Question: Chapter 5 Homework eBook Problem 5-29 Charitable Contributions (LO 5.9) Doran made the following contributions during 2023: His synagogue (by check) $4,600 The Republican Party

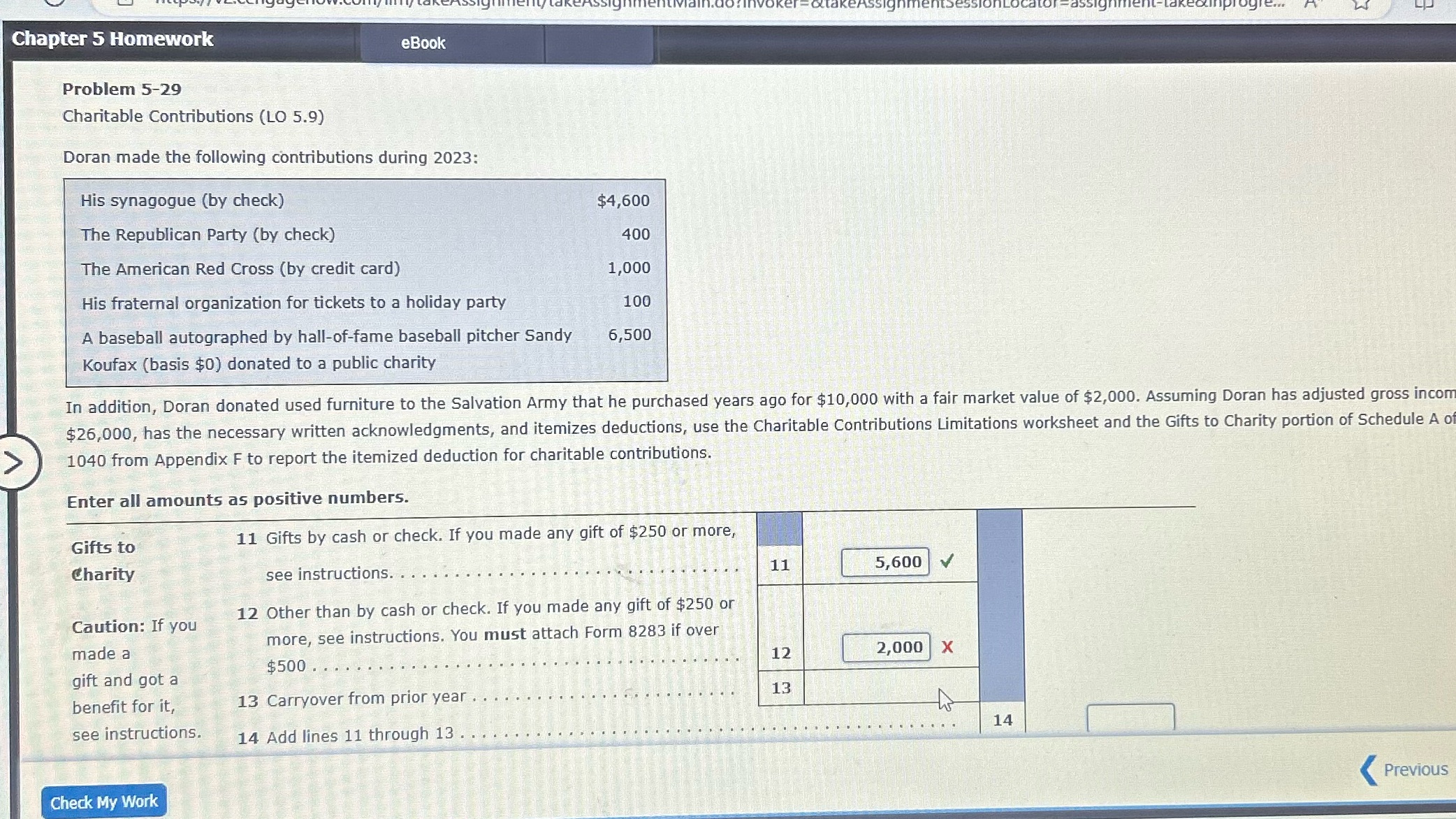

Chapter 5 Homework eBook Problem 5-29 Charitable Contributions (LO 5.9) Doran made the following contributions during 2023: His synagogue (by check) $4,600 The Republican Party (by check) 400 The American Red Cross (by credit card) 1,000 His fraternal organization for tickets to a holiday party 100 A baseball autographed by hall-of-fame baseball pitcher Sandy 6,500 Koufax (basis $0) donated to a public charity In addition, Doran donated used furniture to the Salvation Army that he purchased years ago for $10,000 with a fair market value of $2,000. Assuming Doran has adjusted gross incom $26,000, has the necessary written acknowledgments, and itemizes deductions, use the Charitable Contributions Limitations worksheet and the Gifts to Charity portion of Schedule A of 1040 from Appendix F to report the itemized deduction for charitable contributions. Enter all amounts as positive numbers. Gifts to 11 Gifts by cash or check. If you made any gift of $250 or more, Charity see instructions. . 11 5,600 V Caution: If you 12 Other than by cash or check. If you made any gift of $250 or more, see instructions. You must attach Form 8283 if over made a 12 2,000 X $500 . . gift and got a benefit for it, 13 Carryover from prior year . . 13 see instructions. 14 Add lines 11 through 13 14 Previous Check My Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts