Question: Chapter 8 Stock Valuation 8.1 Dividend Discount Model Problem. Currently a stock pays a dividend per share of $6.64. A security analyst projects the future

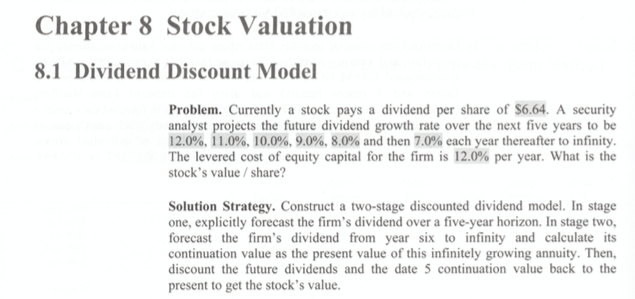

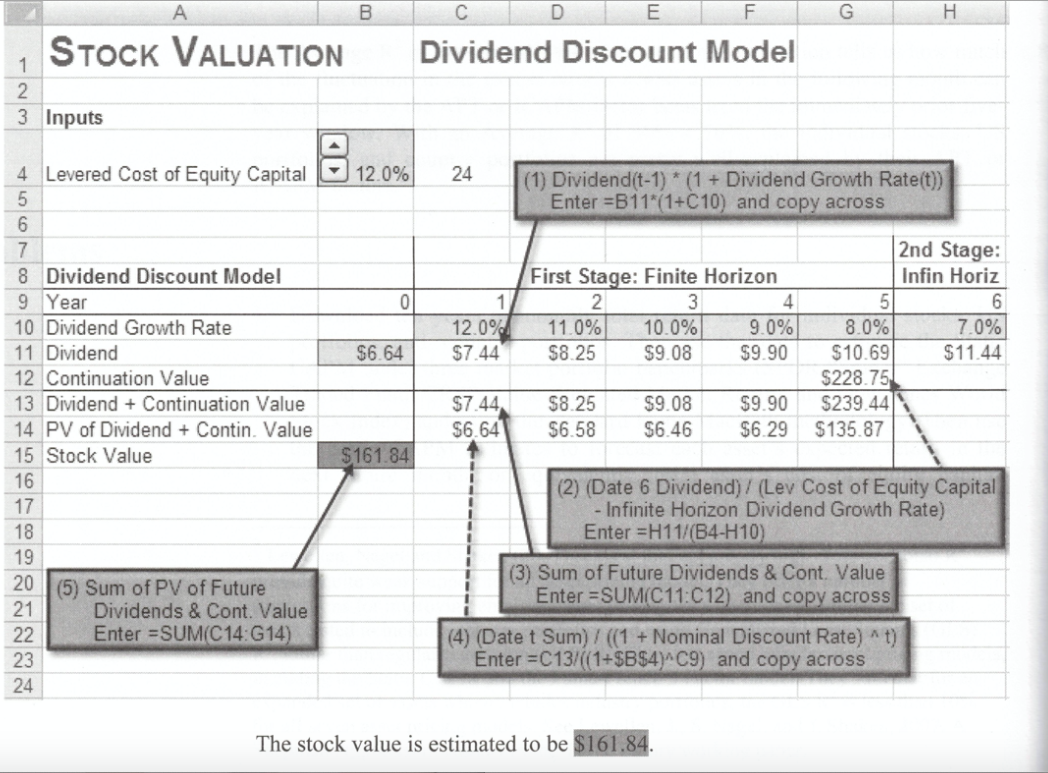

Chapter 8 Stock Valuation 8.1 Dividend Discount Model Problem. Currently a stock pays a dividend per share of $6.64. A security analyst projects the future dividend growth rate over the next five years to be 12.0%, 11.0%, 10.0%, 9.0%, 8.0% and then 7.0% each year thereafter to infinity The levered cost of equity capital for the firm is 12.0% per year. What is the stock's value /share? Solution Strategy. Construct a two-stage discounted dividend model. In stage one, explicitly forecast the firm's dividend over a five-year horizon. In stage two, forecast the firm's dividend from year six to infinity and calculate its continuation value as the present value of this infinitely growing annuity. Then, discount the future dividends and the date 5 continuation value back to the present to get the stock's value. B E G H STOCK VALUATION Dividend Discount Model 1 2 3 Inputs 12.0% 24 (1) Dividend(t-1) * (1 + Dividend Growth Rate(t) Enter =B11*(1+C10) and copy across 0 1 12.0% $7.44 First Stage: Finite Horizon 2 3 4 11.0% 10.0% S8.25 $9.08 $9.90 9.0% 4 Levered Cost of Equity Capital 5 6 7 8 Dividend Discount Model 9 Year 10 Dividend Growth Rate 11 Dividend 12 Continuation Value 13 Dividend + Continuation Value 14 PV of Dividend + Contin. Value 15 Stock Value 16 17 18 19 20 (5) Sum of PV of Future 21 Dividends & Cont. Value 22 Enter =SUM(C14: G14) 23 24 2nd Stage: Infin Horiz 5 6 8.0% 7.0% $10.691 $11.44 $228.75 $239.44 $135.87 $6.64 $7.44 $6.64 $8.25 $6.58 $9.08 $6.46 $9.90 $6.29 $161.84 (2) (Date 6 Dividend)/ (Lev Cost of Equity Capital - Infinite Horizon Dividend Growth Rate) Enter =H11/(B4-H10) (3) Sum of Future Dividends & Cont. Value Enter =SUM(C11C12) and copy across (4) (Date t Sum) / ((1 + Nominal Discount Rate) t) Enter =C13/((1+$B$4)^C9) and copy across The stock value is estimated to be $161.84. Chapter 8 Stock Valuation 8.1 Dividend Discount Model Problem. Currently a stock pays a dividend per share of $6.64. A security analyst projects the future dividend growth rate over the next five years to be 12.0%, 11.0%, 10.0%, 9.0%, 8.0% and then 7.0% each year thereafter to infinity The levered cost of equity capital for the firm is 12.0% per year. What is the stock's value /share? Solution Strategy. Construct a two-stage discounted dividend model. In stage one, explicitly forecast the firm's dividend over a five-year horizon. In stage two, forecast the firm's dividend from year six to infinity and calculate its continuation value as the present value of this infinitely growing annuity. Then, discount the future dividends and the date 5 continuation value back to the present to get the stock's value. B E G H STOCK VALUATION Dividend Discount Model 1 2 3 Inputs 12.0% 24 (1) Dividend(t-1) * (1 + Dividend Growth Rate(t) Enter =B11*(1+C10) and copy across 0 1 12.0% $7.44 First Stage: Finite Horizon 2 3 4 11.0% 10.0% S8.25 $9.08 $9.90 9.0% 4 Levered Cost of Equity Capital 5 6 7 8 Dividend Discount Model 9 Year 10 Dividend Growth Rate 11 Dividend 12 Continuation Value 13 Dividend + Continuation Value 14 PV of Dividend + Contin. Value 15 Stock Value 16 17 18 19 20 (5) Sum of PV of Future 21 Dividends & Cont. Value 22 Enter =SUM(C14: G14) 23 24 2nd Stage: Infin Horiz 5 6 8.0% 7.0% $10.691 $11.44 $228.75 $239.44 $135.87 $6.64 $7.44 $6.64 $8.25 $6.58 $9.08 $6.46 $9.90 $6.29 $161.84 (2) (Date 6 Dividend)/ (Lev Cost of Equity Capital - Infinite Horizon Dividend Growth Rate) Enter =H11/(B4-H10) (3) Sum of Future Dividends & Cont. Value Enter =SUM(C11C12) and copy across (4) (Date t Sum) / ((1 + Nominal Discount Rate) t) Enter =C13/((1+$B$4)^C9) and copy across The stock value is estimated to be $161.84

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts