Question: Chapter 9 Homework i 12 1.17 points eBook Print References Saved Adrienne is a single mother with a six-year-old daughter who lived with her during

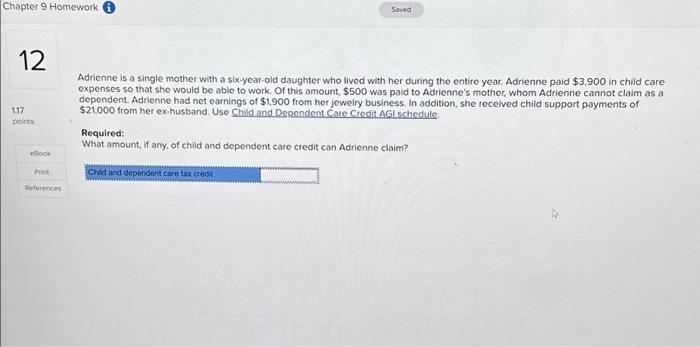

Adrienne is a single mother with a six-year-old daughter who lived with her during the entire year. Adrienne paid $3,900 in child care expenses so that she would be able to work. Of this amount, $500 was paid to Adrienne's mother, whom Adrienne cannot claim as a dependent. Adrienne had net earnings of $1,900 from her jowelry business, In addition, she recelved child support poyments of $21,000 from her ex-husband. Use child and Dependent Care Grodit AGLschedule. Required: What amount, if any, of child and dependent care credit can Adrienne claim

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts