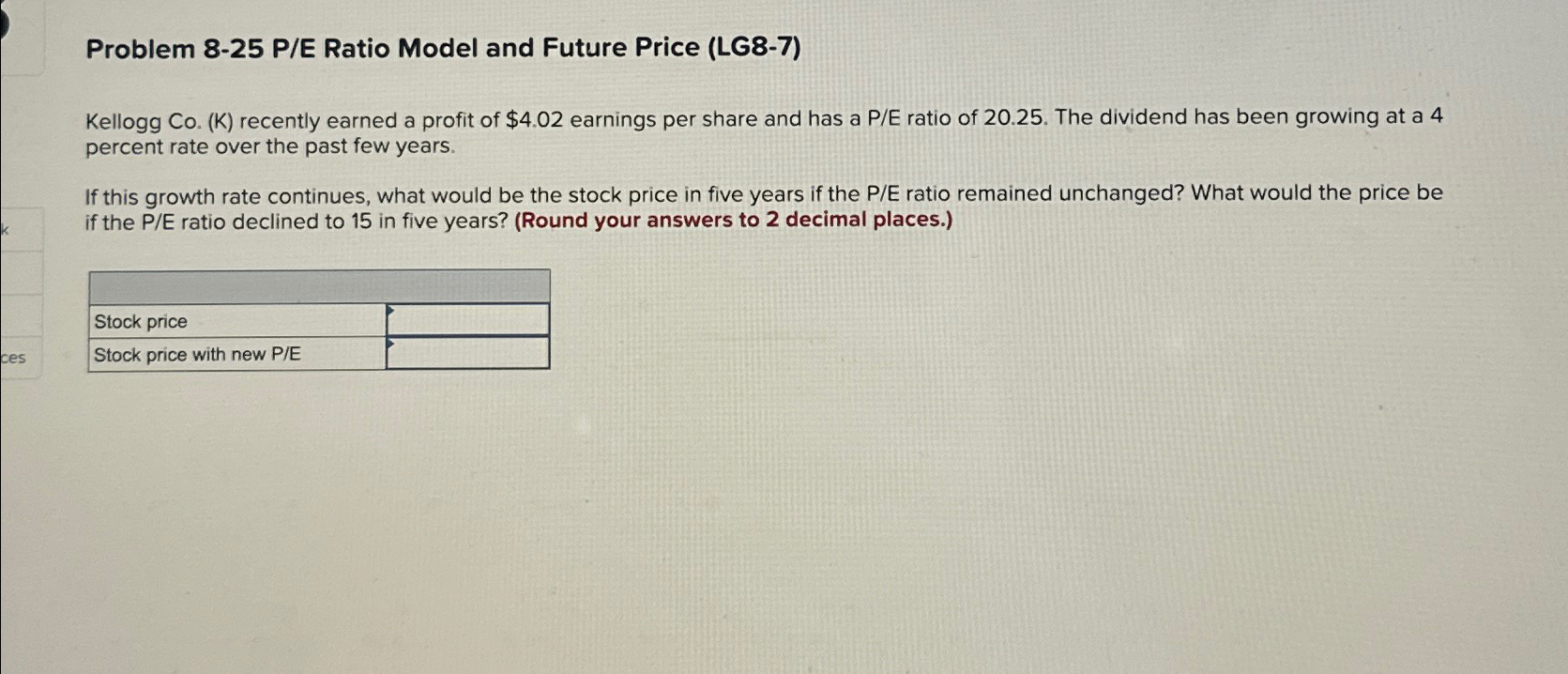

Question: Problem 8 - 2 5 P / E Ratio Model and Future Price ( LG 8 - 7 ) Kellogg Co . ( K )

Problem PE Ratio Model and Future Price LG

Kellogg CoK recently earned a profit of $ earnings per share and has a PE ratio of The dividend has been growing at a percent rate over the past few years.

If this growth rate continues, what would be the stock price in five years if the PE ratio remained unchanged? What would the price be if the PE ratio declined to in five years? Round your answers to decimal places.

Stock price

Stock price with new PE

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock