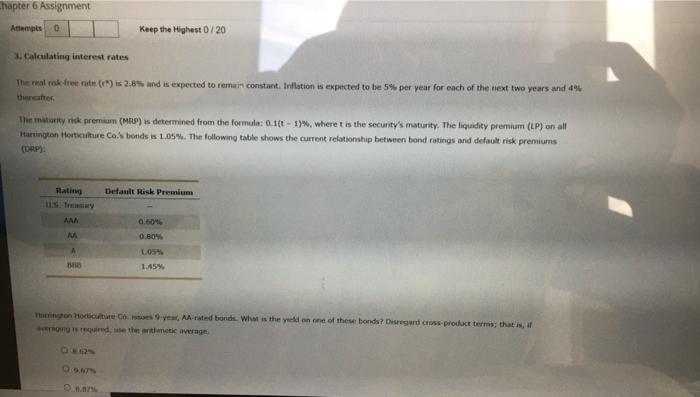

Question: Chapter 6 Assignment Attempts 0 Keep the Highest / 20 1. Calculating interest rates The rest ok free note() 2.8% and is expected to remain

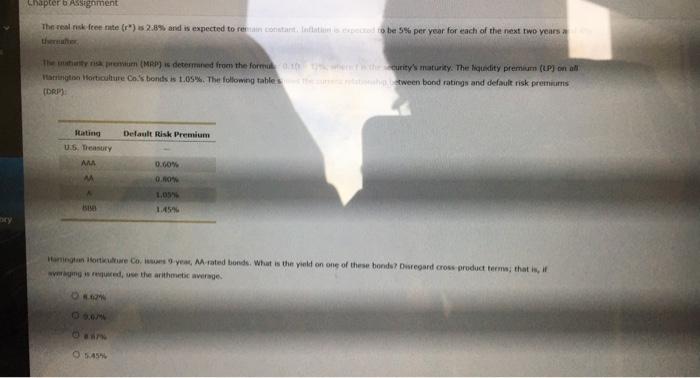

Chapter 6 Assignment Attempts 0 Keep the Highest / 20 1. Calculating interest rates The rest ok free note() 2.8% and is expected to remain constant. Inflation is expected to be per year for each of the next two years and 44 Tematy nisk premium (MRP) s determined from the formula: 0.1( - 19%, where is the security's maturity. The liquidity premium (LP) on all Harrington Houlture Co bonds is 1.05%. The following table shows the current relationship between bond ratings and default risk premiums (EP). Default Risk Premium 0.60 AAA M 0.80 1.05% 1.45% Thon Houyeur, AA rated bonds. What is the yield on one of these bonds? Diregard cross product terms, that is, of od we the the average Chapter 6 Assignment The real nike free nute() is 2.8% and is expected to reconstant to be 5% per year for each of the next two years ther There (MAP) is determned from the format curity's maturity. The qudity premium (UP) on all Harington Horticulture Cobonds is 1.5%. The following tables Atween bond ratings and default risk premium (DRM) Default Risk Premium Rating U.S. Deasury 0.00% M 0.00 1,09 1.45% DY Haningen forte Cos you, Mrated bonds. What is the yield on one of these bonds? Disregard cross product terms, that is, wang sed, use the arithmetic average On OSAS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts