Question: Chapter 6 Homework Download this document and complete the homework questions. Then turn the completed homework file in through Brightspace. Show your work where appropriate

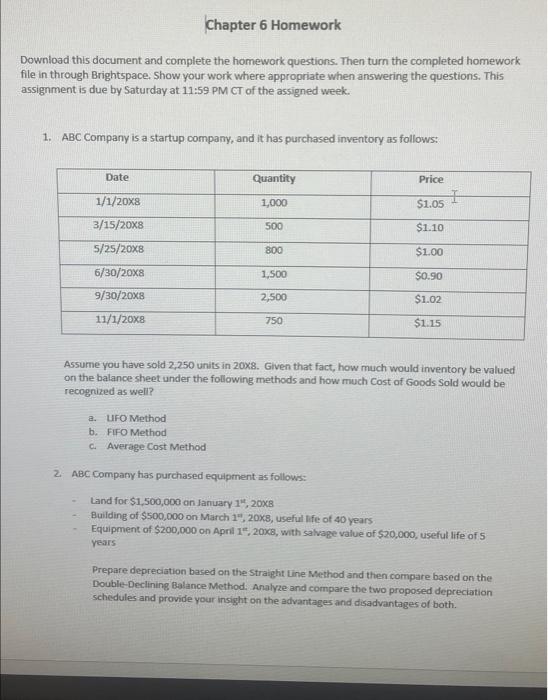

Download this document and complete the homework questions. Then turn the completed homework file in through Brightspace. Show your work where appropriate when answering the questions. This assignment is due by Saturday at 11:59 PM CT of the assigned week. 1. ABC Company is a startup company, and it has purchased inventory as follows: Assume you have sold 2,250 units in 20x8. Given that fact, how much would inventory be valued on the balance sheet under the following methods and how much cost of Goods Sold would be recognized as well? a. UFo Method b. Fifo Method c. Average Cost Method 2. ABC Compary has purchased equipenent as follows: - Land for $1,500,000 on January 110,,208 - Building of $500,000 on March 1,208, useful life of 40 years - Equipment of $200,000 on April 1e,2008, with salvage value of $20,000, useful life of 5 vears Prepare depreciation based on the Straight tine Method and then compare based on the Double-Declining Balance Method. Analyze and compare the two proposed depreciation schedules and provide your insight on the advantages and disadvantages of both. Download this document and complete the homework questions. Then turn the completed homework file in through Brightspace. Show your work where appropriate when answering the questions. This assignment is due by Saturday at 11:59 PM CT of the assigned week. 1. ABC Company is a startup company, and it has purchased inventory as follows: Assume you have sold 2,250 units in 20x8. Given that fact, how much would inventory be valued on the balance sheet under the following methods and how much cost of Goods Sold would be recognized as well? a. UFo Method b. Fifo Method c. Average Cost Method 2. ABC Compary has purchased equipenent as follows: - Land for $1,500,000 on January 110,,208 - Building of $500,000 on March 1,208, useful life of 40 years - Equipment of $200,000 on April 1e,2008, with salvage value of $20,000, useful life of 5 vears Prepare depreciation based on the Straight tine Method and then compare based on the Double-Declining Balance Method. Analyze and compare the two proposed depreciation schedules and provide your insight on the advantages and disadvantages of both

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts