Question: Chapters 3 In-Class Exercises 1. Calculate the ratios below using the Balance Sheet and Income Statement for Tradewinds, Inc. Additional facts are that Tradewinds has

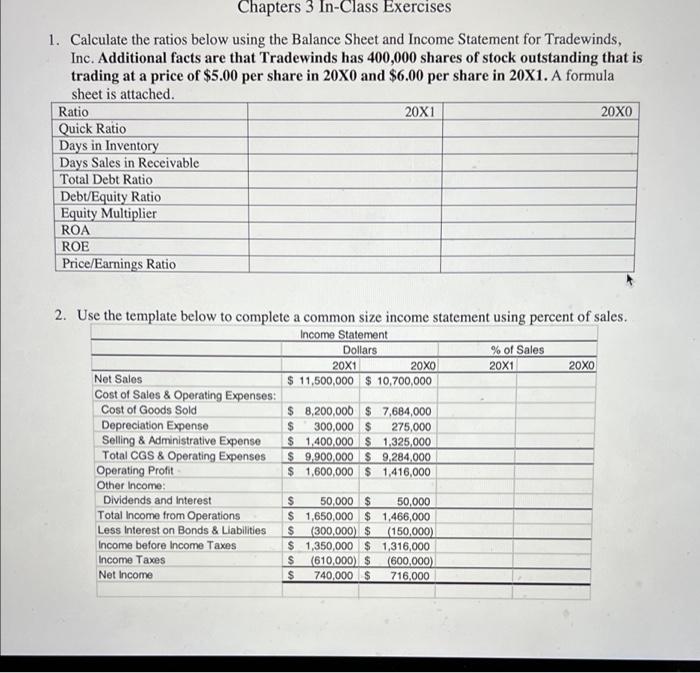

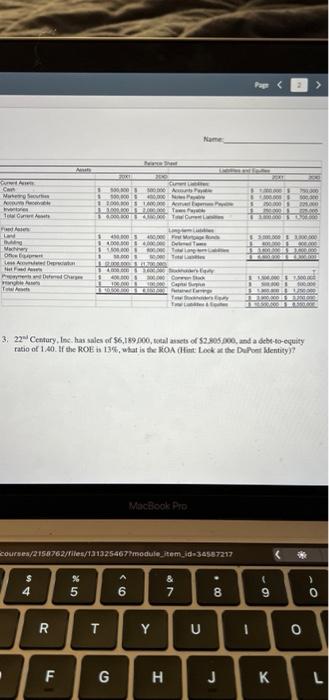

Chapters 3 In-Class Exercises 1. Calculate the ratios below using the Balance Sheet and Income Statement for Tradewinds, Inc. Additional facts are that Tradewinds has 400,000 shares of stock outstanding that is trading at a price of $5.00 per share in 20X0 and $6.00 per share in 20X1. A formula sheet is attached. Ratio 20X1 20X0 Quick Ratio Days in Inventory Days Sales in Receivable Total Debt Ratio Debt/Equity Ratio Equity Multiplier ROA ROE Price/Earnings Ratio 2. Use the template below to complete a common size income statement using percent of sales. Income Statement Dollars % of Sales 20X1 20x0 20X1 20X0 Net Sales $ 11,500,000 $ 10,700,000 Cost of Sales & Operating Expenses: Cost of Goods Sold $ 8,200,000 $ 7,684,000 Depreciation Expense $ 300,000 $275,000 Selling & Administrative Expense $ 1.400.000 $ 1.325,000 Total CGS & Operating Expenses $ 9,900,000 $9.284.000 Operating Profit $ 1,600,000 $ 1.416,000 Other Income: Dividends and Interest $ 50,000 $ 50,000 Total Income from Operations $ 1,650,000 $ 1,466,000 Less Interest on Bonds & Liabilities $ 300,000) $ (150,000) Income before Income Taxes $ 1,350,000 $ 1,316,000 Income Taxes $ (610,000) $ (600,000) Net Income $ 740,000 $ 716.000 2 > Name Na 5000 100,000 100 Am Tourer . 100 Nary 100 100 LAW Per CS 3. 22 Centary, Inc. has sales of $6,189.000, soal assets of $20.000, and a debt-to-equity ratio of 140. If the ROE 13%, what is the BOA (Hot Look at the DuPont entity? MacBook Pro courses/2156762/files/131325467"module_item_id=34567217 Au % 5 0 > A 6 & 7 1 9 4 8 9 o R Y Y UI o F G H J

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts