Question: Chapter 9 Question 5 Current Position Analysis Google Drive https://drive.google.com/drive/u/0/my-drive Cash Temporary investments Accounts and notes receivable (net) Inventories Prepaid expenses he comparative balance sheet

Chapter 9 Question 5

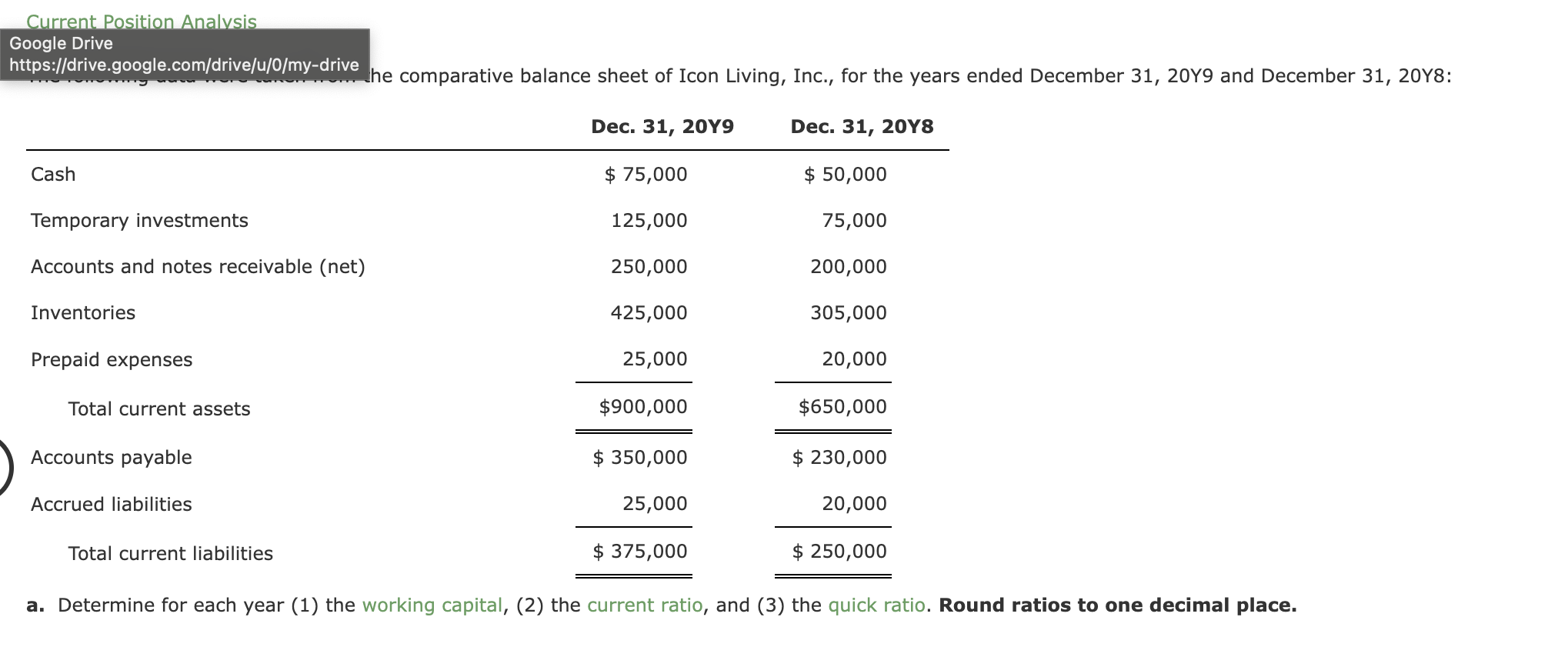

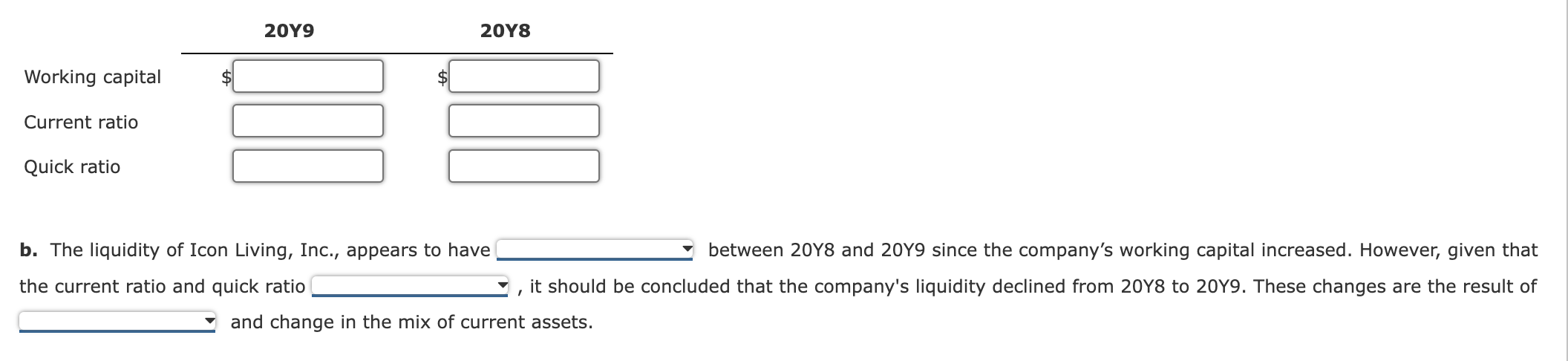

Current Position Analysis Google Drive https://drive.google.com/drive/u/0/my-drive Cash Temporary investments Accounts and notes receivable (net) Inventories Prepaid expenses he comparative balance sheet of Icon Living, Inc., for the years ended December 31, 20Y9 and December 31, 20Y8: Dec. 31, 20Y9 Dec. 31, 20Y8 $ 75,000 $ 50,000 125,000 75,000 250,000 200,000 425,000 305,000 25,000 20,000 $900,000 $650,000 $ 350,000 $ 230,000 25,000 20,000 Total current liabilities $ 375,000 $ 250,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Total current assets Accounts payable Accrued liabilities 20Y9 20Y8 Working capital Current ratio Quick ratio b. The liquidity of Icon Living, Inc., appears to have between 20Y8 and 20Y9 since the company's working capital increased. However, given that the current ratio and quick ratio it should be concluded that the company's liquidity declined from 20Y8 to 20Y9. These changes are the result of I and change in the mix of current assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts