Question: CHAPTER NINE True-False: before each false statement 1. g statements are either true or false. Place a (T) in the parentheses before each true statement

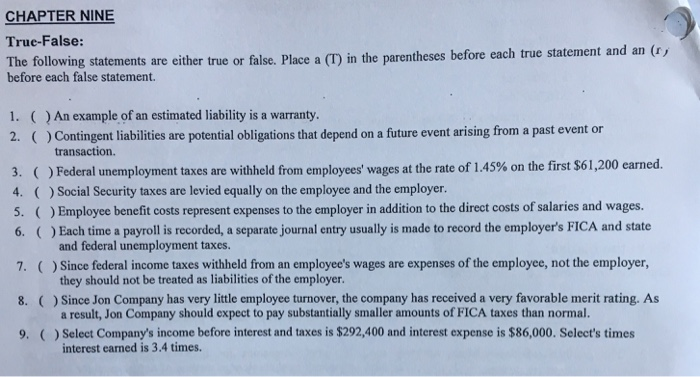

CHAPTER NINE True-False: before each false statement 1. g statements are either true or false. Place a (T) in the parentheses before each true statement and an ( ) An example of an estimated liability is a warranty 2. (Contingent liabilities are potential obligations that depend on a future event arising from a past event or transaction. 3. Federal unemployment taxes are withheld from employees' wages at the rate of 1.45% on the first $61,200 earned. 4. ()Social Security taxes are levied equally on the employee and the employer. 5. () Employee benefit costs represent expenses to the employer in addition to the direct costs of salaries and wages. 6. )Each time a payroll is recorded, a separate journal entry usually is made to record the employer's FICA and state 7. (Since federal income taxes withheld from an employee's wages are expenses of the employee, not the employer, 8. Since Jon Company has very little employee turnover, the company has received a very favorable merit rating. As 9. () Select Company's income before interest and taxes is $292,400 and interest expense is $86,000. Select's times and federal unemployment taxes they should not be treated as liabilities of the employer. a result, Jon Company should expect to pay substantially smaller amounts of FICA taxes than normal. interest earned is 3.4 times

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts