Question: Chapter 5 Time Value of Money Problems Set R Data To what amounts will the following investments accumulate? A . $ 3 6 , 4

Chapter Time Value of Money Problems Set R Data

To what amounts will the following investments accumulate?

A $ invested for years at percent compounded annually.

B $ invested for years at percent compounded quarterly.

How many periods will the following take?

A $ to grow to $ if invested at percent compounded annually.

B $ to grow to $ if invested at percent compounded semiannually.

At what rate would the following have to be invested?

A $ to grow to $ in years compounded annually.

B $ to grow to $ in years compounded semiannually.

How much would you have to deposit today to receive the following future amounts?

A $ to be received in years discounted back to the present at percent compounded annually.

B $ to be received in years discounted back to the present at percent compounded monthly.

What would the payments be

A If you finance $ for years, paying percent, with monthly payments?

B If you finance $ for years, paying percent, with annual payments?Chapter Time Value of Money Problems Set R Data

To what amounts will the following investments accumulate?

A $ invested for years at percent compounded annually.

B $ invested for years at percent compounded quarterly.

How many periods will the following take?

A $ to grow to $ if invested at percent compounded annually.

B $ to grow to $ if invested at percent compounded semiannually.

At what rate would the following have to be invested?

A $ to grow to $ in years compounded annually.

B $ to grow to $ in years compounded semiannually.

How much would you have to deposit today to receive the following future amounts?

A $ to be received in years discounted back to the present at percent compounded annually.

B $ to be received in years discounted back to the present at percent compounded monthly.

What would the payments be

A If you finance $ for years, paying percent, with monthly payments?

B If you finance $ for years, paying percent, with annual payments?

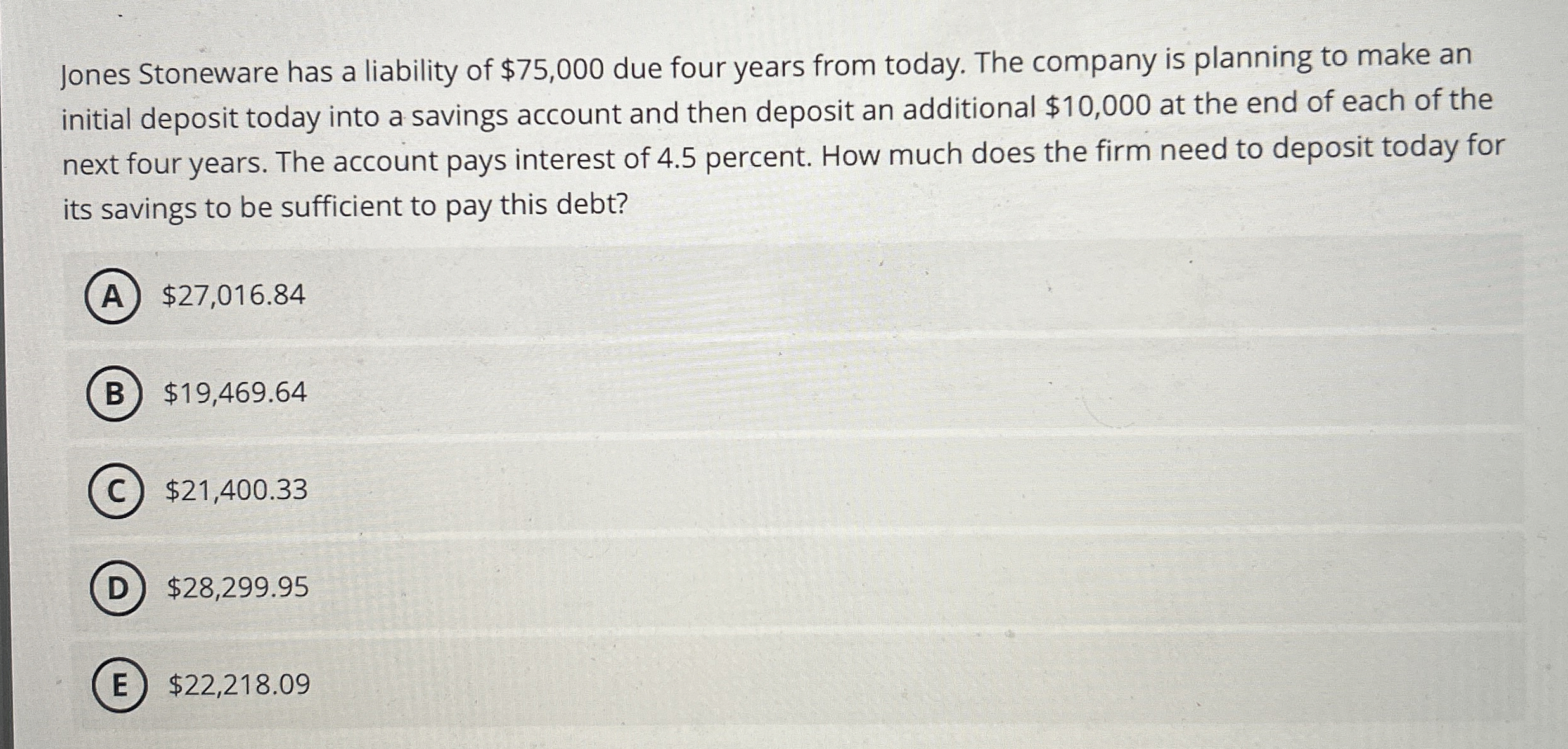

Jones Stoneware has a liability of $ due four years from today. The company is planning to make an

initial deposit today into a savings account and then deposit an additional $ at the end of each of the

next four years. The account pays interest of percent. How much does the firm need to deposit today for

its savings to be sufficient to pay this debt?

$

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock