Question: Chapter 9, Problem 14QP Bookmark Show all steps: Mr. K, a risk-neutral investor, is contemplating a one-year 8% loan of $500 to firm J. Mr.

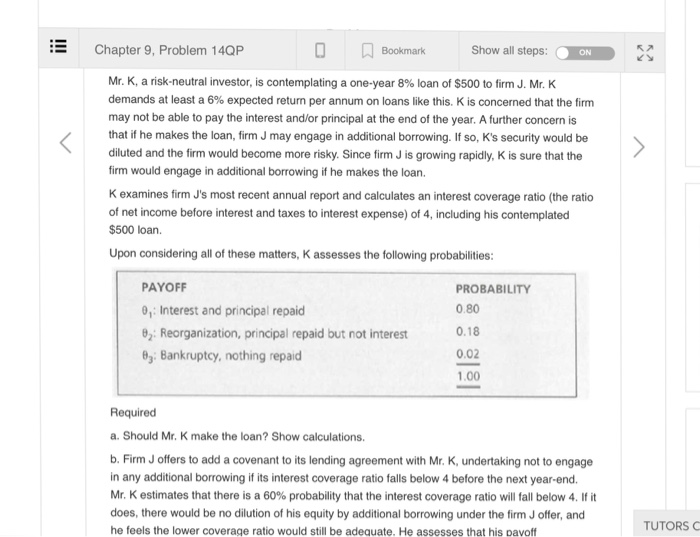

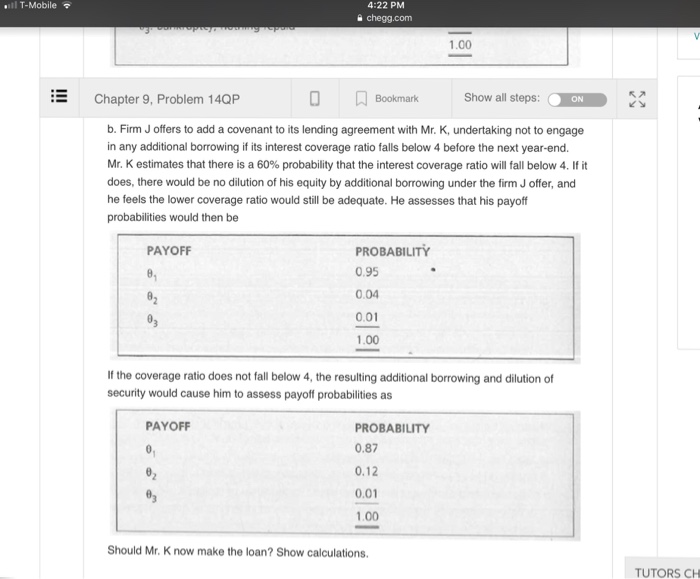

Chapter 9, Problem 14QP Bookmark Show all steps: Mr. K, a risk-neutral investor, is contemplating a one-year 8% loan of $500 to firm J. Mr. K demands at least a 6% expected return per annum on loans like this. K is concerned that the firm may not be able to pay the interest and/or principal at the end of the year. A further concern is that if he makes the loan, firm J may engage in additional borrowing. If so, K's security would be diluted and the firm would become more risky. Since firm J is growing rapidly, K is sure that the firm would engage in additional borrowing if he makes the loan. K examines firm J's most recent annual report and calculates an interest coverage ratio (the ratio of net income before interest and taxes to interest expense) of 4, including his contemplated $500 loan. Upon considering all of these matters, K assesses the following probabilities PAYOFF PROBABILITY 0.80 0.18 0.02 1.00 0,: Interest and principal repaid Reorganization, principal repaid but not interest B3: Bankruptcy, nothing repaid Required a. Should Mr. K make the loan? Show calculations. b. Firm J offers to add a covenant to its lending agreement with Mr. K, undertaking not to engage in any additional borrowing if its interest coverage ratio falls below 4 before the next year-end. Mr. K estimates that there is a 60% probability that the interest coverage ratio will fall below 4 . If it does, there would be no dilution of his equity by additional borrowing under the firm J offer, and he feels the lower coverage ratio would still be adequate. He assesses that his pavoff TUTORSC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts