Question: Chapter 9-Problems i Saved Help Save & Exit Submit Check my work 9 The McGregor Whisky Company is proposing to market diet scotch. The product

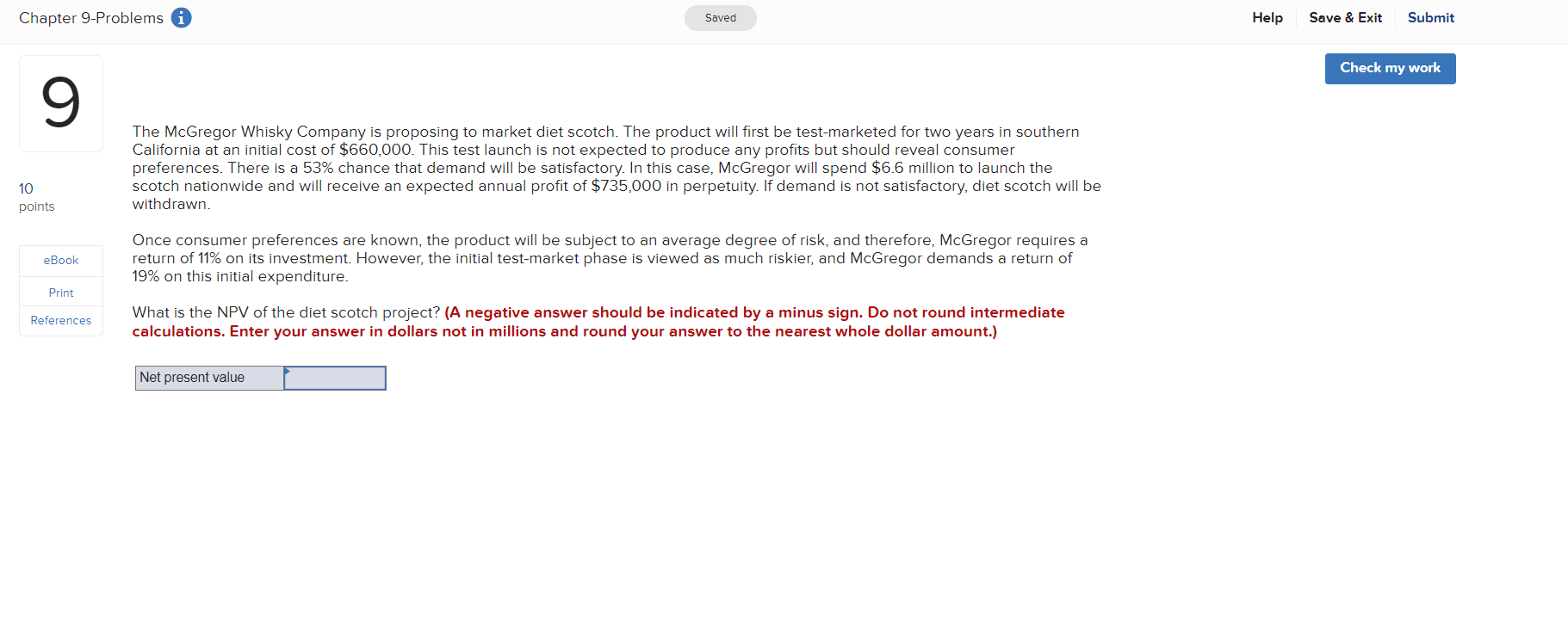

Chapter 9-Problems i Saved Help Save & Exit Submit Check my work 9 The McGregor Whisky Company is proposing to market diet scotch. The product will first be test-marketed for two years in southern California at an initial cost of $660,000. This test launch is not expected to produce any profits but should reveal consumer preferences. There is a 53% chance that demand will be satisfactory. In this case, McGregor will spend $6.6 million to launch the scotch nationwide and will receive an expected annual profit of $735,000 in perpetuity. If demand is not satisfactory, diet scotch will be withdrawn. 10 points eBook Once consumer preferences are known, the product will be subject to an average degree of risk, and therefore, McGregor requires a return of 11% on its investment. However, the initial test-market phase is viewed as much riskier, and McGregor demands a return of 19% on this initial expenditure. Print References What is the NPV of the diet scotch project? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations. Enter your answer in dollars not in millions and round your answer to the nearest whole dollar amount.) Net present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts