Question: Chapter 5 Itemized Deductions EA LO 5 - 5 6 3 . Reynaldo and Sonya, a married couple, had flood damage in their home due

Chapter Itemized Deductions

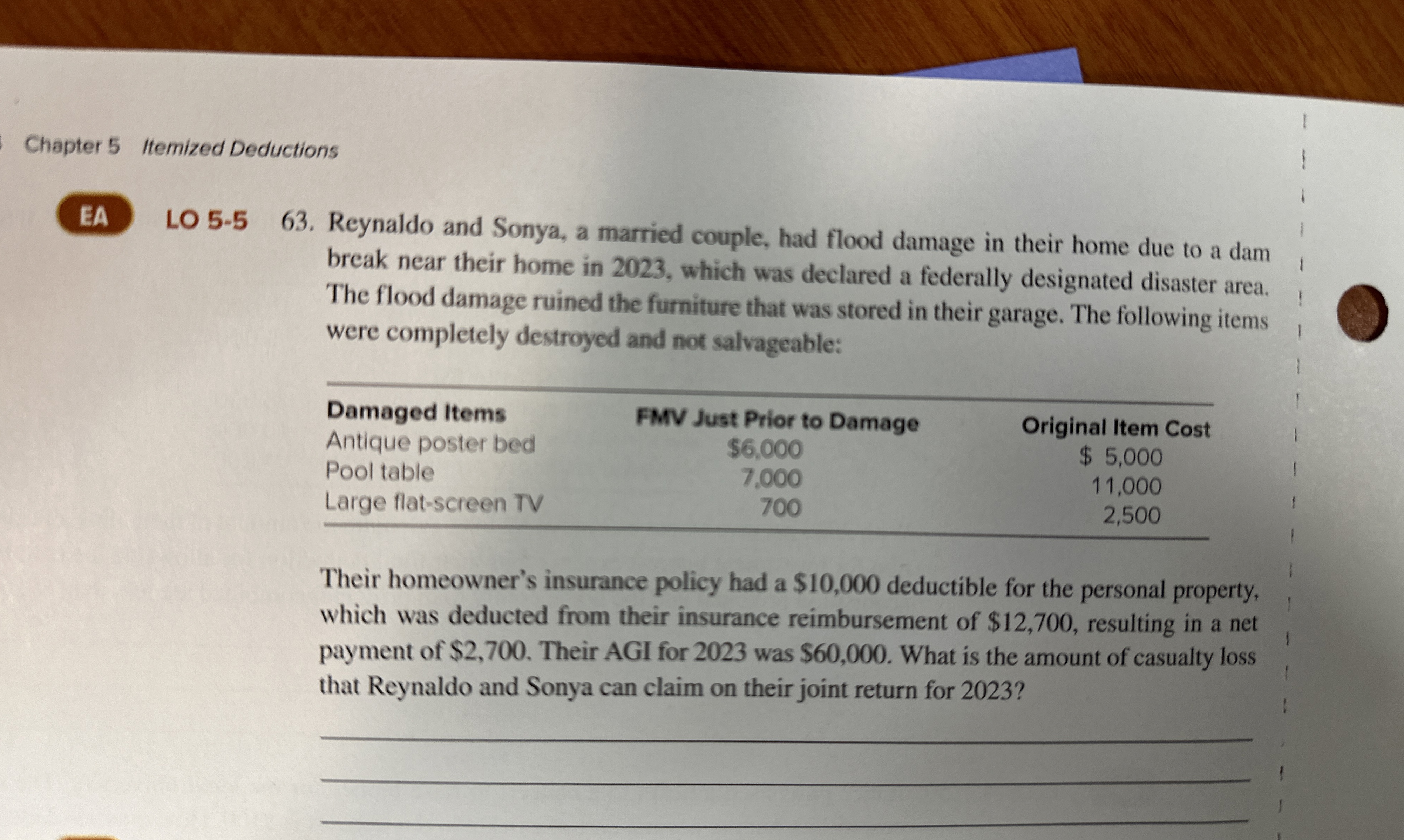

EA LO Reynaldo and Sonya, a married couple, had flood damage in their home due to a dam

break near their home in which was declared a federally designated disaster area.

The flood damage ruined the furniture that was stored in their garage. The following items

were completely destroyed and not salvageable:

Their homeowner's insurance policy had a $ deductible for the personal property,

which was deducted from their insurance reimbursement of $ resulting in a net

payment of $ Their AGI for was $ What is the amount of casualty loss

that Reynaldo and Sonya can claim on their joint return for

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock