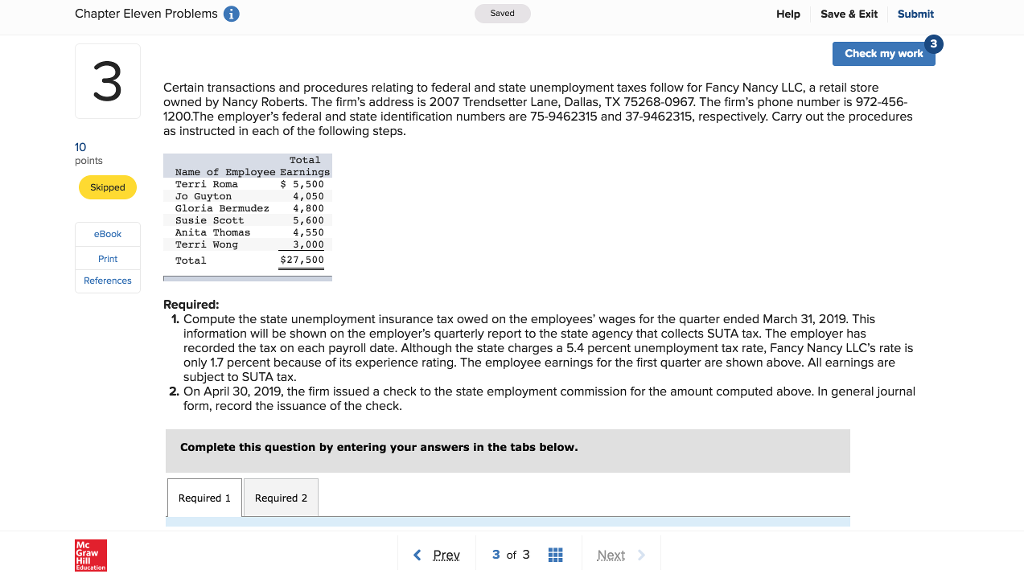

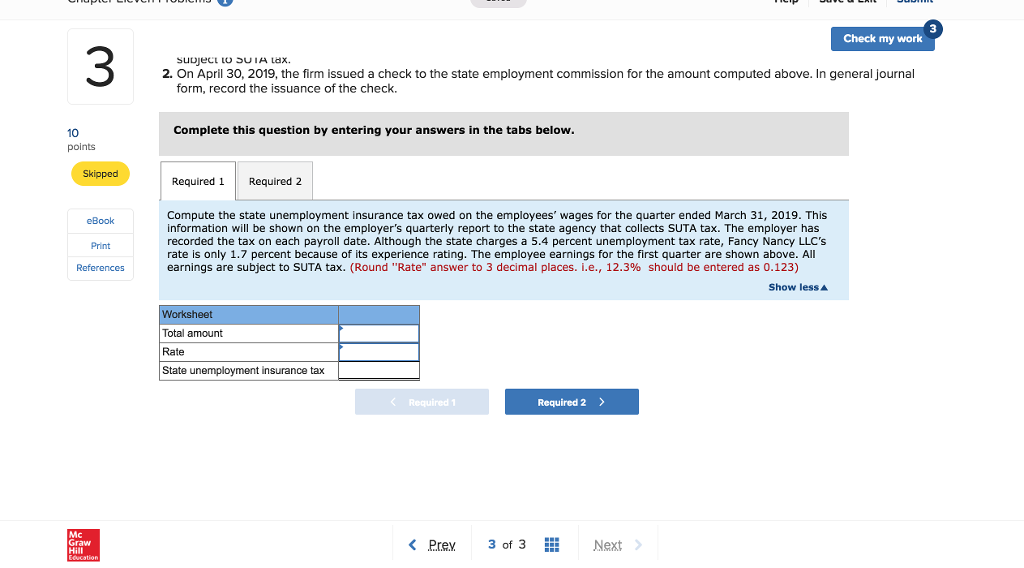

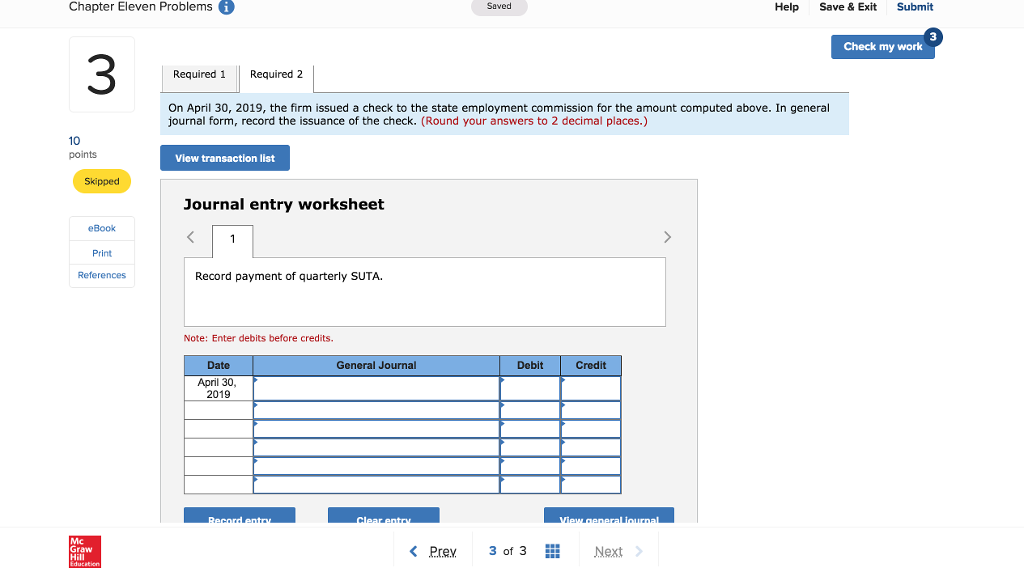

Question: Chapter Eleven Problems Help Save & Exit Submit Saved 3 Check my work The payroll register of Big House Cleaning Company showed total employee earnings

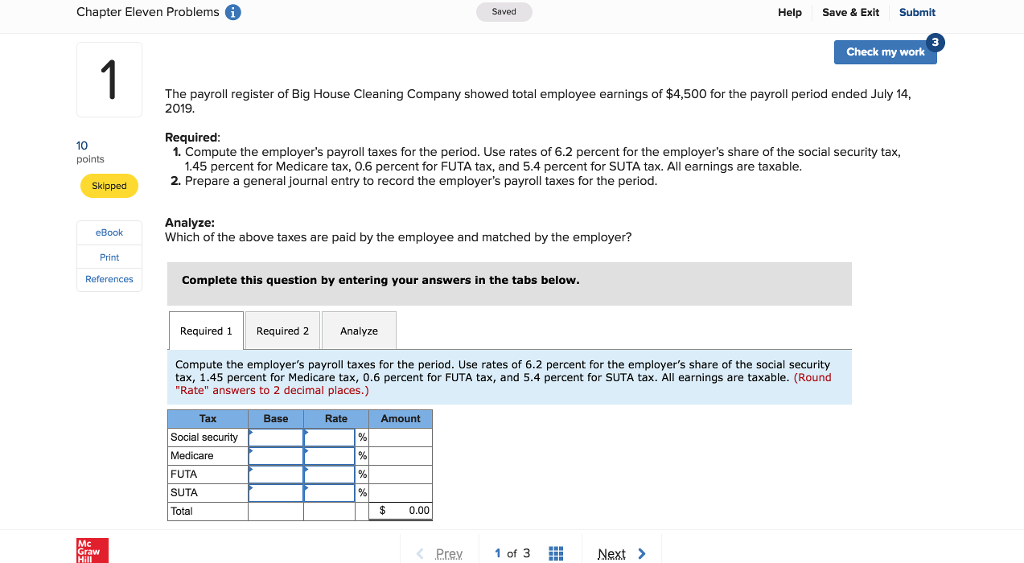

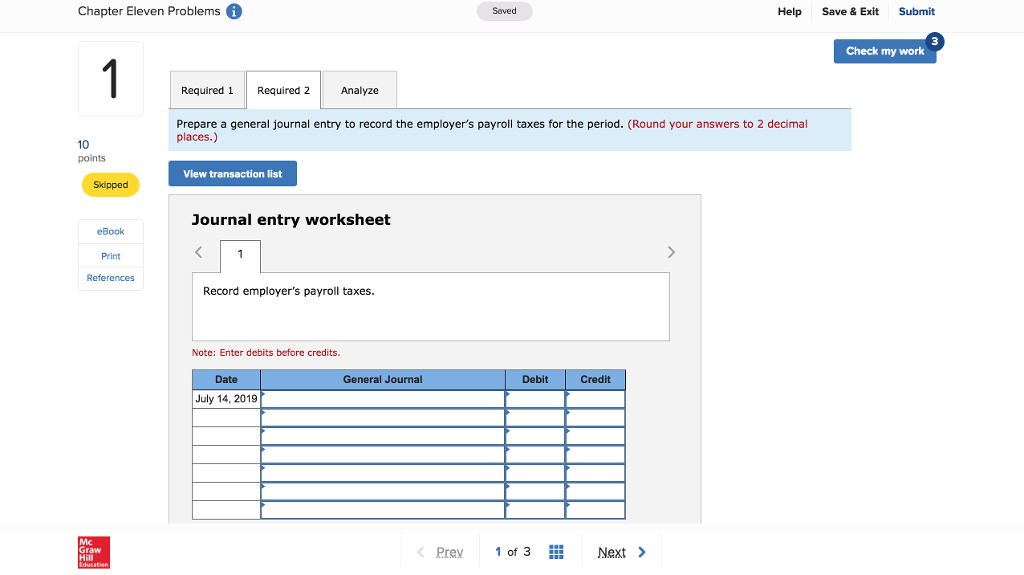

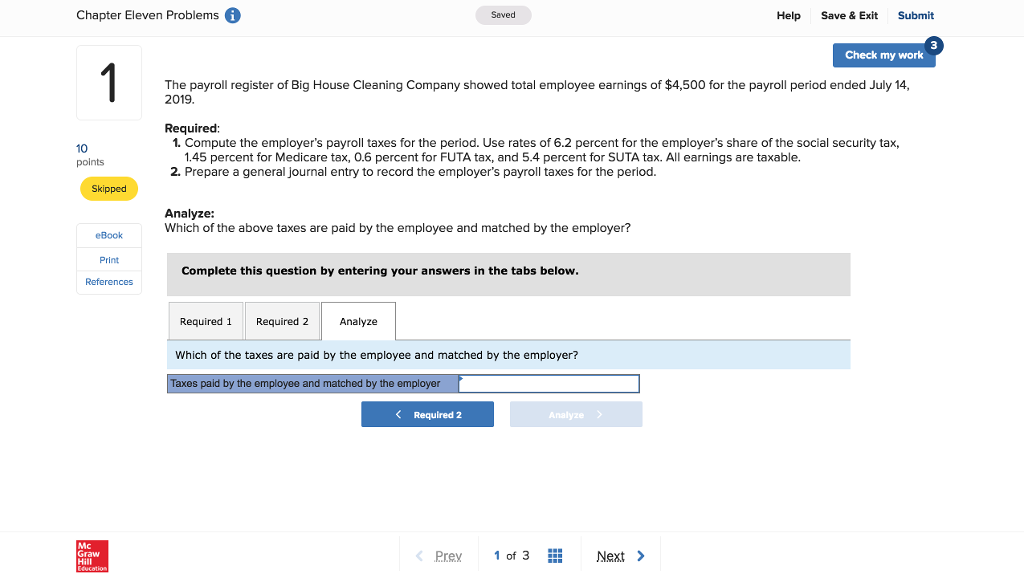

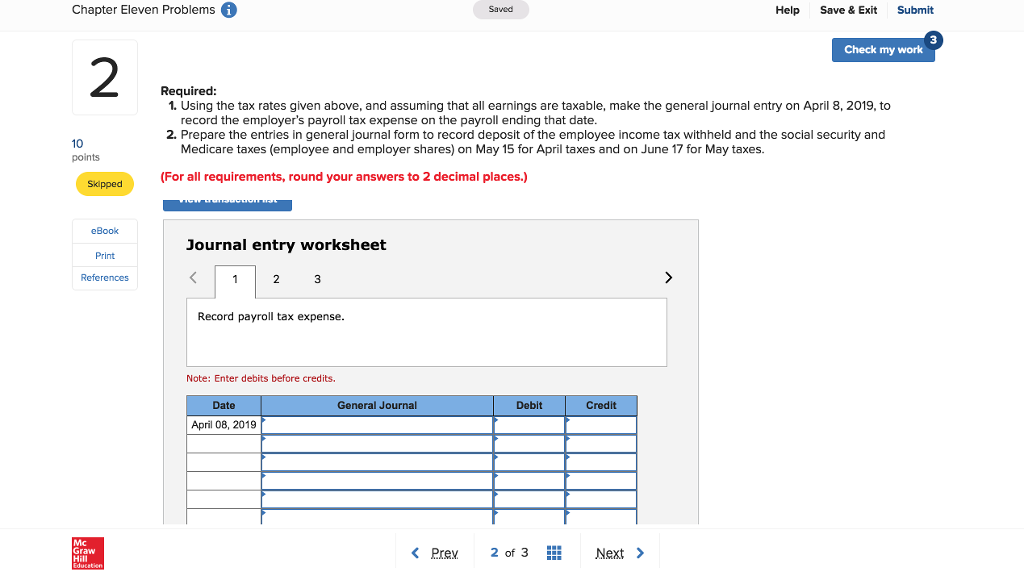

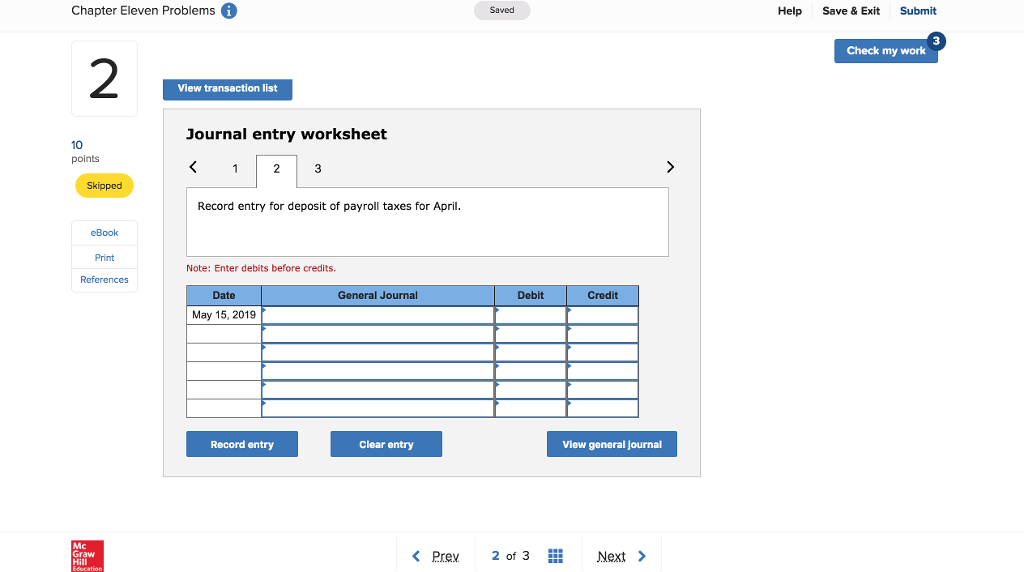

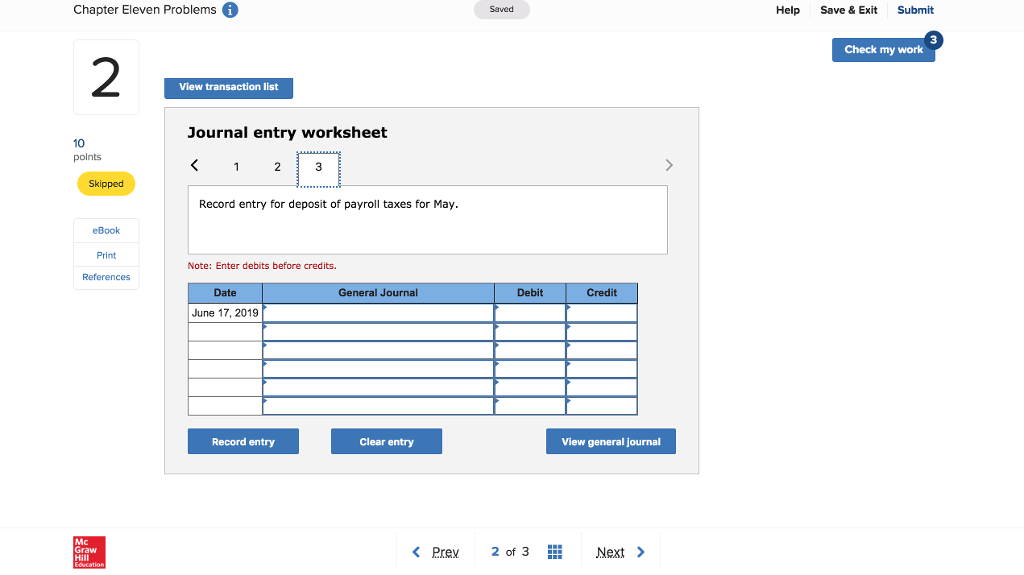

Chapter Eleven Problems Help Save & Exit Submit Saved 3 Check my work The payroll register of Big House Cleaning Company showed total employee earnings of $4,500 for the payroll period ended July 14 2019. Required 10 points 1. Compute the employer's payroll taxes for the period. Use rates of 6.2 percent for the employer's share of the social security tax, 1.45 percent for Medicare tax, 0.6 percent for FUTA tax, and 5.4 percent for SUTA tax. All earnings are taxable. 2. Prepare a general journal entry to record the employer's payroll taxes for the period Skipped Analyze: Which of the above taxes are paid by the employee and matched by the employer? eBook Print References Complete this question by entering your answers in the tabs below Required 1 Required 2 Analyze Compute the employer's payroll taxes for the period. Use rates of 6.2 percent for the employer's share of the social security tax, 1.45 percent for Medicare tax, 0.6 percent for FUTA tax, and 5.4 percent for SUTA tax. All earnings are taxable. (Round "Rate" answers to 2 decimal places.) Tax Base Rate Amount Social security FUTA SUTA Total $0.00 1013 Next >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts