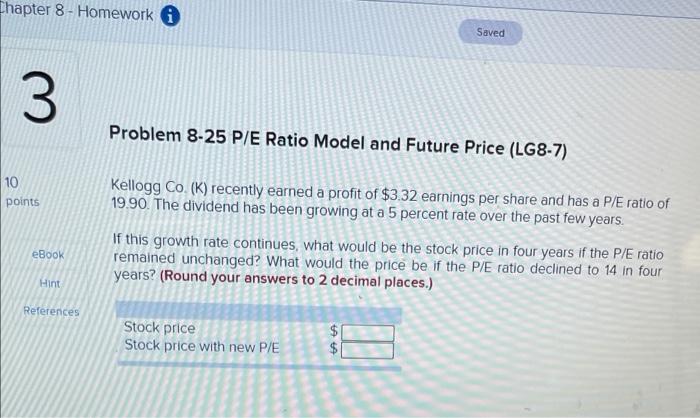

Question: Chapter 8 - Homework 0 Saved 3 Problem 8-25 P/E Ratio Model and Future Price (LG8-7) 10 points Kellogg Co. (K) recently earned a profit

Chapter 8 - Homework 0 Saved 3 Problem 8-25 P/E Ratio Model and Future Price (LG8-7) 10 points Kellogg Co. (K) recently earned a profit of $3.32 earnings per share and has a P/E ratio of 19.90. The dividend has been growing at a 5 percent rate over the past few years. If this growth rate continues, what would be the stock price in four years if the P/E ratio remained unchanged? What would the price be if the P/E ratio declined to 14 in four years? (Round your answers to 2 decimal places.) eBook Hint References Stock price Stock price with new P/E LATA $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts