Question: Chapter 8 : Applying Excel: Exercise ( Algo ) ( Part 2 of 2 ) 2 . Change all of the numbers in the data

Chapter : Applying Excel: Exercise AlgoPart of

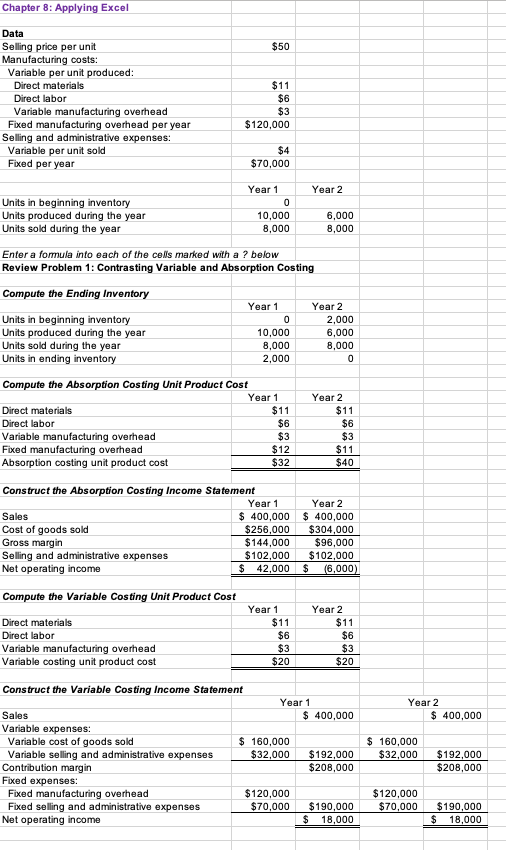

Change all of the numbers in the data area of your worksheet so that it looks like this: begintabularcccc

hline & A & B & C

hline & Chapter : Applying Excel & &

hline & & &

hline & Data & &

hline & Selling price per unit & $ &

hline & Manufacturing costs: & &

hline & Variable per unit produced: & &

hline & Direct materials & $ &

hline & Direct labor & $ &

hline & Variable manufacturing overhead & $ &

hline & Fixed manufacturing overhead per year & $ &

hline & Selling and administrative expenses: & &

hline & Variable per unit sold & $ &

hline & Fixed per year & $ &

hline & & &

hline & & Year & Year

hline & Units in beginning inventory & &

hline & Units produced during the year & &

hline & Units sold during the year & &

hline

endtabular

Chapter : Applying Excel: Exercise AlgoPart of

Change all of the numbers in the data area of your worksheet so that it looks like this:

If your formulas are correct, you should get the correct answers to the following questions.

a What is the net operating income loss in Year under absorption costing?

b What is the net operating income loss in Year under absorption costing?

c What is the net operating income loss in Year under variable costing?

d What is the net operating income loss in Year under variable costing?

e The net operating income loss under absorption costing is less than the net operating income loss under variable costing in Year

because:

Note: You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct

answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark

will be automatically graded as incorrect.

Units were left over from the previous year.

The cost of goods sold is always less under variable costing than under absorption costing.

Sales exceeded production so some of the fixed manufacturing overhead of the period was released from inventories under absorption

costing.

Make a note of the absorption costing net operating income loss in Year

At the end of Year the company's board of directors set a target for Year net operating income of $ under absorption

costing. If this target is met, a large bonus would be paid to the CEO of the company. Keeping everything else the same from part

above, change the units produced in Year to units.

a Would this change result in a bonus being paid to the CEO?

Yes

No

b What is the net operating income loss in Year under absorption costing?

c Would this doubling of production in Year be in the best interests of the company if sales are expected to continue to be

units per year?

Yes

No

I have attached my answer for part the excel spreadsheet but this question has multiple parts to it I would appreciate if you could explain the steps for better understanding on my part

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock