Question: Chapter 7 Accounting for Receivables Prepare journal entries to record the following selected transactions of Ridge Company. Mar. 21 Accepted a $9,500. 180-day, 8% note

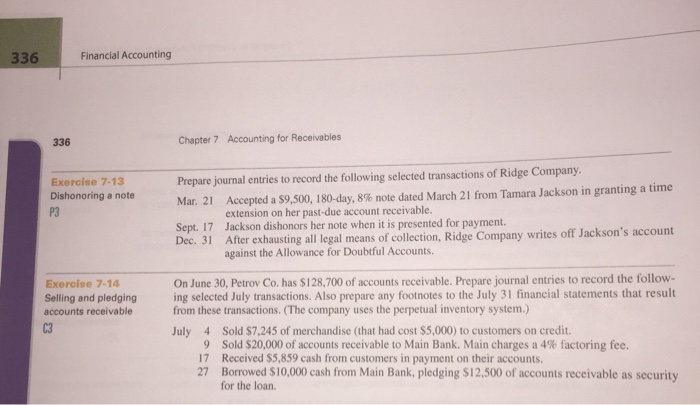

Chapter 7 Accounting for Receivables Prepare journal entries to record the following selected transactions of Ridge Company. Mar. 21 Accepted a $9,500. 180-day, 8% note dated March 21 from Tamara Jackson in granting a time extension on her past-due account receivable. Sept. 17 Jackson dishonors her note when it is presented for payment. Dec. 31 After exhausting all legal means of collection. Ridge Company writes off Jackson s account against the Allowance for Doubtful Accounts. On June 30. Petrov Co. has SI28.700 of accounts receivable. Prepare journal entries to record the following selected July transactions. Also prepare any footnotes to the July 31 financial statements that result from these transactions. (The company uses the perpetual inventory system.) July 4 Sold $7,245 of merchandise (that had cost $5,000) to customers on credit. 9 Sold $20,000 of accounts receivable to Main Bank. Main charges a 4% factoring fee. 17 Received $5,859 cash from customers in payment on their accounts. 27 Borrowed $10,000 cash from Main Rank, pledging $12,500 of accounts receivable as security for the loan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts