Question: CHAPTER 5 - EXERCISE 1. Hassan has just won a prize of RM10,000. He wants to finance the future study of his newly born daughter

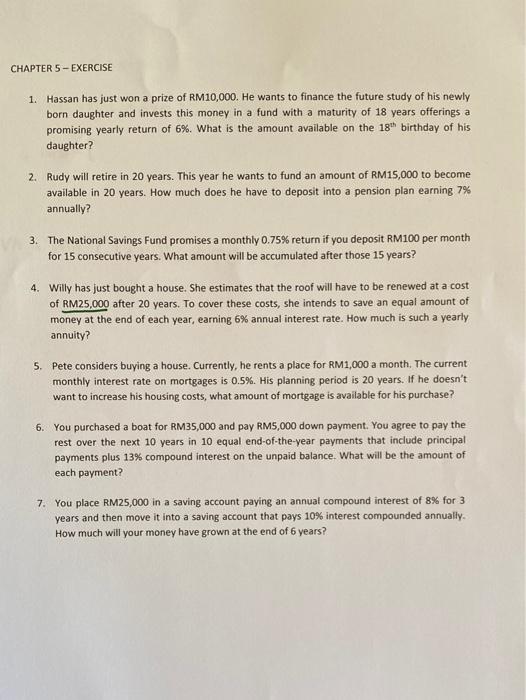

CHAPTER 5 - EXERCISE 1. Hassan has just won a prize of RM10,000. He wants to finance the future study of his newly born daughter and invests this money in a fund with a maturity of 18 years offerings a promising yearly return of 6%. What is the amount available on the 18th birthday of his daughter? 2. Rudy will retire in 20 years. This year he wants to fund an amount of RM15,000 to become available in 20 years. How much does he have to deposit into a pension plan earning 7% annually? 3. The National Savings Fund promises a monthly 0.75% return if you deposit RM100 per month for 15 consecutive years. What amount will be accumulated after those 15 years? 4. Willy has just bought a house. She estimates that the roof will have to be renewed at a cost of RM25,000 after 20 years. To cover these costs, she intends to save an equal amount of money at the end of each year, earning 6% annual interest rate. How much is such a yearly annuity? 5. Pete considers buying a house. Currently, he rents a place for RM1,000 a month. The current monthly interest rate on mortgages is 0.5%. His planning period is 20 years. If he doesn't want to increase his housing costs, what amount of mortgage is available for his purchase? 6. You purchased a boat for RM35,000 and pay RM5,000 down payment. You agree to pay the rest over the next 10 years in 10 equal end-of-the-year payments that include principal payments plus 13% compound interest on the unpaid balance. What will be the amount of each payment? 7. You place RM25,000 in a saving account paying an annual compound interest of 8% for 3 years and then move it into a saving account that pays 10% interest compounded annually. How much will your money have grown at the end of 6 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts