Question: (CHAPTER 6) You would like to take a loan for a house purchase. You stopped by two different banks, Bank et and Bark 22, to

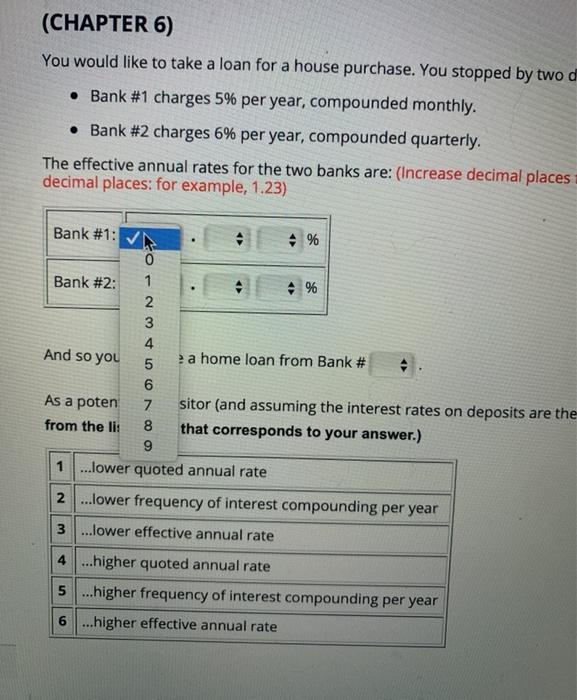

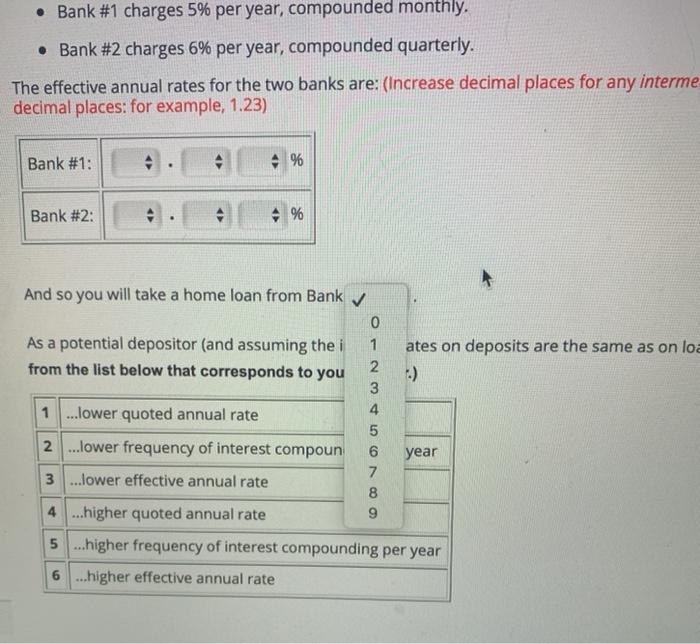

(CHAPTER 6) You would like to take a loan for a house purchase. You stopped by two different banks, Bank et and Bark 22, to compare the home loan rates. Bank 41 charges 5% per year, compounded monthly Bank 2 charpes 6 per year compounded quarterly The effective anaw rates for the two banks are create decimal places for any dntermediate chciations from the default 2106 or higher, Only round your first answer to Two decimal places for example123) Bank 1 Bank 2 And so you will tace a home loan from Banka As a potential depositor and assuming the interest rates on eposts are the same as on you would deposit your money into Banke from the list below that corresponds to your www Toma because this Bokho. . Choose the number Jower unted annual rate lower frequency of interest compounding per year 2 3 Sowretective mate 4 higher Quoted annat s higher frequency of interest compounding per year higher efective arte (CHAPTER 6) You would like to take a loan for a house purchase. You stopped by two d Bank #1 charges 5% per year, compounded monthly. Bank #2 charges 6% per year, compounded quarterly. The effective annual rates for the two banks are: (Increase decimal places decimal places: for example, 1.23) And so you Bank #1: 4 % 0 Bank #2: 1 4 % 2 3 4 5 a home loan from Bank # 6 As a poten 7 sitor (and assuming the interest rates on deposits are the from the li: that corresponds to your answer.) 9 1 ...lower quoted annual rate 2 ...lower frequency of interest compounding per year 3 ...lower effective annual rate 4 ...higher quoted annual rate 5 ...higher frequency of interest compounding per year 6 ...higher effective annual rate Bank #1 charges 5% per year, compounded monthly. Bank #2 charges 6% per year, compounded quarterly. The effective annual rates for the two banks are: (Increase decimal places for any interme decimal places: for example, 1.23) Bank #1: 4 % Bank #2: 4 % And so you will take a home loan from Bank 0 As a potential depositor (and assuming the i 1 ates on deposits are the same as on loa from the list below that corresponds to you 2 :) 3 4 1 ...lower quoted annual rate 5 2 ...lower frequency of interest compoun 6 year 7 3 ...lower effective annual rate 8 4 ...higher quoted annual rate 9 5 ...higher frequency of interest compounding per year 6 ...higher effective annual rate oans), you would deposit your money into Bank This is because this Bank has... + (Choose the number 2 3 4 5 6 7 8 9 (CHAPTER 6) You would like to take a loan for a house purchase. You stopped by two different banks, Bank et and Bark 22, to compare the home loan rates. Bank 41 charges 5% per year, compounded monthly Bank 2 charpes 6 per year compounded quarterly The effective anaw rates for the two banks are create decimal places for any dntermediate chciations from the default 2106 or higher, Only round your first answer to Two decimal places for example123) Bank 1 Bank 2 And so you will tace a home loan from Banka As a potential depositor and assuming the interest rates on eposts are the same as on you would deposit your money into Banke from the list below that corresponds to your www Toma because this Bokho. . Choose the number Jower unted annual rate lower frequency of interest compounding per year 2 3 Sowretective mate 4 higher Quoted annat s higher frequency of interest compounding per year higher efective arte (CHAPTER 6) You would like to take a loan for a house purchase. You stopped by two d Bank #1 charges 5% per year, compounded monthly. Bank #2 charges 6% per year, compounded quarterly. The effective annual rates for the two banks are: (Increase decimal places decimal places: for example, 1.23) And so you Bank #1: 4 % 0 Bank #2: 1 4 % 2 3 4 5 a home loan from Bank # 6 As a poten 7 sitor (and assuming the interest rates on deposits are the from the li: that corresponds to your answer.) 9 1 ...lower quoted annual rate 2 ...lower frequency of interest compounding per year 3 ...lower effective annual rate 4 ...higher quoted annual rate 5 ...higher frequency of interest compounding per year 6 ...higher effective annual rate Bank #1 charges 5% per year, compounded monthly. Bank #2 charges 6% per year, compounded quarterly. The effective annual rates for the two banks are: (Increase decimal places for any interme decimal places: for example, 1.23) Bank #1: 4 % Bank #2: 4 % And so you will take a home loan from Bank 0 As a potential depositor (and assuming the i 1 ates on deposits are the same as on loa from the list below that corresponds to you 2 :) 3 4 1 ...lower quoted annual rate 5 2 ...lower frequency of interest compoun 6 year 7 3 ...lower effective annual rate 8 4 ...higher quoted annual rate 9 5 ...higher frequency of interest compounding per year 6 ...higher effective annual rate oans), you would deposit your money into Bank This is because this Bank has... + (Choose the number 2 3 4 5 6 7 8 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts