Question: Chapter 7 | Question 6: Please answer the following questions below (see image): Assume Highline Company has just paid an annual dividend of $1.02. Analysts

Chapter 7 | Question 6: Please answer the following questions below (see image):

Assume Highline Company has just paid an annual dividend of

$1.02.

Analysts are predicting an

11.8%

per year growth rate in earnings over the next five years. After then, Highline's earnings are expected to grow at the current industry average of

5.1%

per year. If Highline's equity cost of capital is

7.7%

per year and its dividend payout ratio remains constant, for what price does the dividend-discount model predict Highline stock should sell?

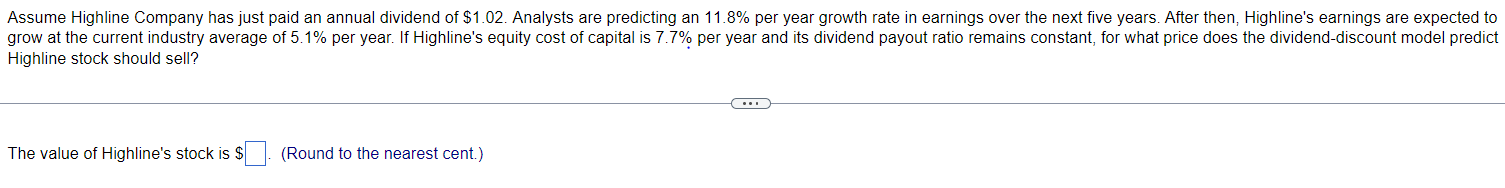

Assume Highline Company has just paid an annual dividend of $1.02. Analysts are predicting an 11.8% per year growth rate in earnings over the next five years. After then, Highline's earnings are expected to grow at the current industry average of 5.1% per year. If Highline's equity cost of capital is 7.7% per year and its dividend payout ratio remains constant, for what price does the dividend-discount model predict Highline stock should sell? The value of Highline's stock is $ (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts