Question: Chapter 9 Lecture example Grayman Inc is preparing its annual budgets for the year ending 12/31/19. Relevant data pertaining to sales and production follow. Sales

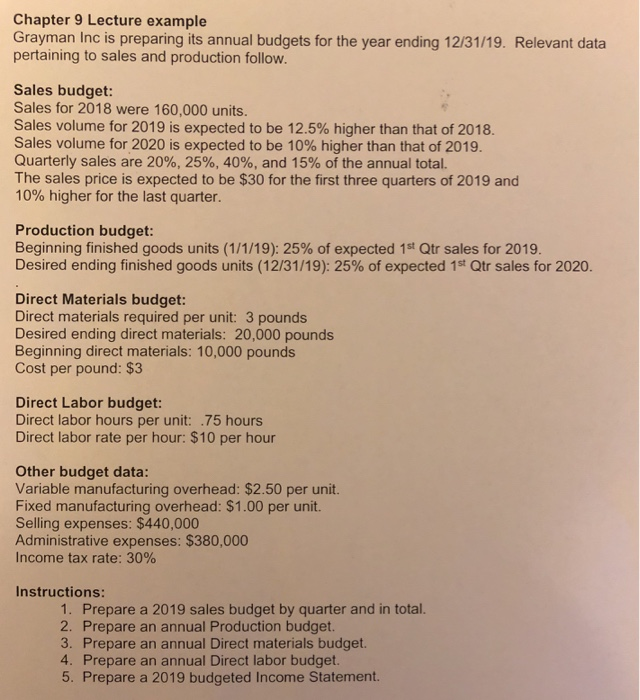

Chapter 9 Lecture example Grayman Inc is preparing its annual budgets for the year ending 12/31/19. Relevant data pertaining to sales and production follow. Sales budget: Sales for 2018 were 160,000 units. Sales volume for 2019 is expected to be 12.5% higher than that of 2018. Sales volume for 2020 is expected to be 10% higher than that of 2019. Quarterly sales are 20%, 25%, 40%, and 15% of the annual total. The sales price is expected to be $30 for the first three quarters of 2019 and 10% higher for the last quarter. Production budget: Beginning finished goods units (1/1/19): 25% of expected 1st Qtr sales for 2019. Desired ending finished goods units (12/31/19): 25% of expected 1st Qtr sales for 2020. Direct Materials budget: Direct materials required per unit: 3 pounds Desired ending direct materials: 20,000 pounds Beginning direct materials: 10,000 pounds Cost per pound: $3 Direct Labor budget: Direct labor hours per unit: .75 hours Direct labor rate per hour: $10 per hour Other budget data: Variable manufacturing overhead: $2.50 per unit. Fixed manufacturing overhead: $1.00 per unit. Selling expenses: $440,000 Administrative expenses: $380,000 Income tax rate: 30% Instructions: 1. Prepare a 2019 sales budget by quarter and in total. 2. Prepare an annual Production budget. 3. Prepare an annual Direct materials budget. 4. Prepare an annual Direct labor budget. 5. Prepare a 2019 budgeted Income Statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts