Question: Chapter 7 Full Cost Accounting 241 ADD&A assuming all possible costs are excluded from the amortization base: Costs to Be Amortized Proved property costs

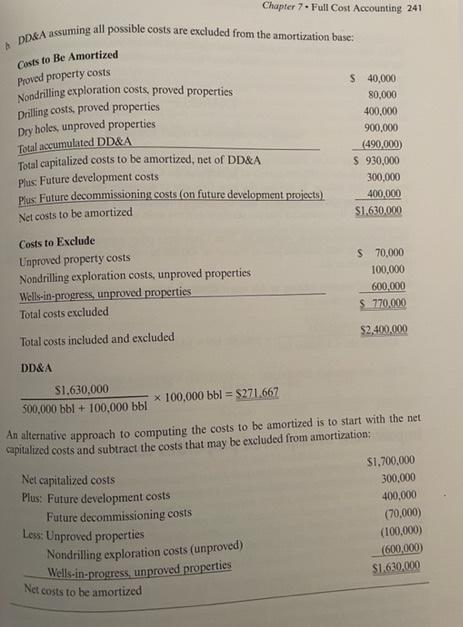

Chapter 7 Full Cost Accounting 241 ADD&A assuming all possible costs are excluded from the amortization base: Costs to Be Amortized Proved property costs Nondrilling exploration costs, proved properties Drilling costs, proved properties Dry holes, unproved properties Total accumulated DD&A Total capitalized costs to be amortized, net of DD&A Plus: Future development costs Plus Future decommissioning costs (on future development projects) $ 40,000 80,000 400,000 900,000 (490,000) $ 930,000 300,000 400,000 $1,630,000 Net costs to be amortized Costs to Exclude Unproved property costs Wells-in-progress, unproved properties Nondrilling exploration costs, unproved properties Total costs excluded Total costs included and excluded DD&A $1,630,000 $ 70,000 100,000 600,000 $ 770,000 $2,400,000 500,000 bbl + 100,000 bbl = x 100,000 bbl $271.667 An alternative approach to computing the costs to be amortized is to start with the net capitalized costs and subtract the costs that may be excluded from amortization: Net capitalized costs Plus: Future development costs Future decommissioning costs Less: Unproved properties Nondrilling exploration costs (unproved) Wells-in-progress, unproved properties Net costs to be amortized $1,700,000 300,000 400,000 (70,000) (100,000) (600,000) $1,630,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts