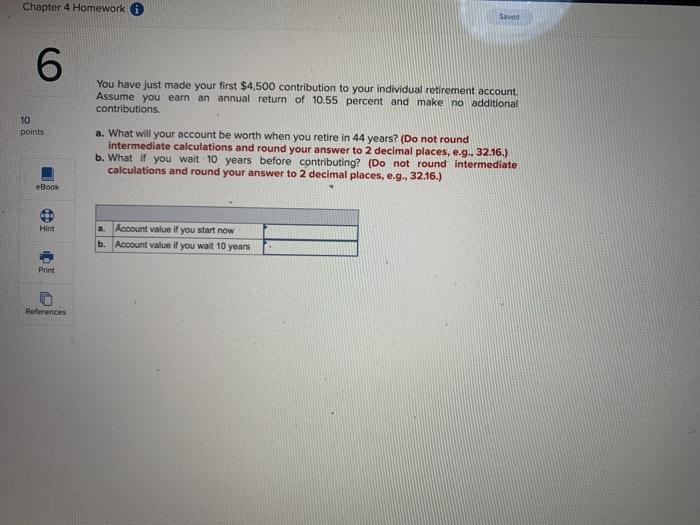

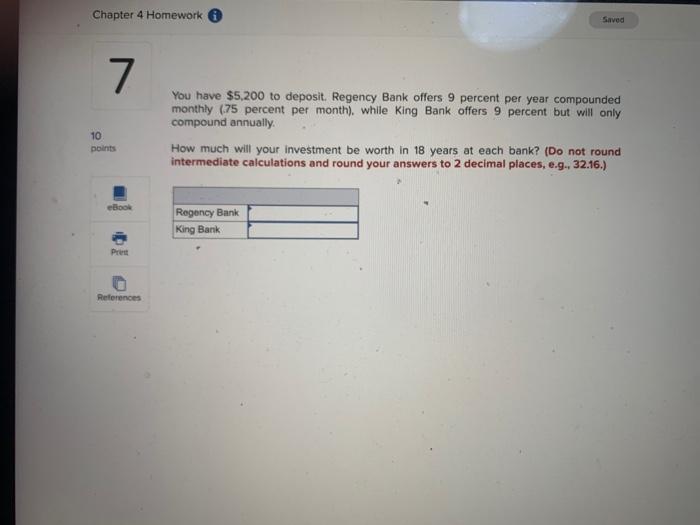

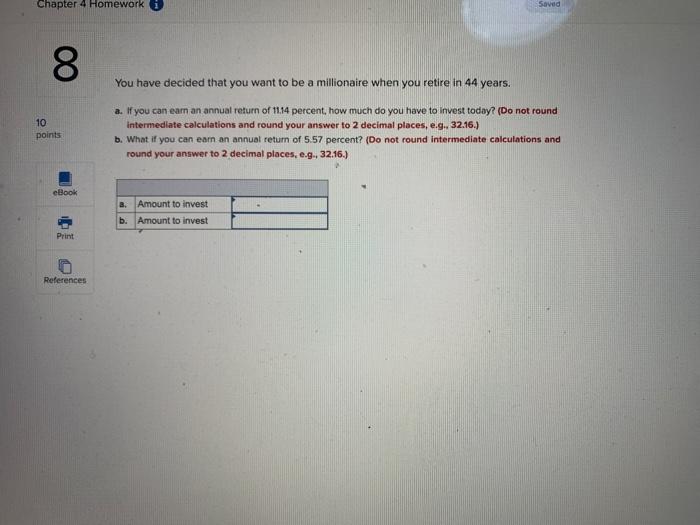

Chapter 4 Homework i Saved 5 Suppose you are committed to owning a $185,000 Ferrari. If you believe your mutual fund can achieve an annual return of 10.5 percent, and you want to buy the car in 10 years on the day you turn 30, how much must you invest today? (Do not round intermediate calculations and round your answer to 2 decimal places, e... 32.16.) 10 points eBook Amount to be invested Print References Chapter 4 Homework Saved 6 You have just made your first $4,500 contribution to your individual retirement account. Assume you earn an annual return of 10.55 percent and make no additional contributions 10 points a. What will your account be worth when you retire in 44 years? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g.. 32.16.) b. What if you wait 10 years before contributing? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) eBook Hint a Account value if you start now Account value if you wait 10 years b. Print References Chapter 4 Homework Saved 7 You have $5,200 to deposit. Regency Bank offers 9 percent per year compounded monthly (75 percent per month), while King Bank offers 9 percent but will only compound annually How much will your investment be worth in 18 years at each bank? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) 10 points eBook Regency Bank King Bank References Chapter 4 Homework Saved 8 You have decided that you want to be a millionaire when you retire in 44 years. 10 points a. If you can earn an annual return of 11.14 percent, how much do you have to invest today? (Do not round Intermediate calculations and round your answer to 2 decimal places, e.g. 32.16.) b. What if you can earn an annual return of 5.57 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) eBook Amount to invest Amount to invest b. Print References

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts