Question: Chapter 5 Time Value of Money Problems Set R Data To what amounts will the following investments accumulate? A . $ 3 6 , 4

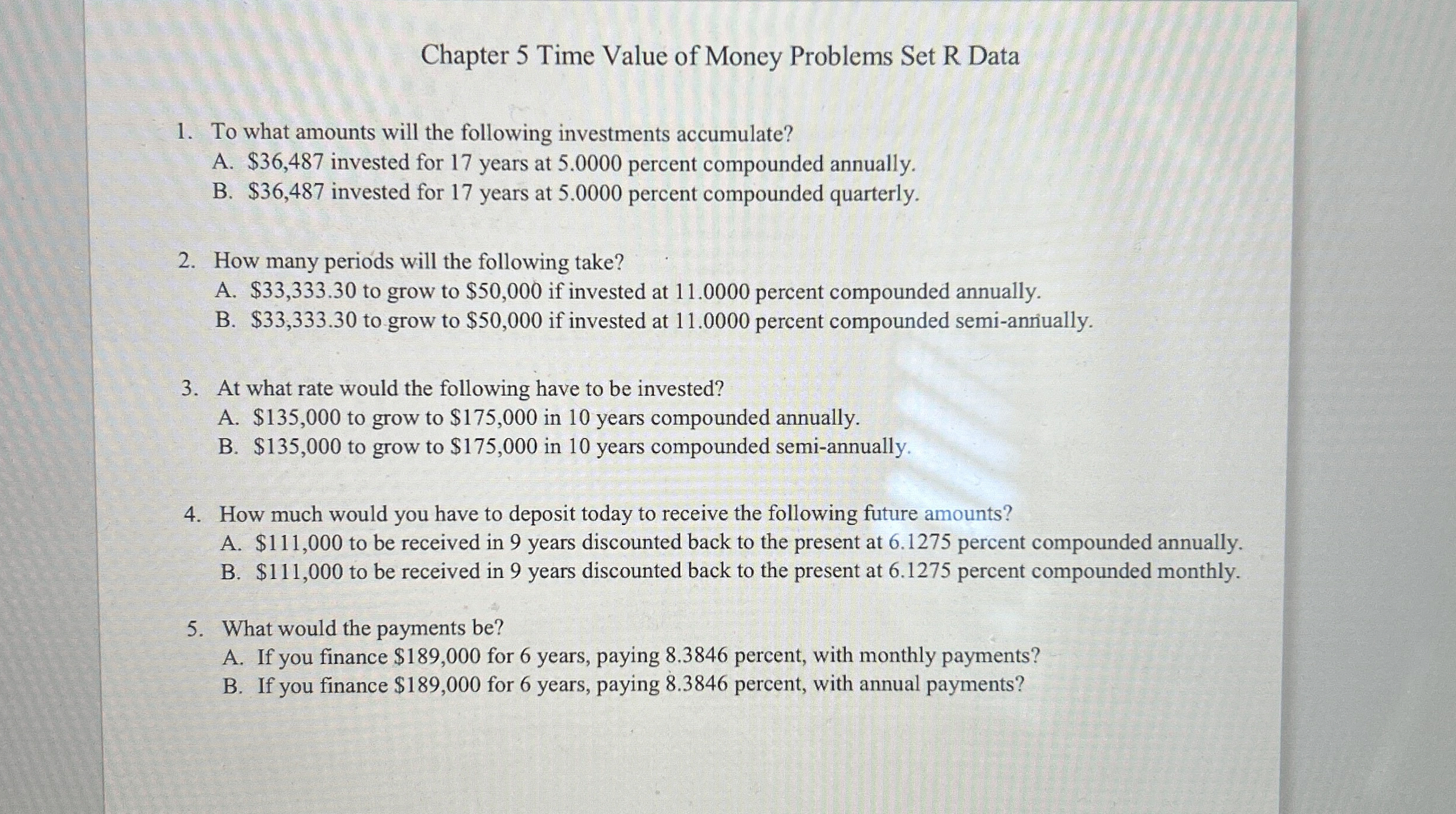

Chapter Time Value of Money Problems Set R Data

To what amounts will the following investments accumulate?

A $ invested for years at percent compounded annually.

B $ invested for years at percent compounded quarterly.

How many periods will the following take?

A $ to grow to $ if invested at percent compounded annually.

B $ to grow to $ if invested at percent compounded semiannually.

At what rate would the following have to be invested?

A $ to grow to $ in years compounded annually.

B $ to grow to $ in years compounded semiannually.

How much would you have to deposit today to receive the following future amounts?

A $ to be received in years discounted back to the present at percent compounded annually.

B $ to be received in years discounted back to the present at percent compounded monthly.

What would the payments be

A If you finance $ for years, paying percent, with monthly payments?

B If you finance $ for years, paying percent, with annual payments?Chapter Time Value of Money Problems Set R Data

To what amounts will the following investments accumulate?

A $ invested for years at percent compounded annually.

B $ invested for years at percent compounded quarterly.

How many periods will the following take?

A $ to grow to $ if invested at percent compounded annually.

B $ to grow to $ if invested at percent compounded semiannually.

At what rate would the following have to be invested?

A $ to grow to $ in years compounded annually.

B $ to grow to $ in years compounded semiannually.

How much would you have to deposit today to receive the following future amounts?

A $ to be received in years discounted back to the present at percent compounded annually.

B $ to be received in years discounted back to the present at percent compounded monthly.

What would the payments be

A If you finance $ for years, paying percent, with monthly payments?

B If you finance $ for years, paying percent, with annual payments?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock