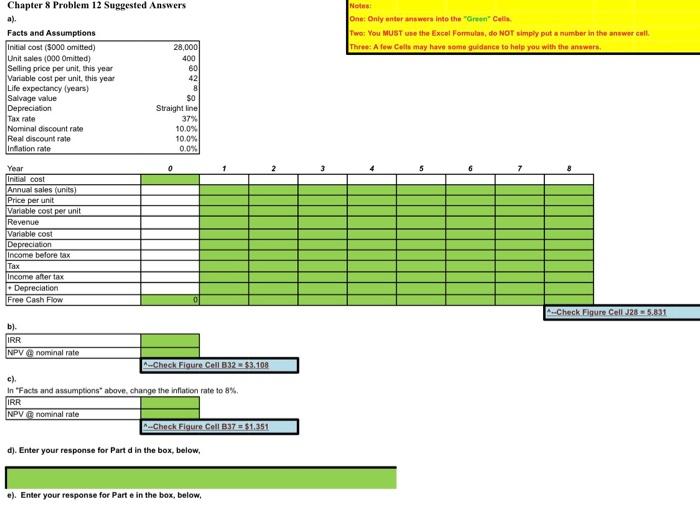

Question: Chapter 8 Problem 12 Suggested Answers Netne: One: Only enter answers into the Gretn Celtik. a). Two: You MUST une the Excel Formulas, do Nor

Chapter 8 Problem 12 Suggested Answers Netne: One: Only enter answers into the "Gretn" Celtik. a). Two: You MUST une the Excel Formulas, do Nor simpiy put a number in the answer call. Farte and Alecumntione Three: A few Cells may have some guidance to halp you with the antwers. c). In "Facts and assumptions" above, change the inflation rate to 8%. d). Enter your response for Part d in the box, below, e). Enter your response for Part e in the box, below, willing to accept on purchase of the out of capital is 11 percent. It is plan- 4. Your company's weighted-avcrage cost of capital is 11 percent. It is plan-. ning to undertake a project with an intemal rate of return of l4 percent, ments would you use to convince your toms to forego the project despite its high rate of rerurn? Is it possille that making investments with returns higher than the firm's cost of capital will destroy value? If so, how? ABC Cormoration and XYZ Corporation are both bidding for an Chapter 8 Problem 12 Suggested Answers Netne: One: Only enter answers into the "Gretn" Celtik. a). Two: You MUST une the Excel Formulas, do Nor simpiy put a number in the answer call. Farte and Alecumntione Three: A few Cells may have some guidance to halp you with the antwers. c). In "Facts and assumptions" above, change the inflation rate to 8%. d). Enter your response for Part d in the box, below, e). Enter your response for Part e in the box, below, willing to accept on purchase of the out of capital is 11 percent. It is plan- 4. Your company's weighted-avcrage cost of capital is 11 percent. It is plan-. ning to undertake a project with an intemal rate of return of l4 percent, ments would you use to convince your toms to forego the project despite its high rate of rerurn? Is it possille that making investments with returns higher than the firm's cost of capital will destroy value? If so, how? ABC Cormoration and XYZ Corporation are both bidding for an

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts