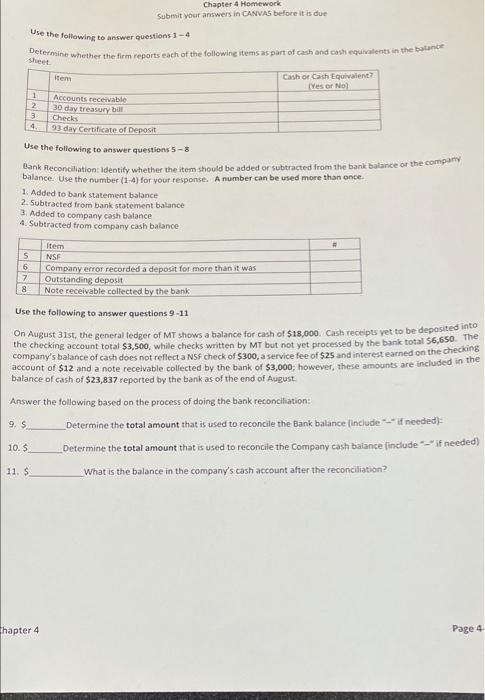

Question: Chapter 4 Homework Submit your answers in CANVAS before it is due Use the following to answer questions 1-4 Determine whether the firm reports each

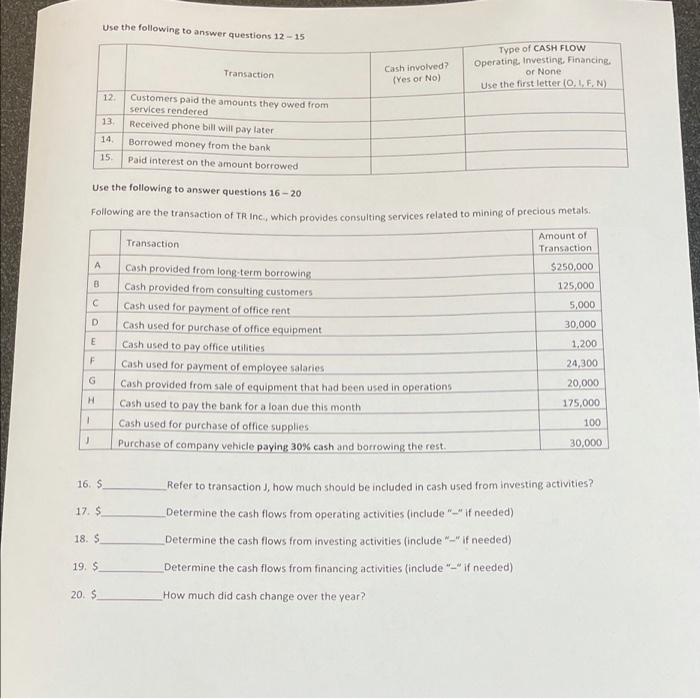

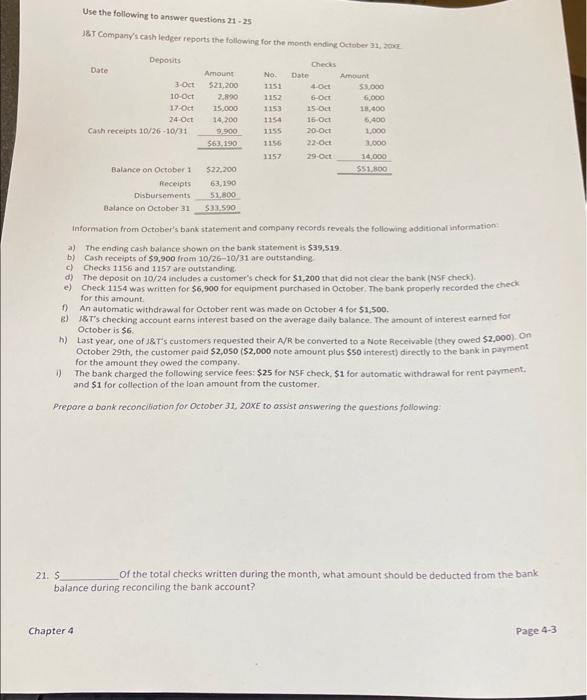

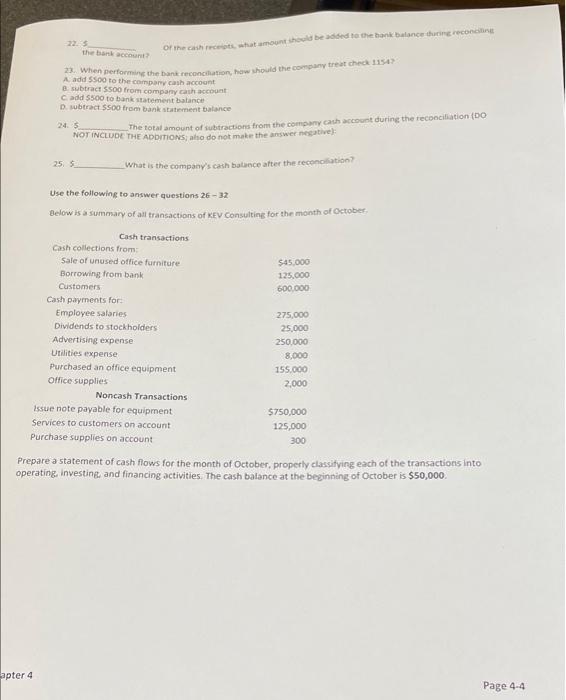

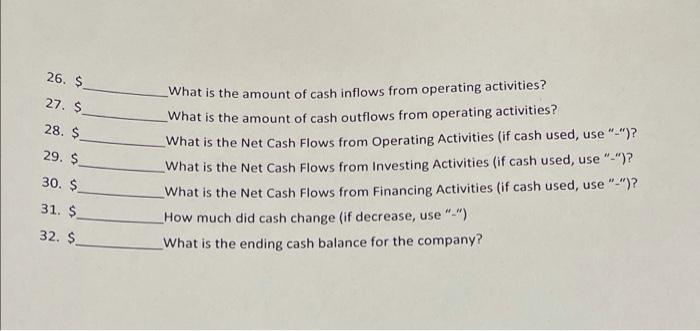

Chapter 4 Homework Submit your answers in CANVAS before it is due Use the following to answer questions 1-4 Determine whether the firm reports each of the following items as part of cash and cash equatents in the balance item Cash or Cash Equivalent? Ves or No 1 2 3 4 Accounts receivable 30 day treasury hill checks 93 day Certificate of Deposit Use the following to answer questions 5-8 Bank Reconciliation: Identify whether the item should be added or subtracted from the bank balance or the company balance. Use the number (1-4) for your response. A number can be used more than once. 1. Added to bank statement balance 2. Subtracted from bank statement balance 3. Added to company cash balance 4. Subtracted from company cash balance # 5 6 7 8 Item NSE Company error recorded a deposit for more than it was Outstanding deposit Note receivable collected by the bank Use the following to answer questions 9-11 On August 31st, the general ledger of MT shows a balance for cash of $18,000 Cash receipts yet to be deposited into the checking account total $3,500, while checks written by MT but not yet processed by the bank total 56,650. The company's balance of cash does not reflecta NSF check of $300, a service fee of $25 and interest earned on the checking account of $12 and a note receivable collected by the bank of $3,000, however, these amounts are included in the balance of cash of $23,837 reported by the bank as of the end of August. Answer the following based on the process of doing the bank reconciliation: 9.5 Determine the total amount that is used to reconcile the Bank balance (include is needed): 10. $ Determine the total amount that is used to reconcile the Company cash balance include if needed) 11. $ What is the balance in the company's cash account after the reconciliation? Chapter 4 Page 4 Use the following to answer questions 12-15 Type of CASH FLOW Operating Investing Financing or None Use the first letter (0.1, FN) Transaction Cash involved? (Yes or No) 12 13 14 15 Customers paid the amounts they owed from services rendered Received phone bill will pay later Borrowed money from the bank Paid interest on the amount borrowed Use the following to answer questions 16-20 Following are the transaction of TR Inc, which provides consulting services related to mining of precious metals. Transaction Amount of Transaction A B $250,000 125,000 5,000 30,000 D E 1,200 F Cash provided from long-term borrowing Cash provided from consulting customers Cash used for payment of office rent Cash used for purchase of office equipment Cash used to pay office utilities Cash used for payment of employee salaries Cash provided from sale of equipment that had been used in operations Cash used to pay the bank for a loan due this month Cash used for purchase of office supplies. Purchase of company vehicle paying 30% cash and borrowing the rest. 24,300 20,000 175,000 100 H 1 30,000 16. S 17. $ 18. S Refer to transaction , how much should be included in cash used from investing activities? Determine the cash flows from operating activities (include "_" if needed) Determine the cash flows from investing activities (include="if needed) Determine the cash flows from financing activities (include "-"if needed) How much did cash change over the year? 19. S 20. $ Use the following to answer questions 21-25 J&T Company's cash ledger reports the following for the month ending October 31, 2015 Depouts Date 3-Oct 10-Oct 12.Oct 24 Oct Cash receipts 10/26 -10/31 Amount 521,200 2.820 15.000 14,200 9.900 563.190 No 1151 1152 1153 Checks Date Amount 4 od 53,000 6-Oct 6,000 15-0 18,000 16 Oct 5.400 20-Oct 1.000 22-Oct 3.000 29-Oct 14.000 55100 1155 1156 1157 Balance on October 1 Receipts Disbursements Balance on October 31 $22.200 63.190 51.300 533.590 Information from October's bank statement and company records reveals the following additional information c) a) The ending cash balance shown on the bank statement is $39,519 b) Cash receipts of $9.900 from 10/26-10/31 are outstanding Checks 1156 and 1157 are outstanding d) The deposit on 10/24 includes a customer's check for $1,200 that did not clear the bank (NSF check) e) Check 1154 was written for $6,900 for equipment purchased in October. The bank properly recorded the check for this amount An automatic withdrawal for October rent was made on October 4 for $1,500. BI&T's checking account earns interest based on the average daily balance. The amount of interest earned for October is $6 h) Last year, one of J&r's customers requested their A/R be converted to a Note Receivable (they owed $2,000) on October 29th, the customer paid $2,050 ($2,000 note amount plus $interest) directly to the bank in payment for the amount they owed the company, 0 The bank charged the following service fees $25 for NSF check. $1 for automatic withdrawal for rent payment and $1 for collection of the loan amount from the customer. Prepare a bank reconciliation for October 31, 20XE to assist answering the questions following: 21. S of the total checks written during the month, what amount should be deducted from the bank balance during reconciling the bank account? Chapter 4 Page 4-3 the bank account? of the cash recht amount should be dided to the honkbalance sharing reconciling Add SSoo to the company cash account 2. When performing the bank reconcitation, how should the company treat check 11547 B. subtract S500 from company cash account Cadd 5500 to bank statement balance D. subtract 5500 from bank statement balance 24. S The total amount of subtractions from the company cash account during the reconciliation (DO NOT INCLUDE THE ADDITIONS also do not make the answer negative 25 What is the company's cash balance after the reconciation? Use the following to answer questions 26 - 32 Below is a summary of all transactions of KEV Consulting for the month of October Cash transactions Cash collections from Sale or unused office furniture $45.000 Borrowing from bank 125.000 Customers 600.000 Cash payments for: Employee salaries 275.000 Dividends to stockholders 25.000 Advertising expense 250.000 Utilities expense 8,000 Purchased an office equipment 155.000 Office supplies 2,000 Noncash Transactions Issue note payable for equipment $750,000 Services to customers on account 125,000 Purchase supplies on account Prepare a statement of cash flows for the month of October, property classifying each of the transactions into operating Investing and financing activities. The cash balance at the beginning of October is $50,000 300 apter 4 Page 4-4 26. $ 27. $ 28. $ 29. $ What is the amount of cash inflows from operating activities? What is the amount of cash outflows from operating activities? What is the Net Cash Flows from Operating Activities (if cash used, use "-")? What is the Net Cash Flows from Investing Activities (if cash used, use "-")? What is the Net Cash Flows from Financing Activities (if cash used, use "-")? How much did cash change (if decrease, use".") What is the ending cash balance for the company? 30. $ 31. $ 32. $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts