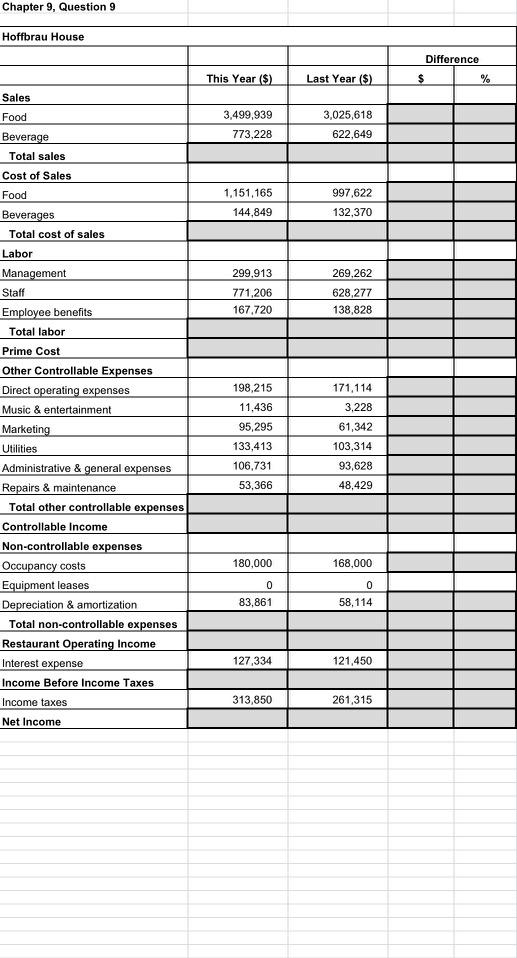

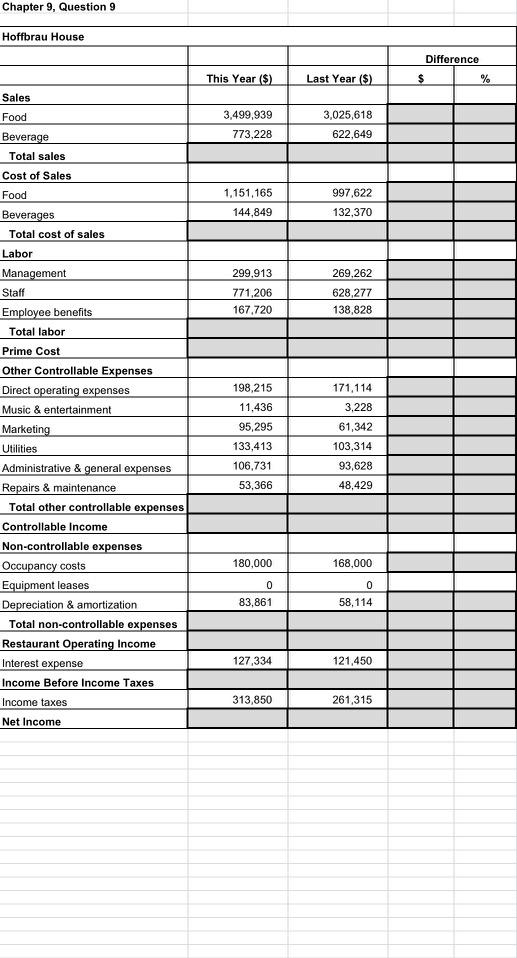

Question: Chapter 9, Question 9 Hoffbrau House Difference This Year ($) Last Year ($) $ % Sales Food 3,499,939 3,025,618 622,649 773,228 Beverage Total sales Cost

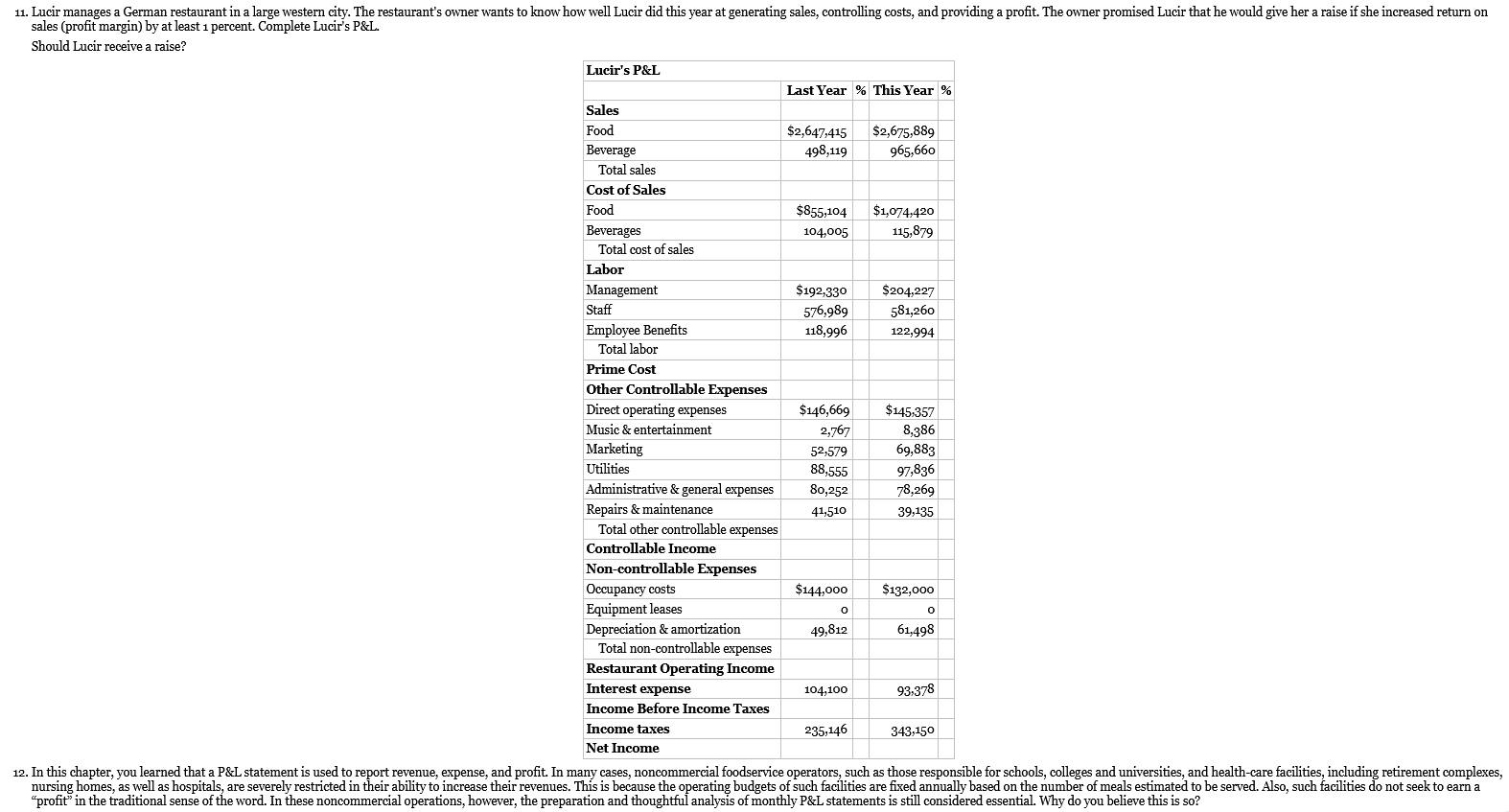

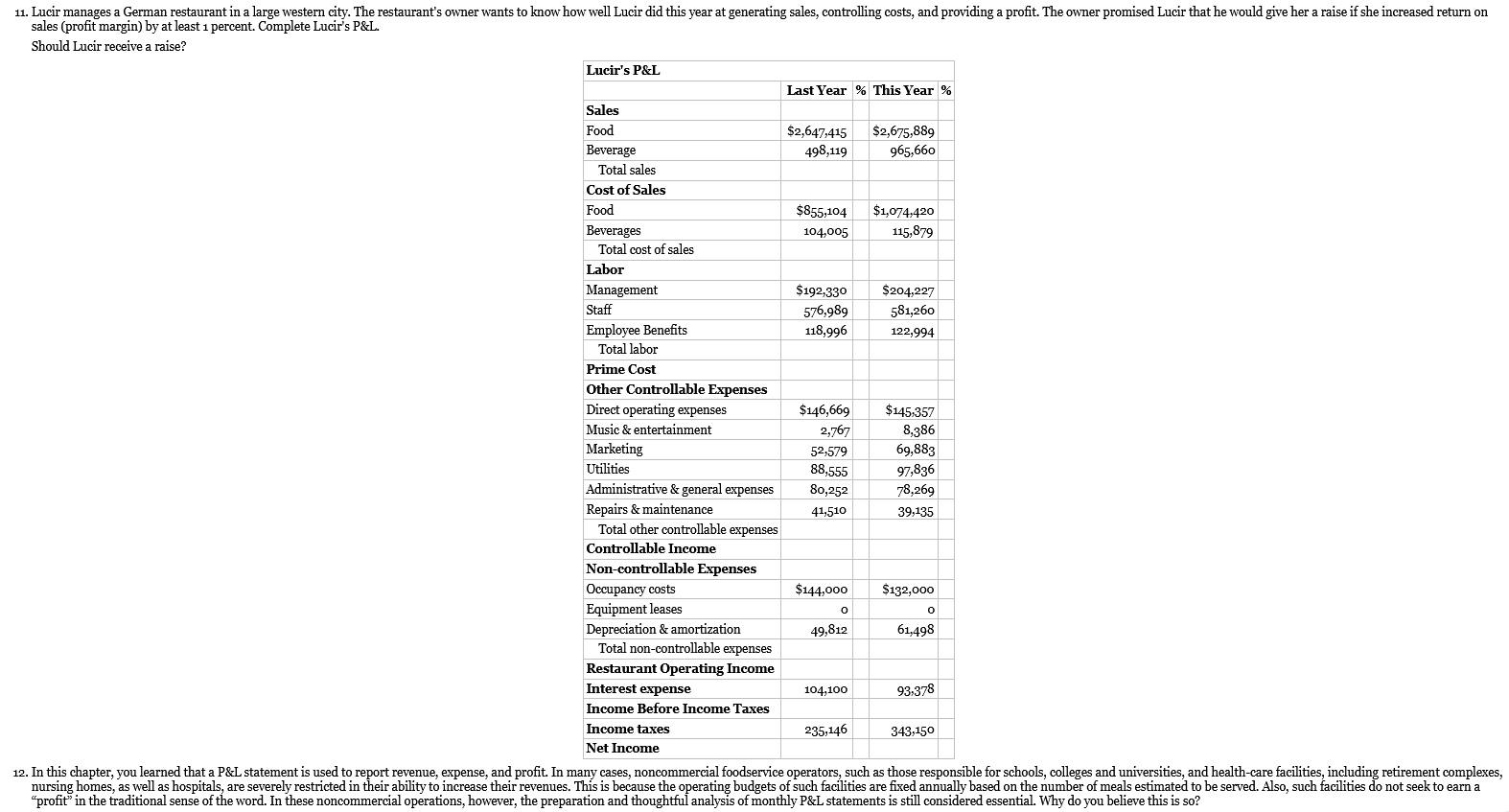

Chapter 9, Question 9 Hoffbrau House Difference This Year ($) Last Year ($) $ % Sales Food 3,499,939 3,025,618 622,649 773,228 Beverage Total sales Cost of Sales Food 1,151,165 144,849 997.622 132,370 299,913 771,206 167.720 269,262 628,277 138,828 171,114 3,228 Beverages Total cost of sales Labor Management Staff Employee benefits Total labor Prime Cost Other Controllable Expenses Direct operating expenses Music & entertainment Marketing Utilities Administrative & general expenses Repairs & maintenance Total other controllable expenses Controllable Income Non-controllable expenses Occupancy costs Equipment leases Depreciation & amortization Total non-controllable expenses Restaurant Operating Income Interest expense Income Before Income Taxes Income taxes Net Income 198,215 11,436 95,295 133,413 106,731 61,342 103,314 93,628 48,429 53,366 180,000 168,000 0 0 83,861 58,114 127,334 121,450 313,850 261,315 Food 11. Lucir manages a German restaurant in a large western city. The restaurant's owner wants to know how well Lucir did this year at generating sales, controlling costs, and providing a profit. The owner promised Lucir that he would give her a raise if she increased return on sales (profit margin) by at least 1 percent. Complete Lucir's P&L. Should Lucir receive a raise? Lucir's P&L Last Year % This Year % Sales $2,647,415 $2,675,889 Beverage 498,119 965,660 Total sales Cost of Sales Food $855,104 $1,074,420 Beverages 104,005 115,879 Total cost of sales Labor Management $192,330 $204,227 Staff 576,989 581,260 Employee Benefits 118,996 122,994 Total labor Prime Cost Other Controllable Expenses Direct operating expenses $146,669 $145,357 Music & entertainment 2,767 8,386 Marketing 52,579 69,883 Utilities 88,555 97,836 Administrative & general expenses 80,252 78,269 Repairs & maintenance 41,510 39,135 Total other controllable expenses Controllable Income Non-controllable Expenses Occupancy costs $144,000 $132,000 Equipment leases o o Depreciation & amortization 49,812 61,498 Total non-controllable expenses Restaurant Operating Income Interest expense 104,100 93,378 Income Before Income Taxes Income taxes 235,146 343,150 Net Income 12. In this chapter, you learned that a P&L statement is used to report revenue, expense, and profit. In many cases, noncommercial foodservice operators, such as those responsible for schools, colleges and universities, and health-care facilities, including retirement complexes, nursing homes, as well as hospitals, are severely restricted in their ability to increase their revenues. This is because the operating budgets of such facilities are fixed annually based on the number of meals estimated to be served. Also, such facilities do not seek to earn a "profit in the traditional sense of the word. In these noncommercial operations, however, the preparation and thoughtful analysis of monthly P&L statements is still considered essential. Why do you believe this is so? Chapter 9, Question 9 Hoffbrau House Difference This Year ($) Last Year ($) $ % Sales Food 3,499,939 3,025,618 622,649 773,228 Beverage Total sales Cost of Sales Food 1,151,165 144,849 997.622 132,370 299,913 771,206 167.720 269,262 628,277 138,828 171,114 3,228 Beverages Total cost of sales Labor Management Staff Employee benefits Total labor Prime Cost Other Controllable Expenses Direct operating expenses Music & entertainment Marketing Utilities Administrative & general expenses Repairs & maintenance Total other controllable expenses Controllable Income Non-controllable expenses Occupancy costs Equipment leases Depreciation & amortization Total non-controllable expenses Restaurant Operating Income Interest expense Income Before Income Taxes Income taxes Net Income 198,215 11,436 95,295 133,413 106,731 61,342 103,314 93,628 48,429 53,366 180,000 168,000 0 0 83,861 58,114 127,334 121,450 313,850 261,315 Food 11. Lucir manages a German restaurant in a large western city. The restaurant's owner wants to know how well Lucir did this year at generating sales, controlling costs, and providing a profit. The owner promised Lucir that he would give her a raise if she increased return on sales (profit margin) by at least 1 percent. Complete Lucir's P&L. Should Lucir receive a raise? Lucir's P&L Last Year % This Year % Sales $2,647,415 $2,675,889 Beverage 498,119 965,660 Total sales Cost of Sales Food $855,104 $1,074,420 Beverages 104,005 115,879 Total cost of sales Labor Management $192,330 $204,227 Staff 576,989 581,260 Employee Benefits 118,996 122,994 Total labor Prime Cost Other Controllable Expenses Direct operating expenses $146,669 $145,357 Music & entertainment 2,767 8,386 Marketing 52,579 69,883 Utilities 88,555 97,836 Administrative & general expenses 80,252 78,269 Repairs & maintenance 41,510 39,135 Total other controllable expenses Controllable Income Non-controllable Expenses Occupancy costs $144,000 $132,000 Equipment leases o o Depreciation & amortization 49,812 61,498 Total non-controllable expenses Restaurant Operating Income Interest expense 104,100 93,378 Income Before Income Taxes Income taxes 235,146 343,150 Net Income 12. In this chapter, you learned that a P&L statement is used to report revenue, expense, and profit. In many cases, noncommercial foodservice operators, such as those responsible for schools, colleges and universities, and health-care facilities, including retirement complexes, nursing homes, as well as hospitals, are severely restricted in their ability to increase their revenues. This is because the operating budgets of such facilities are fixed annually based on the number of meals estimated to be served. Also, such facilities do not seek to earn a "profit in the traditional sense of the word. In these noncommercial operations, however, the preparation and thoughtful analysis of monthly P&L statements is still considered essential. Why do you believe this is so