Question: Chapter 7: Foreign Currency Derivatives Problem 7-2 Peleh writes a put option on Japanese yen with a strike price of $0.008000/ (125.00/$) at a premium

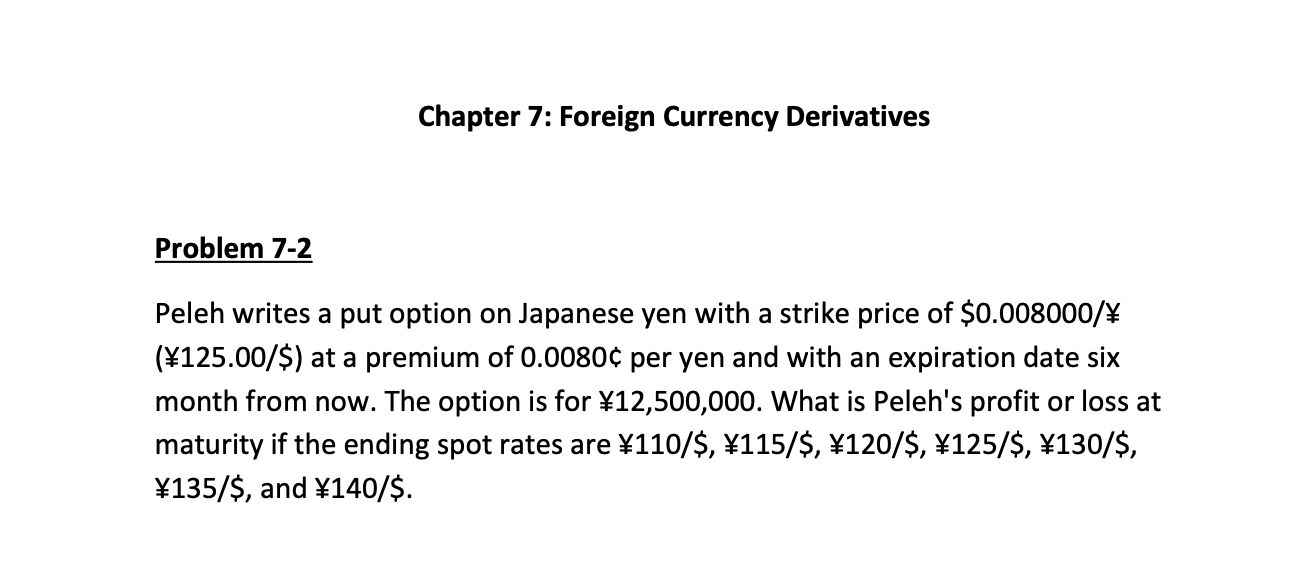

Chapter 7: Foreign Currency Derivatives Problem 7-2 Peleh writes a put option on Japanese yen with a strike price of $0.008000/ (125.00/$) at a premium of 0.0080 per yen and with an expiration date six month from now. The option is for $12,500,000. What is Peleh's profit or loss at maturity if the ending spot rates are 110/$, 115/$, 120/$, 125/$, 130/$, 135/$, and \140/$. Chapter 7: Foreign Currency Derivatives Problem 7-2 Peleh writes a put option on Japanese yen with a strike price of $0.008000/ (125.00/$) at a premium of 0.0080 per yen and with an expiration date six month from now. The option is for $12,500,000. What is Peleh's profit or loss at maturity if the ending spot rates are 110/$, 115/$, 120/$, 125/$, 130/$, 135/$, and \140/$

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts