Question: Chapter 8 Assignment Check my work 9 Part 2 of 2 Required Information {The following information applies to the questions displayed below) Brooke, a single

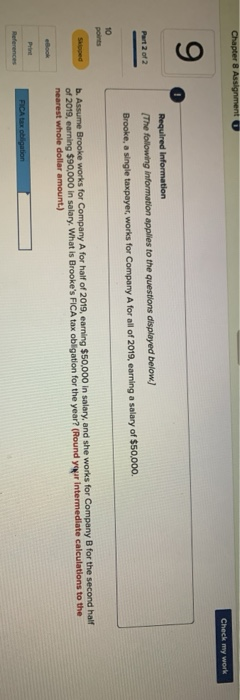

Chapter 8 Assignment Check my work 9 Part 2 of 2 Required Information {The following information applies to the questions displayed below) Brooke, a single taxpayer, works for Company A for all of 2019, earning a salary of $50,000 10 Skloped b. Assume Brooke works for Company A for half of 2019, earning $50,000 in salary, and she works for Company B for the second half of 2019, earning $90,000 in salary. What is Brooke's FICA tax obligation for the year? (Round your intermediate calculations to the nearest whole dollar amount.) FICA tax obligation References

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock