Question: Chapter 7 BEX BEX.07.10 Allocating loint Costs Using the Net Realizable Value Method A company manufactures three products, L-Ten, Trol, and Pioze, from a joint

Chapter 7 BEX BEX.07.10

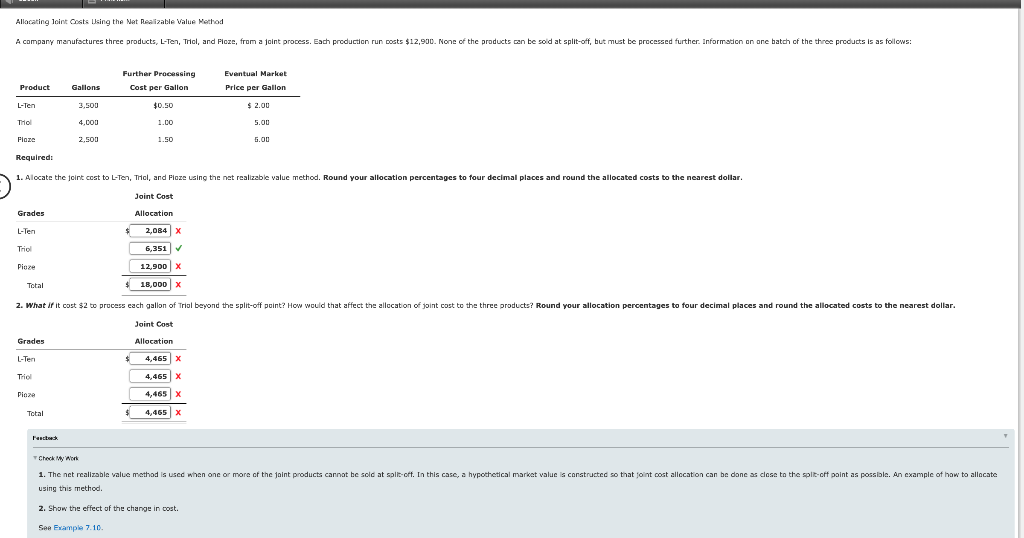

Allocating loint Costs Using the Net Realizable Value Method A company manufactures three products, L-Ten, Trol, and Pioze, from a joint process. Each production run costs $12,900. None of the products can be sold at split-off, but must be processed further. Information on one batch of the three products is as follows: Further Processing Eventual Market Price per Gallon Product Gallons Cost per Gallon $0.50 L-Ten L 3,500 $ 2.00 Triol 4.000 1.00 5.00 Floze 2.500 1.50 5.00 Required: 1. Alocate the joint cost to L-Ten, Trol, and Floze using the net realizable value method. Round your allocation percentages to four decimal places and round the allocated costs to the nearest dollar. Joint Cont Grades Allocation L-Ten 2,084 X Triol 6,351 Pioze 12.900 Total $ 18,000 x 2. What if it cost $2 to process each gallon of Trial beyond the split-off point? How would that affect the allocation of point cost to the three products? Round your allocation percentages to four decimal places and round the allocated costs to the nearest dollar. Joint Cost Grades Allocation L-Ten 4,465 x Triol 4,465 x Pinze 4,465 x Total 4,465 x Fest Check york 1. The net realizable value method is used when one or more of the joint products cannot be sold at salic-off. In this case, a hypothetical market value is constructed so that joint cost allocation can be done as close to the split-off paint as possible. An example of how to allocate using this method. 2. Show the effect of the change in cost. See Fxample 7.10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts