Question: Chapter 6: Project Analysis Case Study: Hit or Miss Sports Hit or Miss Sports is introducing a new product this year. If its see-at-night soccer

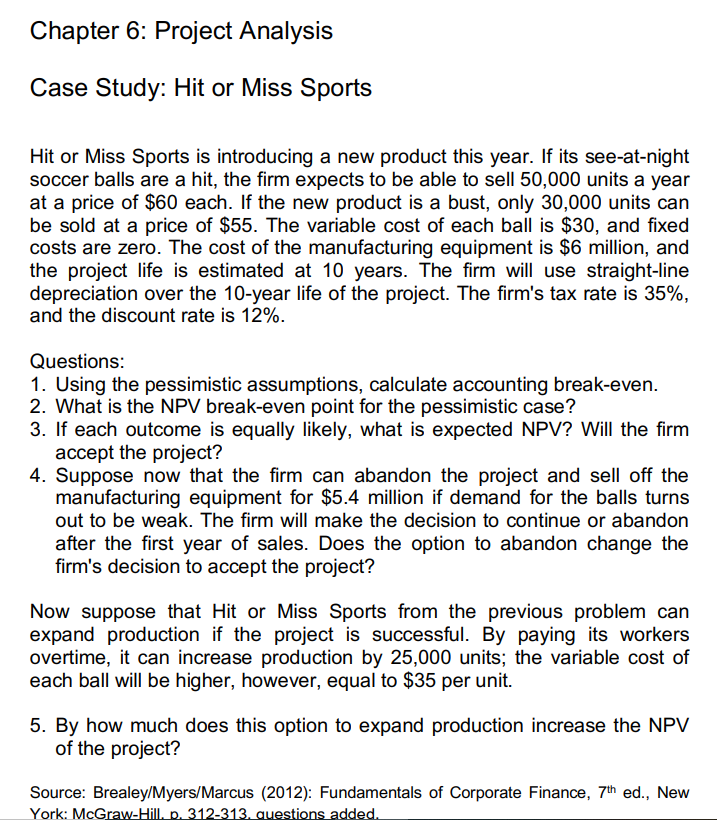

Chapter 6: Project Analysis Case Study: Hit or Miss Sports Hit or Miss Sports is introducing a new product this year. If its see-at-night soccer balls are a hit, the firm expects to be able to sell 50,000 units a year at a price of $60 each. If the new product is a bust, only 30,000 units can be sold at a price of $55. The variable cost of each ball is $30, and fixed costs are zero. The cost of the manufacturing equipment is $6 million, and the project life is estimated at 10 years. The firm will use straight-line depreciation over the 10-year life of the project. The firm's tax rate is 35%, and the discount rate is 12%. Questions: 1. Using the pessimistic assumptions, calculate accounting break-even. 2. What is the NPV break-even point for the pessimistic case? 3. If each outcome is equally likely, what is expected NPV? Will the firm accept the project? 4. Suppose now that the firm can abandon the project and sell off the manufacturing equipment for $5.4 million if demand for the balls turns out to be weak. The firm will make the decision to continue or abandon after the first year of sales. Does the option to abandon change the firm's decision to accept the project? Now suppose that Hit or Miss Sports from the previous problem can expand production if the project is successful. By paying its workers overtime, it can increase production by 25,000 units; the variable cost of each ball will be higher, however, equal to $35 per unit. 5. By how much does this option to expand production increase the NPV of the project? Source: Brealey/Myers/Marcus (2012): Fundamentals of Corporate Finance, 7th ed., New York: McGraw-Hill. p. 312-313. questions added. Chapter 6: Project Analysis Case Study: Hit or Miss Sports Hit or Miss Sports is introducing a new product this year. If its see-at-night soccer balls are a hit, the firm expects to be able to sell 50,000 units a year at a price of $60 each. If the new product is a bust, only 30,000 units can be sold at a price of $55. The variable cost of each ball is $30, and fixed costs are zero. The cost of the manufacturing equipment is $6 million, and the project life is estimated at 10 years. The firm will use straight-line depreciation over the 10-year life of the project. The firm's tax rate is 35%, and the discount rate is 12%. Questions: 1. Using the pessimistic assumptions, calculate accounting break-even. 2. What is the NPV break-even point for the pessimistic case? 3. If each outcome is equally likely, what is expected NPV? Will the firm accept the project? 4. Suppose now that the firm can abandon the project and sell off the manufacturing equipment for $5.4 million if demand for the balls turns out to be weak. The firm will make the decision to continue or abandon after the first year of sales. Does the option to abandon change the firm's decision to accept the project? Now suppose that Hit or Miss Sports from the previous problem can expand production if the project is successful. By paying its workers overtime, it can increase production by 25,000 units; the variable cost of each ball will be higher, however, equal to $35 per unit. 5. By how much does this option to expand production increase the NPV of the project? Source: Brealey/Myers/Marcus (2012): Fundamentals of Corporate Finance, 7th ed., New York: McGraw-Hill. p. 312-313. questions added

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts