Question: Chapter 6 1 eBook Print Item ? Example 6-4 Borden Company received a federal tax levy on John Kline. Kline is single, claims 2 dependents,

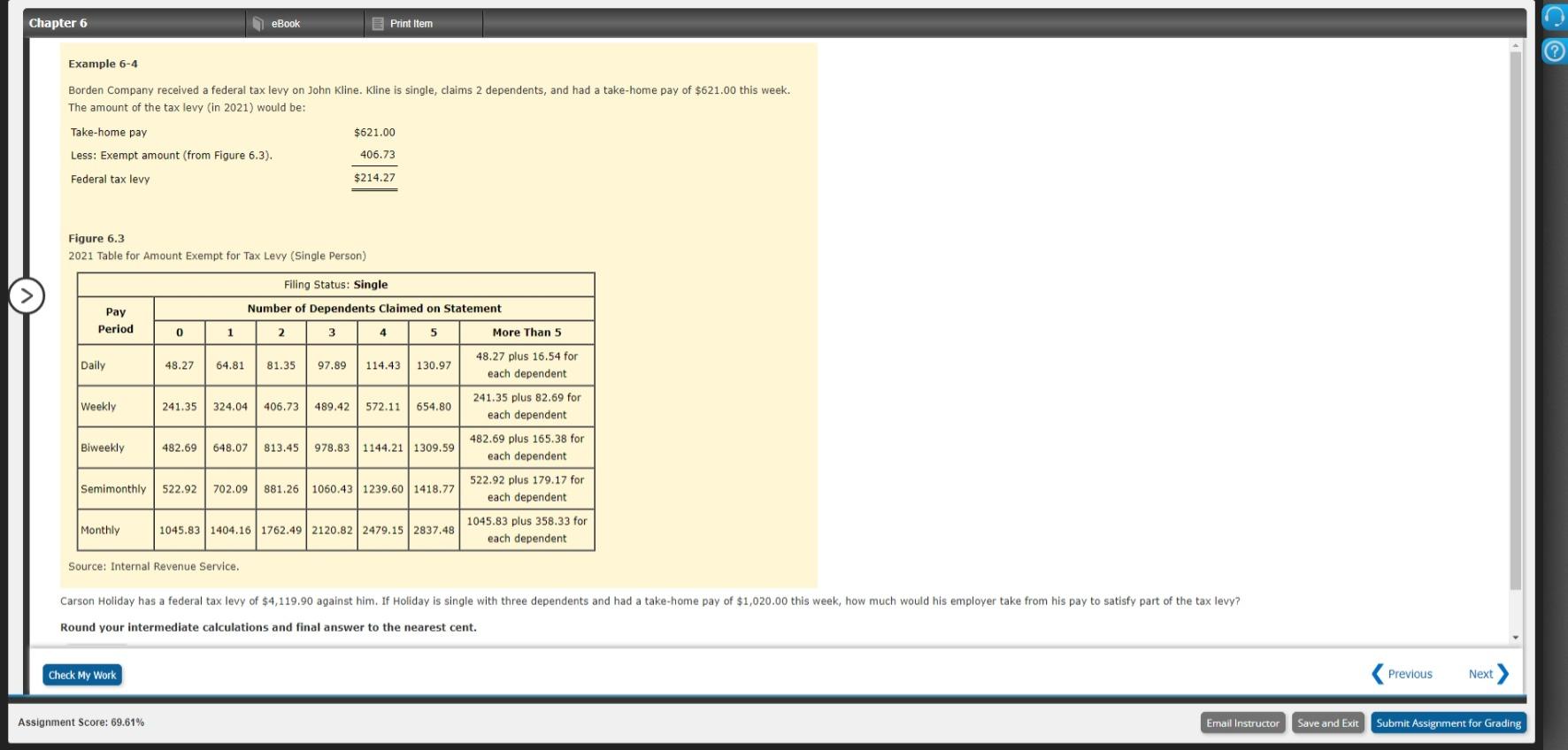

Chapter 6 1 eBook Print Item ? Example 6-4 Borden Company received a federal tax levy on John Kline. Kline is single, claims 2 dependents, and had a take-home pay of $621.00 this week. The amount of the tax levy (in 2021) would be: Take-home pay $621.00 Less: Exempt amount (from Figure 6.3). 406.73 Federal tax levy $214.27 Figure 6.3 2021 Table for Amount Exempt for Tax Levy (Single Person) Filing Status: Single Pay Number of Dependents Claimed on Statement Period 0 1 2 3 4 5 More Than 5 Daily 48.27 64.81 81.35 97.89 114.43 130.97 48.27 plus 16.54 for each dependent Weekly 241.35 324.04 406.73 489.42 572.11 654.80 241.35 plus 82.69 for each dependent Biweekly 482.69 648.07 813.45 978.83 | 1144.21 | 1309.59 144. 482.69 plus 165.38 for each dependent Semimonthly 522.92 702.09 881.26 1060.43 1239.60 1418.77 522.92 plus 179.17 for each dependent Monthly 1045.83 1404.16 1762.49 2120.82 2479.15 2837.48 1045.83 plus 358.33 for each dependent Source: Internal Revenue Service. Carson Holiday has a federal tax levy of $4,119.90 against him. If Holiday is single with three dependents and had a take home pay of $1,020.00 this week, how much would his employer take from his pay to satisfy part of the tax levy? Round your intermediate calculations and final answer to the nearest cent. Check My Work Previous Next Assignment Score: 69.61% Email Instructor Save and Exit Submit Assignment for Grading

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts