Question: Chapter 5 Homework Download this document and complete the homework questions. Then turn the completed homework file in through Brightspace. Show your work where appropriate

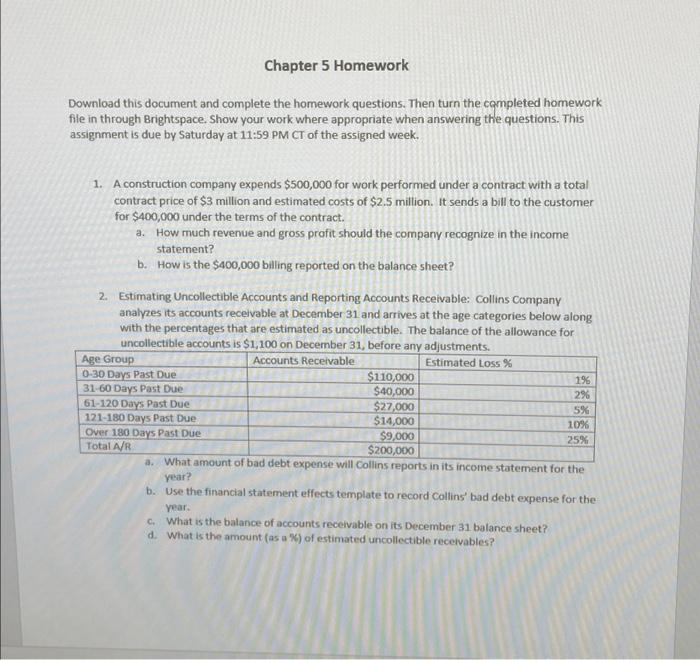

Download this document and complete the homework questions. Then turn the completed homework file in through Brightspace. Show your work where appropriate when answering the questions. This assignment is due by Saturday at 11:59 PM CT of the assigned week. 1. A construction company expends $500,000 for work performed under a contract with a total contract price of $3 million and estimated costs of $2.5 million. It sends a bill to the customer for $400,000 under the terms of the contract. a. How much revenue and gross profit should the compary recognize in the income statement? b. How is the $400,000 billing reported on the balance sheet? 2. Estimating Uncollectible Accounts and Reporting Accounts Receivable: Collins Company analyzes its accounts receivable at December 31 and arrives at the age categories below along with the percentages that are estimated as uncollectible. The balance of the allowance for uncollectible accounts is $1,100 on December 31 , before anv adiustments. a. What amount of bad debt expense will Collins reports in its income statement for the year? b. Use the financial statement effects template to record collin' bad debt expense for the vear. c. What is the balance of accounts recervable on its December 31 balance sheet? d. What is the amount (as a \%) of estimated uncollectible receivables

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts