Question: Chapter 8 Homework Submit your answers in CANVAS before it is due Use the following to answer questions 1 - 5 Select the correct reporting

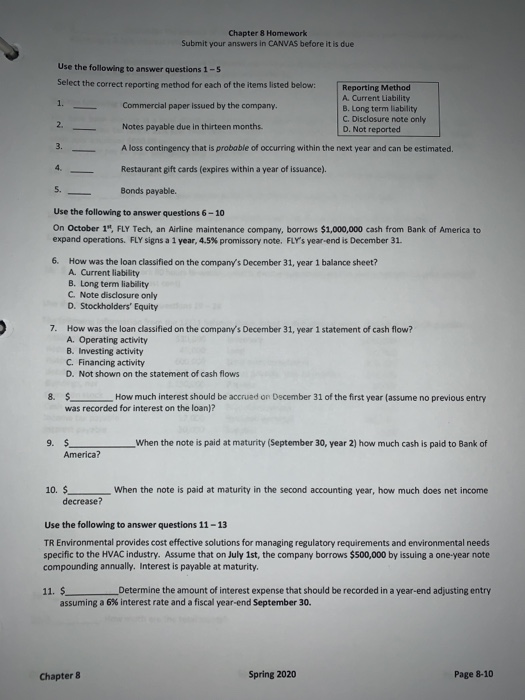

Chapter 8 Homework Submit your answers in CANVAS before it is due Use the following to answer questions 1 - 5 Select the correct reporting method for each of the items listed below: Commercial paper issued by the company. Reporting Method A Current Liability B. Long term liability C Disclosure note only D. Not reported Notes payable due in thirteen months A loss contingency that is probable of occurring within the next year and can be estimated Restaurant gift cards (expires within a year of issuance). Bonds payable. Use the following to answer questions 6-10 On October 1", FLY Tech, an Airline maintenance company, borrows $1,000,000 cash from Bank of America to expand operations. FLY signs a 1 year, 4.5X promissory note. FLY's year-end is December 31. 6. How was the loan classified on the company's December 31, year 1 balance sheet? A. Current liability B. Long term liability C. Note disclosure only D. Stockholders' Equity 7. How was the loan classified on the company's December 31, year 1 statement of cash flow? A. Operating activity B. Investing activity C. Financing activity D. Not shown on the statement of cash flows 8. S How much interest should be accrued on December 31 of the first year (assume no previous entry was recorded for interest on the loan)? 9. When the note is paid at maturity (September 30, year 2) how much cash is paid to Bank of $ America? When the note is paid at maturity in the second accounting year, how much does net income 10. $ decrease? Use the following to answer questions 11-13 TR Environmental provides cost effective solutions for managing regulatory requirements and environmental needs specific to the HVAC industry. Assume that on July 1st, the company borrows $500,000 by issuing a one-year note compounding annually. Interest is payable at maturity. 11. $ Determine the amount of interest expense that should be recorded in a year-end adjusting entry assuming a 6% interest rate and a fiscal year-end September 30. Chapter 8 Spring 2020 Page 8-10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts