Question: here are the options a CE HHH You would like to buy a house. Time to shop for a home loan! You stopped by two

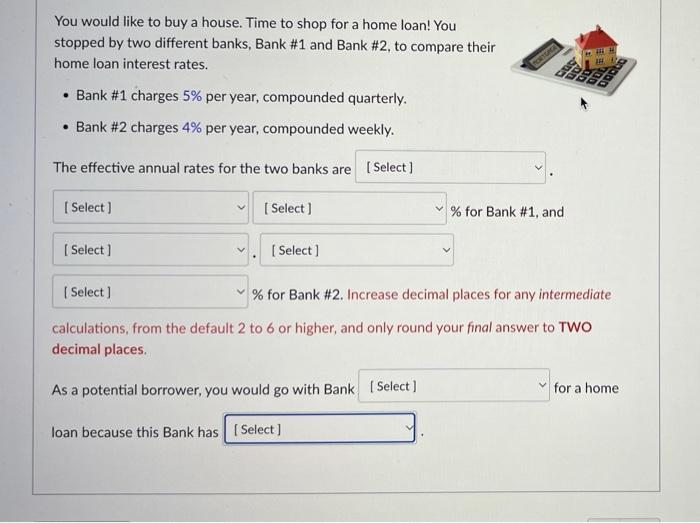

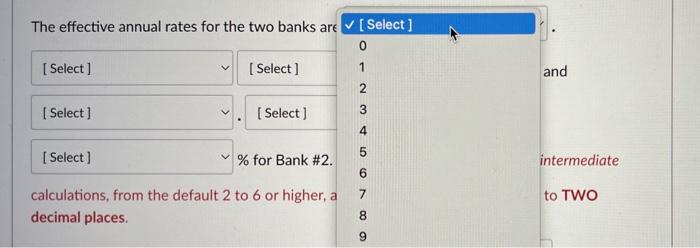

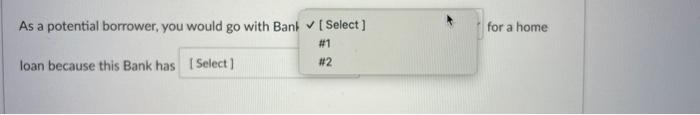

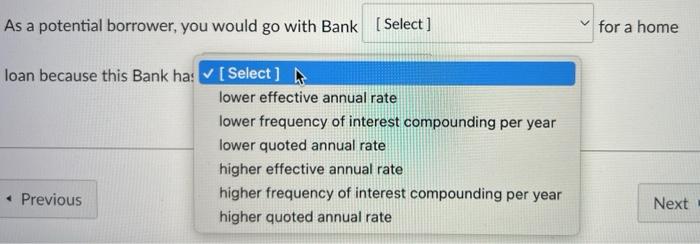

a CE HHH You would like to buy a house. Time to shop for a home loan! You stopped by two different banks, Bank #1 and Bank #2, to compare their home loan interest rates. Bank #1 charges 5% per year, compounded quarterly. Bank #2 charges 4% per year, compounded weekly. LE The effective annual rates for the two banks are [Select [Select] [ Select) % for Bank #1, and Select] Select) Select) % for Bank #2. Increase decimal places for any intermediate calculations, from the default 2 to 6 or higher, and only round your final answer to TWO decimal places As a potential borrower, you would go with Bank (Select) for a home loan because this Bank has Select ] The effective annual rates for the two banks are [ Select) 0 Select) [Select 1 and 2 [Select] [ Select 3 4 5 [Select) % for Bank #2. intermediate 6 7 to TWO calculations, from the default 2 to 6 or higher, a decimal places 8 000 9 for a home As a potential borrower, you would go with Bank Select ] #1 loan because this Bank has [Select] #2 As a potential borrower, you would go with Bank (Select] for a home loan because this Bank ha: [Select] A lower effective annual rate lower frequency of interest compounding per year lower quoted annual rate higher effective annual rate Previous higher frequency of interest compounding per year higher quoted annual rate Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts