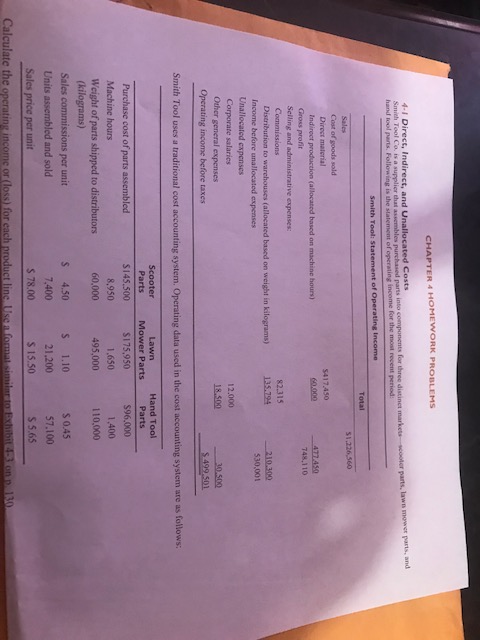

Question: CHAPTER 4 HOMEWORK PROBLEMS parts, and Smith Tool Co. is a supplier that assembles purchased parss into components for the most recent period Smith Tool:

CHAPTER 4 HOMEWORK PROBLEMS parts, and Smith Tool Co. is a supplier that assembles purchased parss into components for the most recent period Smith Tool: Statement of Operating t 51.226,560 Cost of goods sold 5417.450 Indirect production (allocated based on machine hours) Gross profr 748,110 Seiling and administrative expenses: Commissions 82.315 Distribution to warchouses (allocated based on weight in kilograms) Income before unallocated expenses Unallocated expenses Corporate salaries Other general expenses 210.300 530,001 12.000 18.500 Operating income before taxes $499.501 Smith Tool uses a traditional cost accounting system. Operating data used in the cost accounting system are as follows Scooter Parts Hand Tool Lawn Mower Parts $175,950 Parts Purchase cost of parts assembled Machine hours Weight of parts shipped to distributors (kilograms) S96,000 1.400 110,000 S145.500 8,950 1,650 60,000 495,000 Sales commissions per unit Units assembled and sold Sales price per unit S 4.50s 1.10 21.200 S 15.50 7400 S 78.00 s 0.45 57.100 s 5.65 Calculate the operating income or (loss) for each product line Use a format simius to Bx

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts