Question: Chapters 9 and 10 questions 1. Marilee's Electronics uses a periodic inventory system and the average cost retail method to estimate ending inventory and cost

Chapters 9 and 10 questions

1.

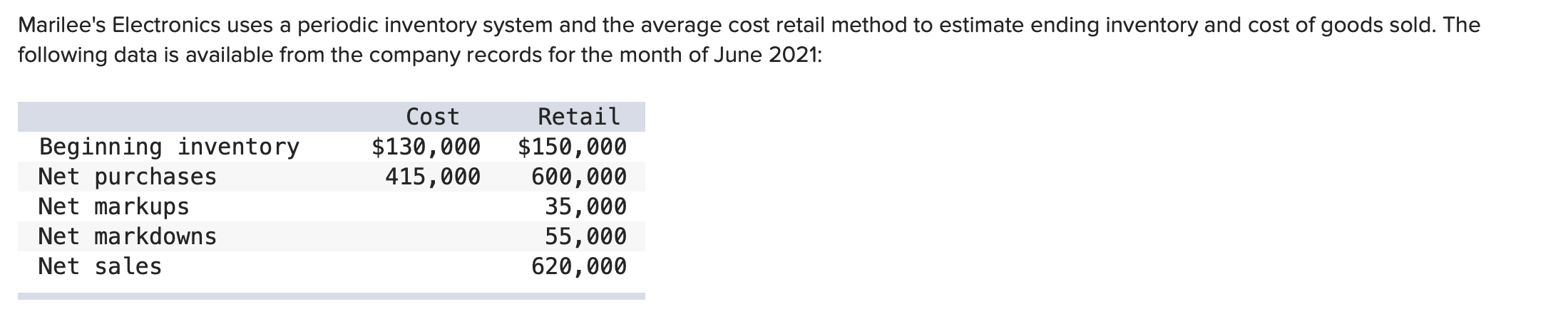

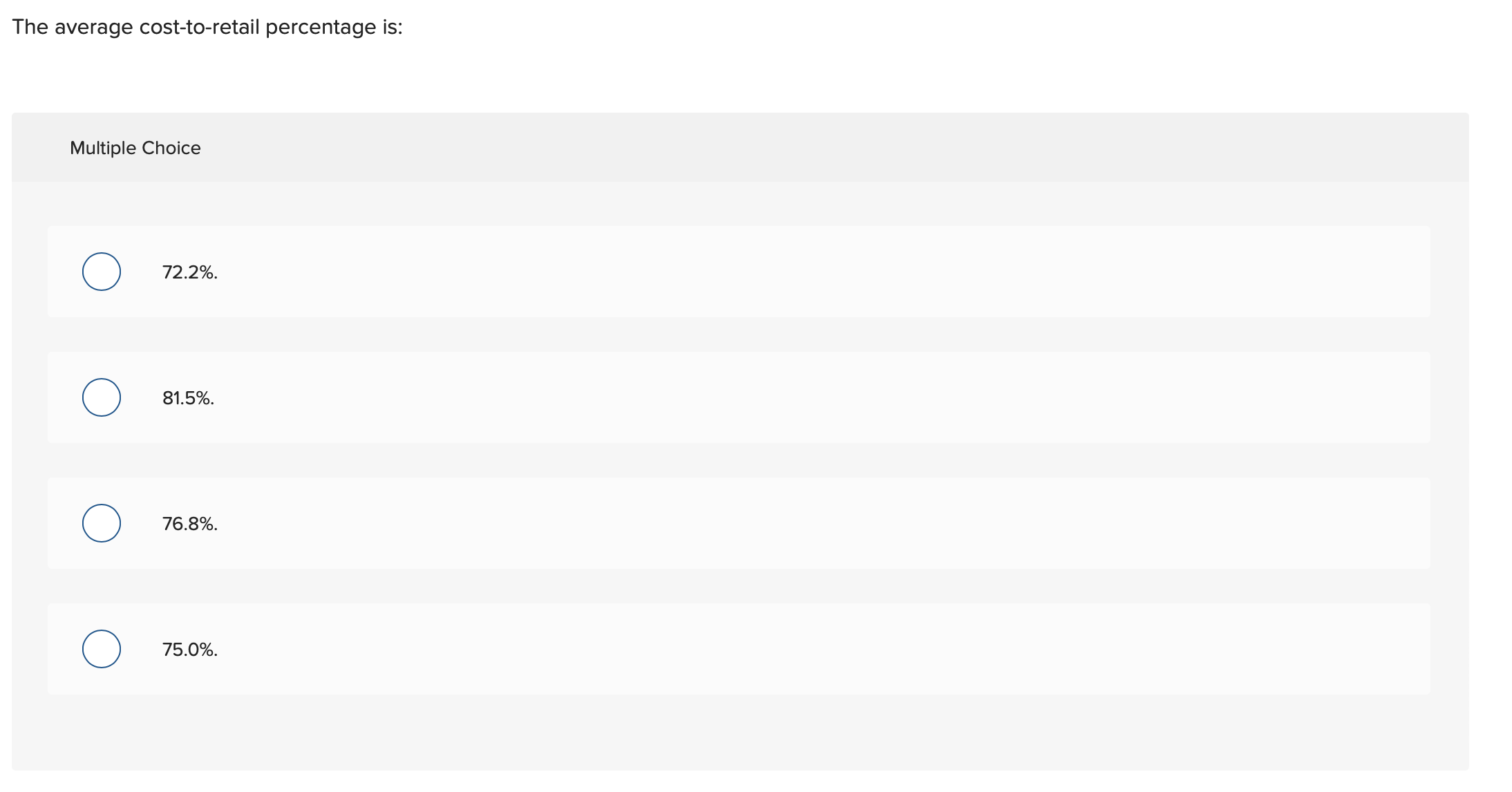

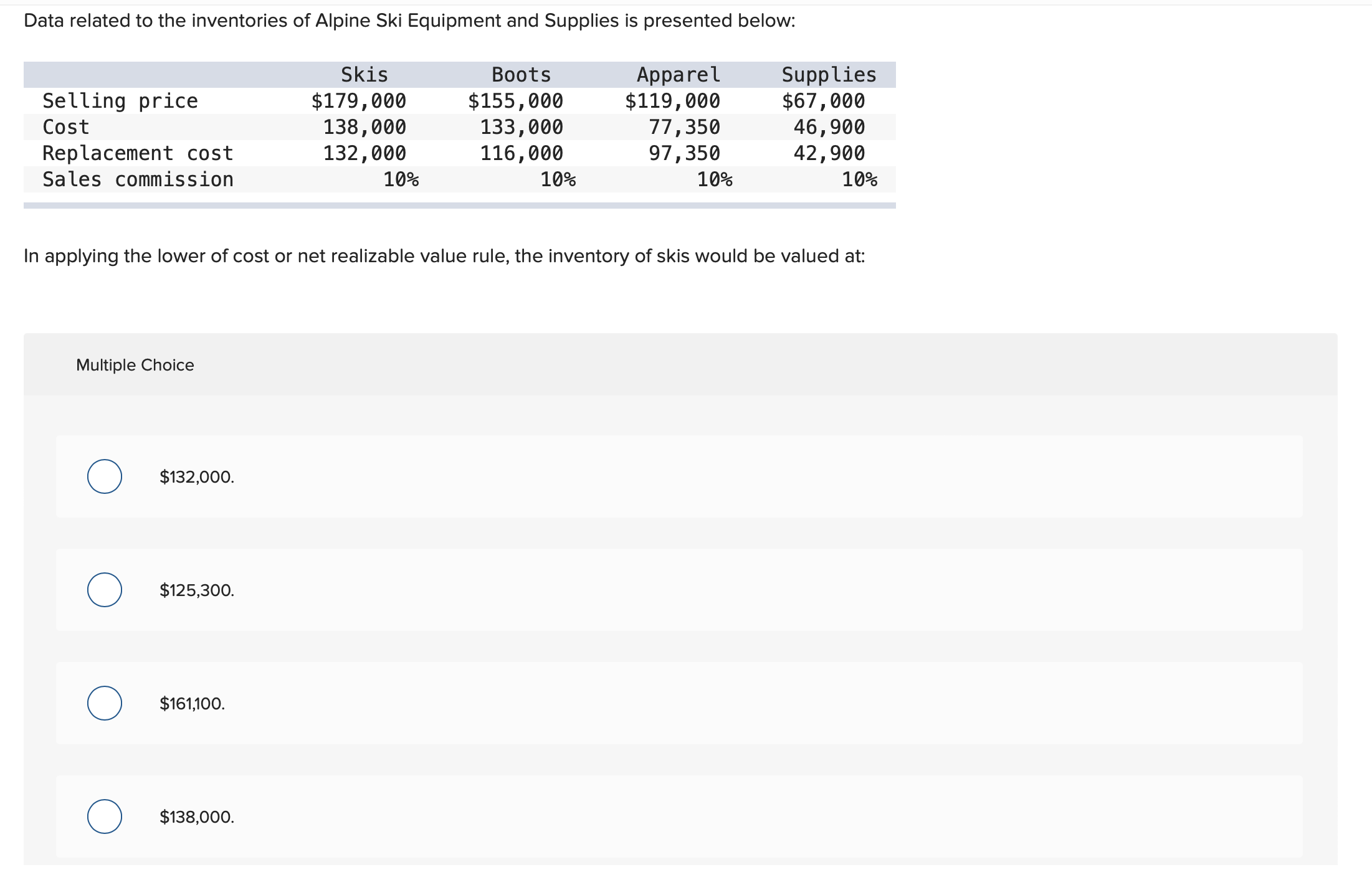

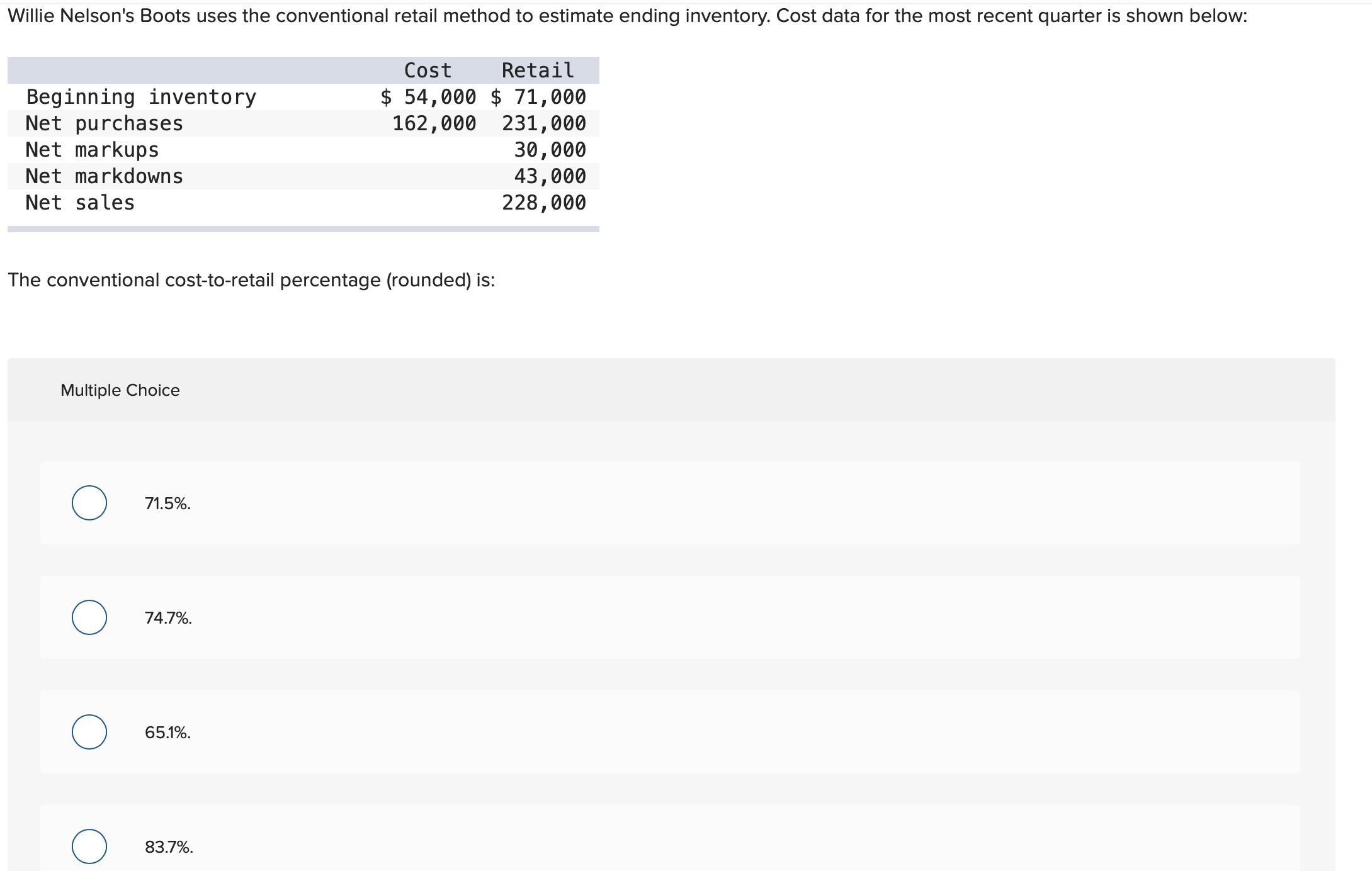

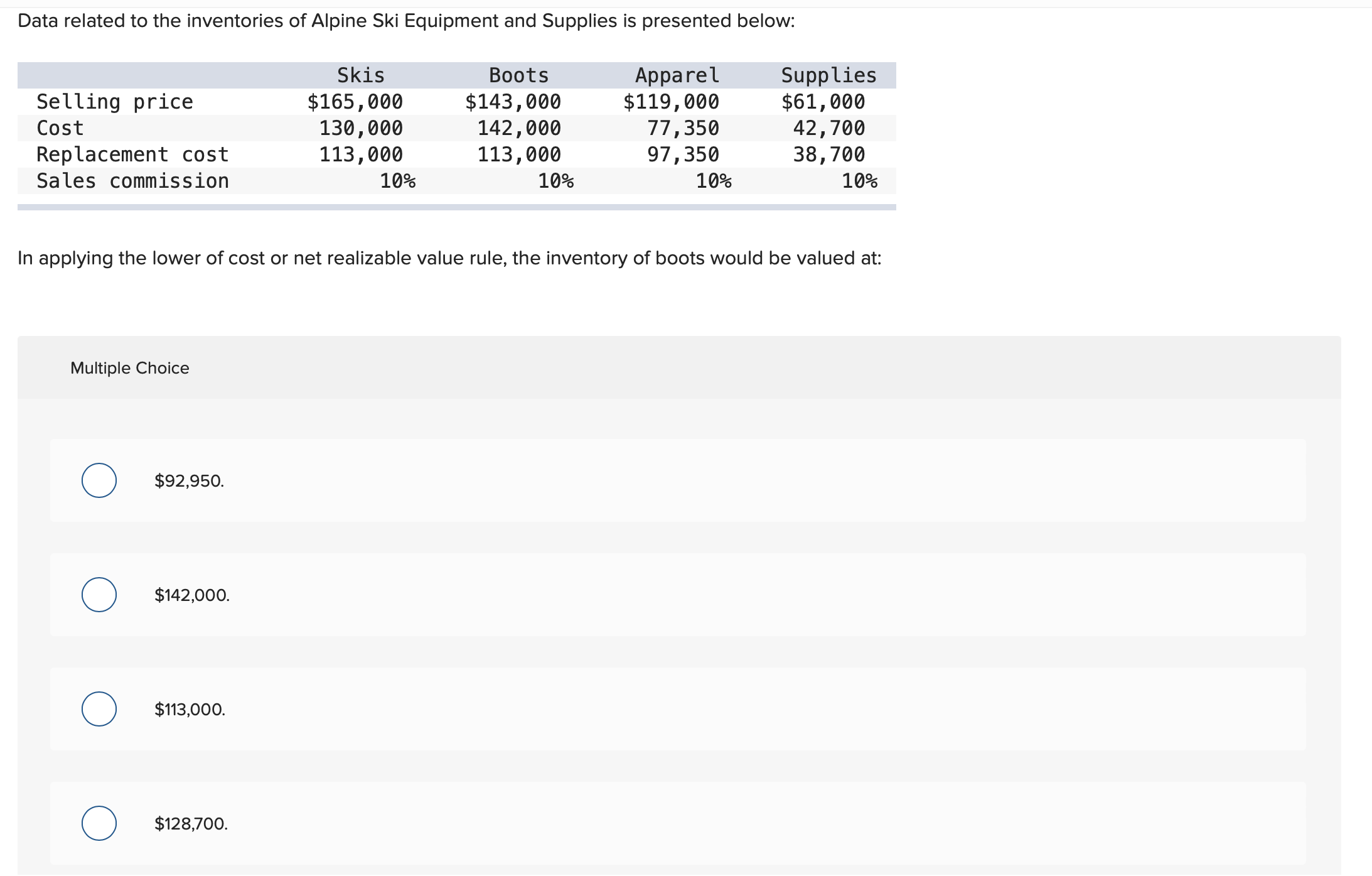

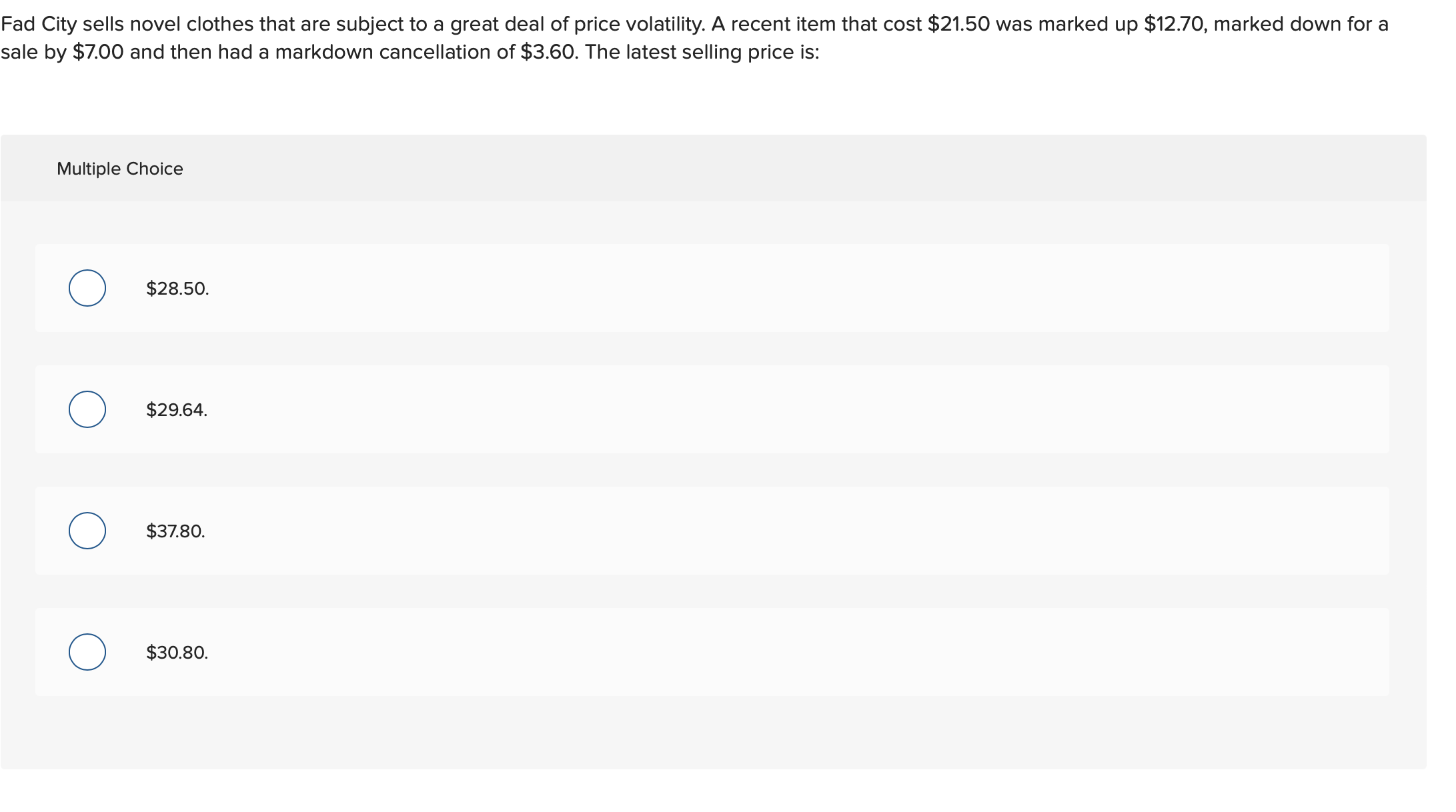

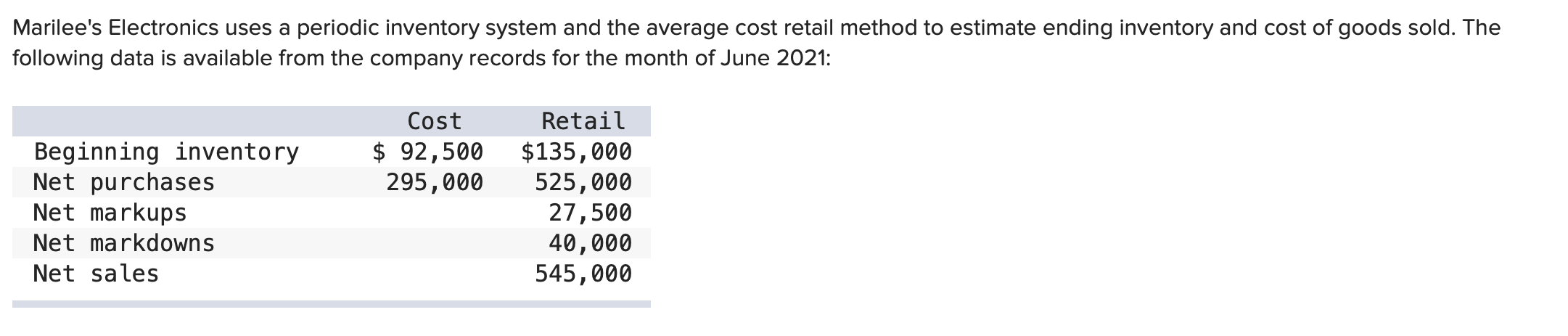

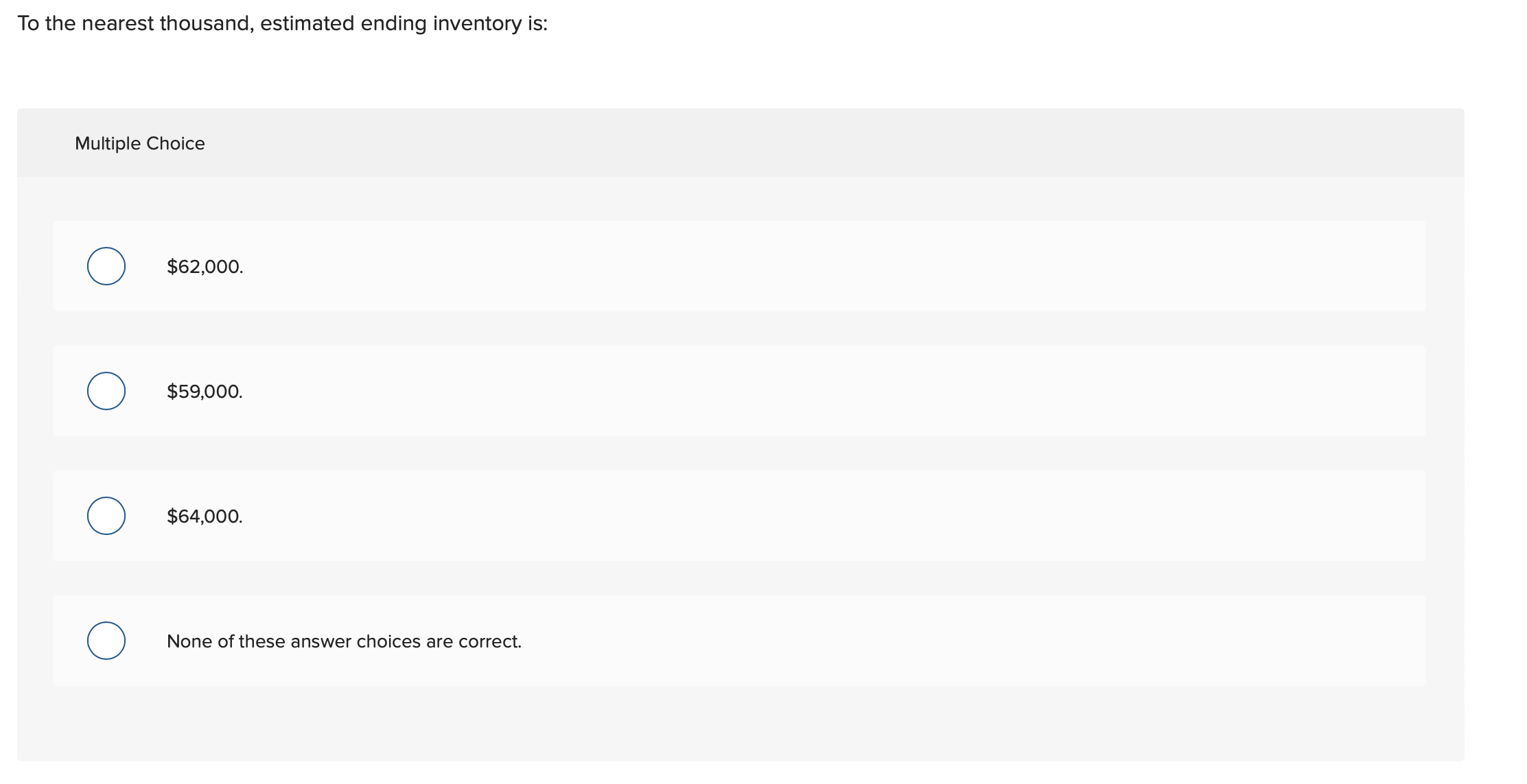

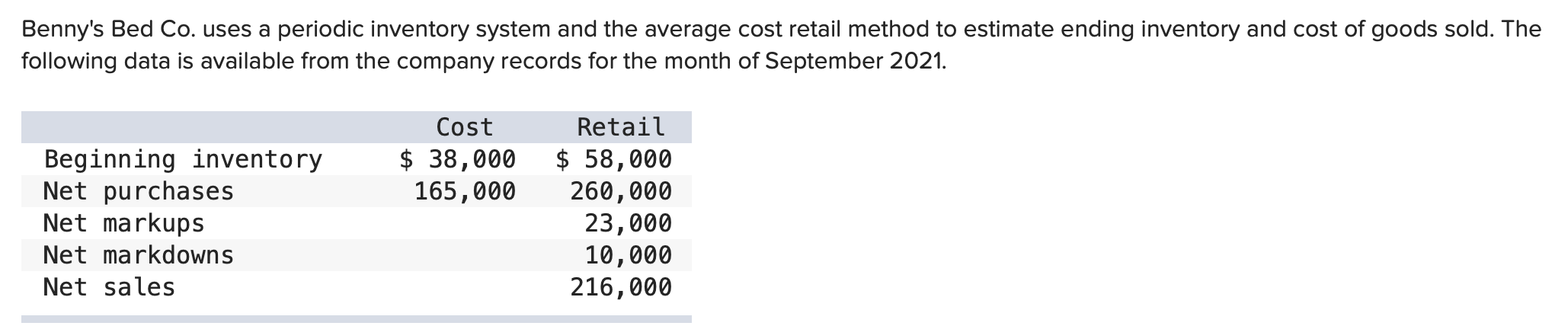

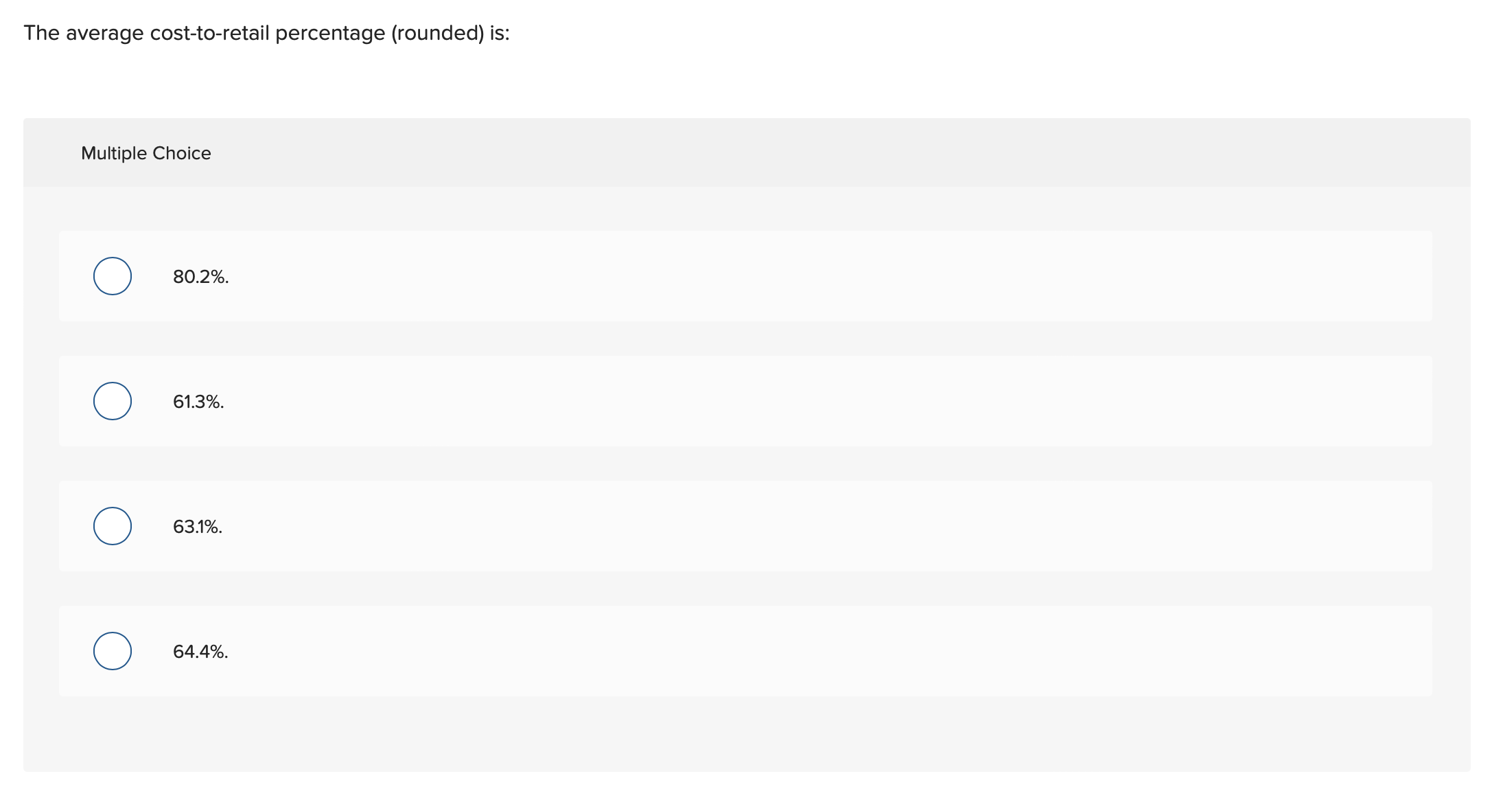

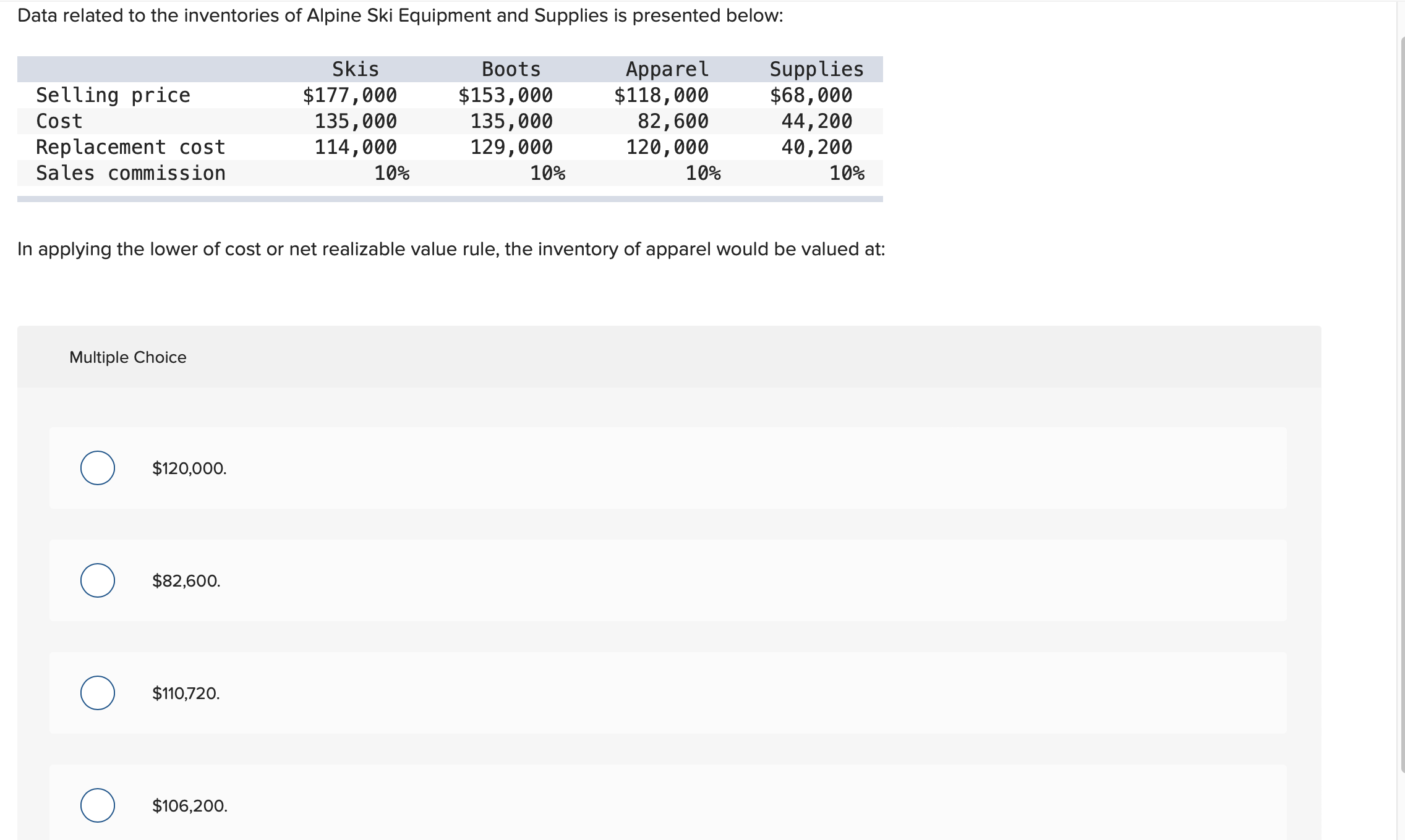

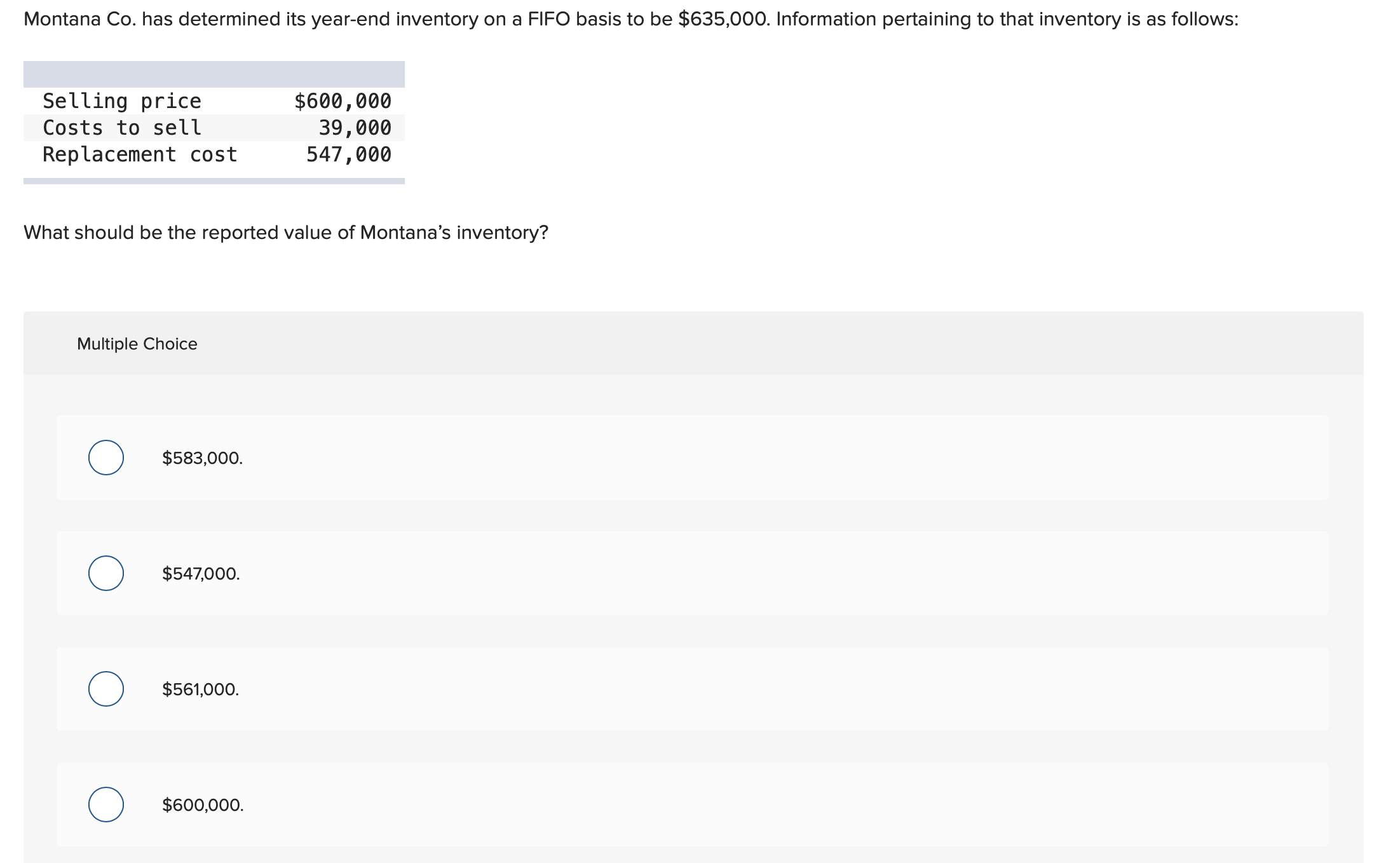

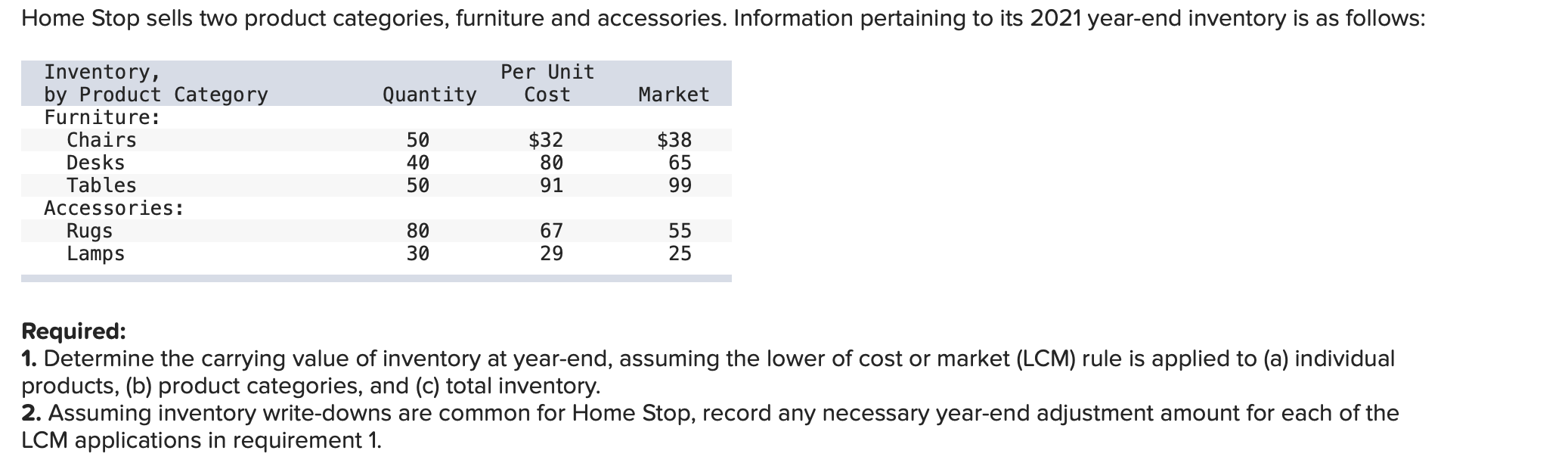

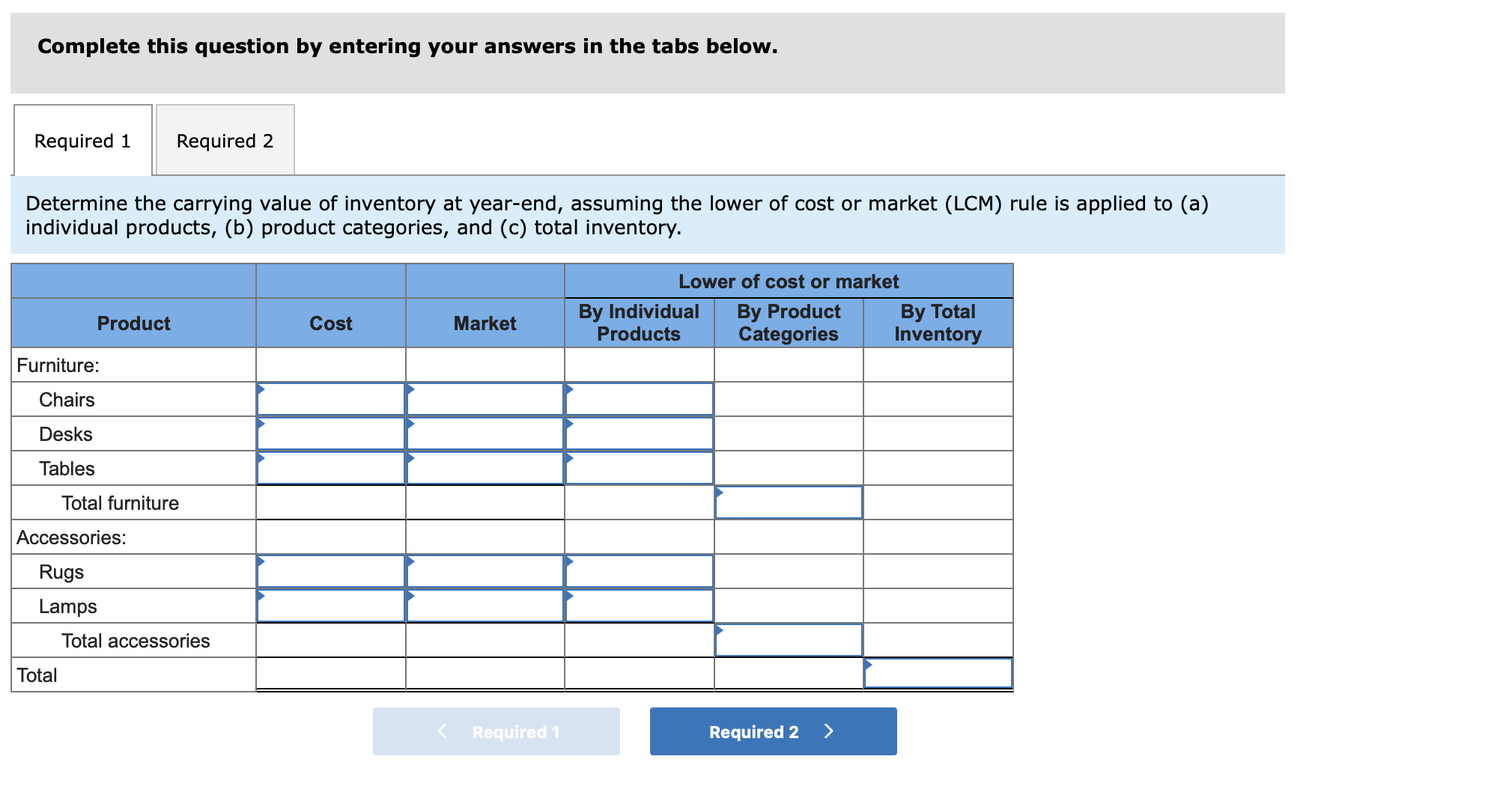

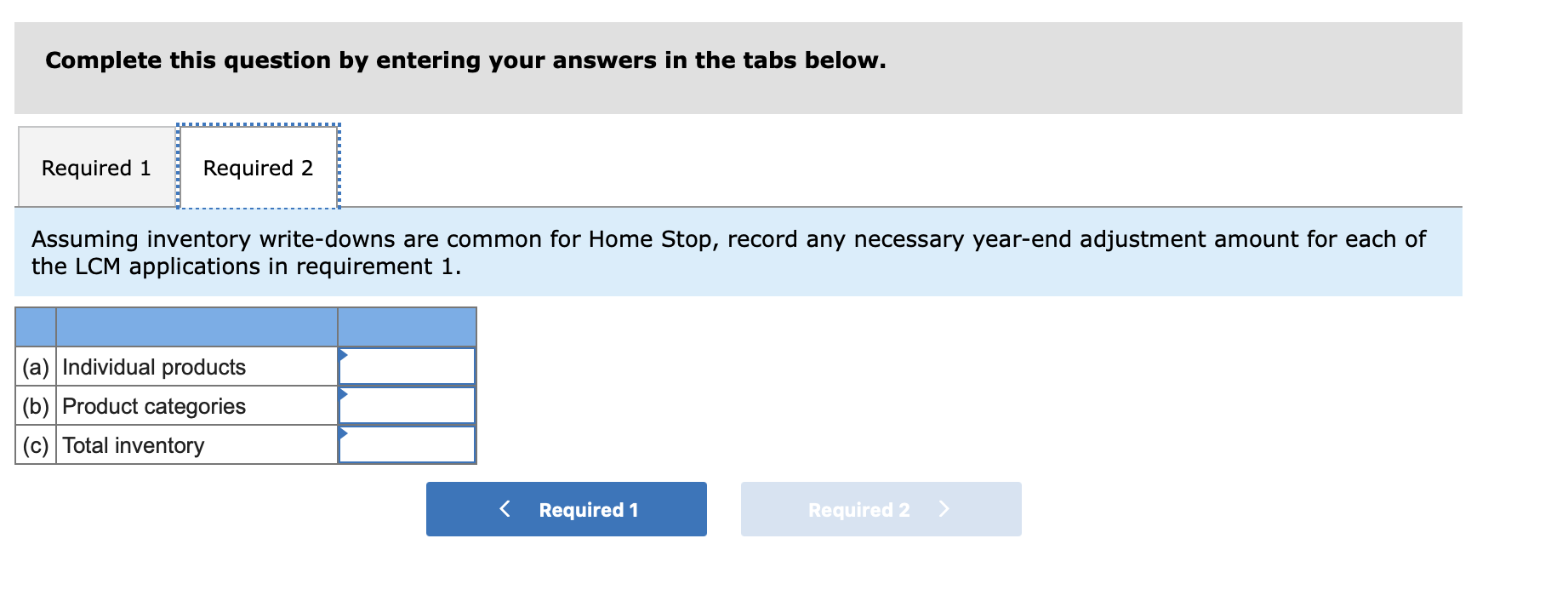

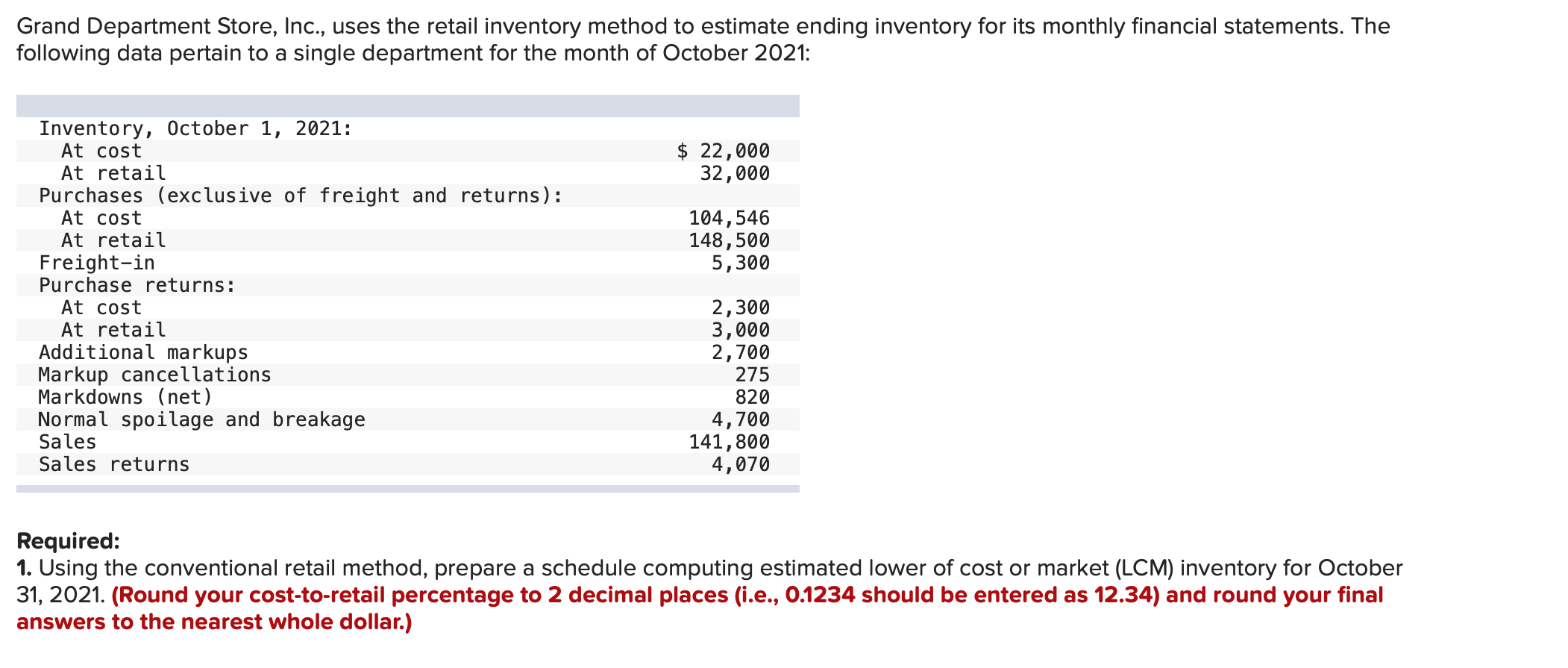

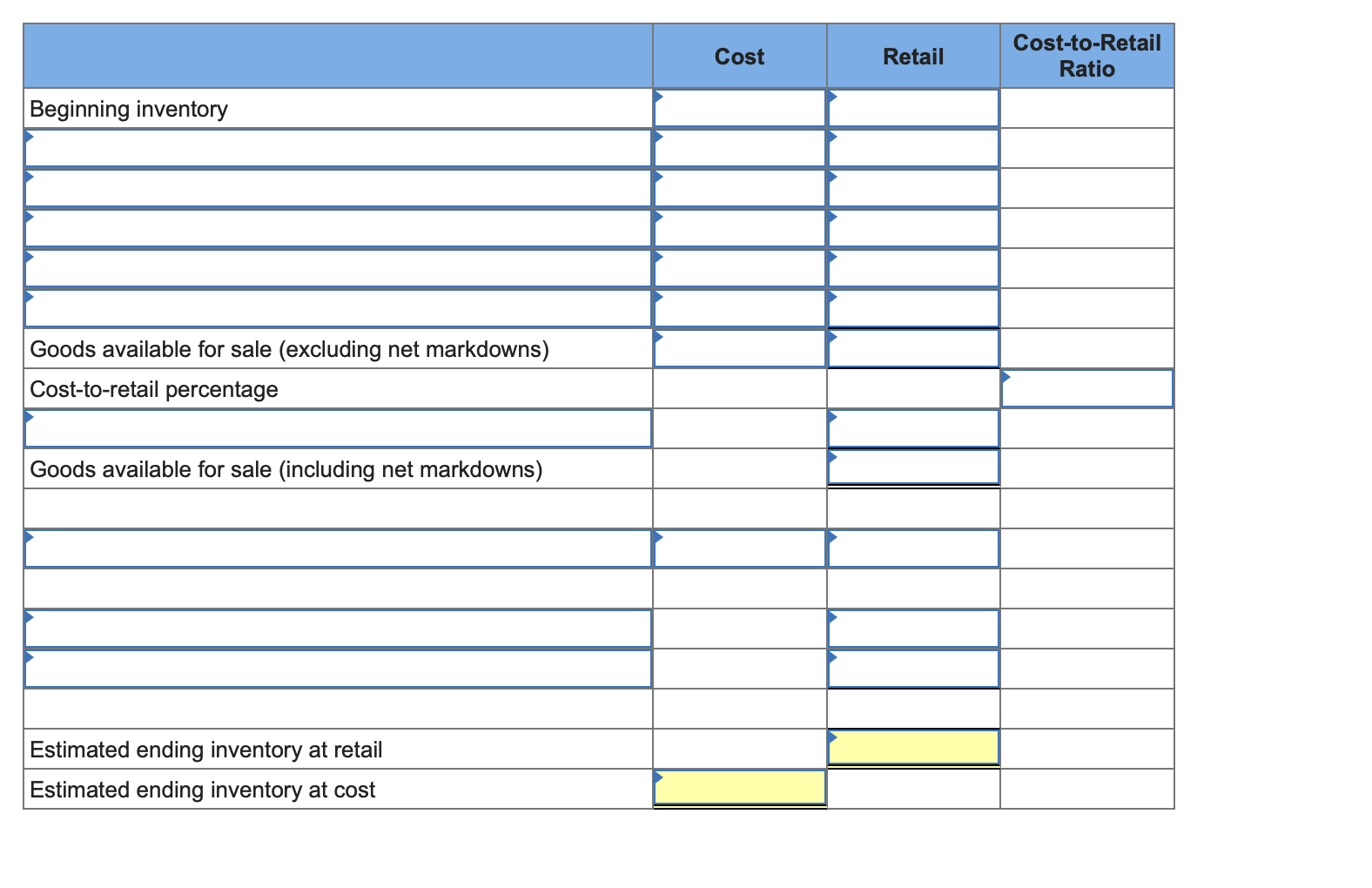

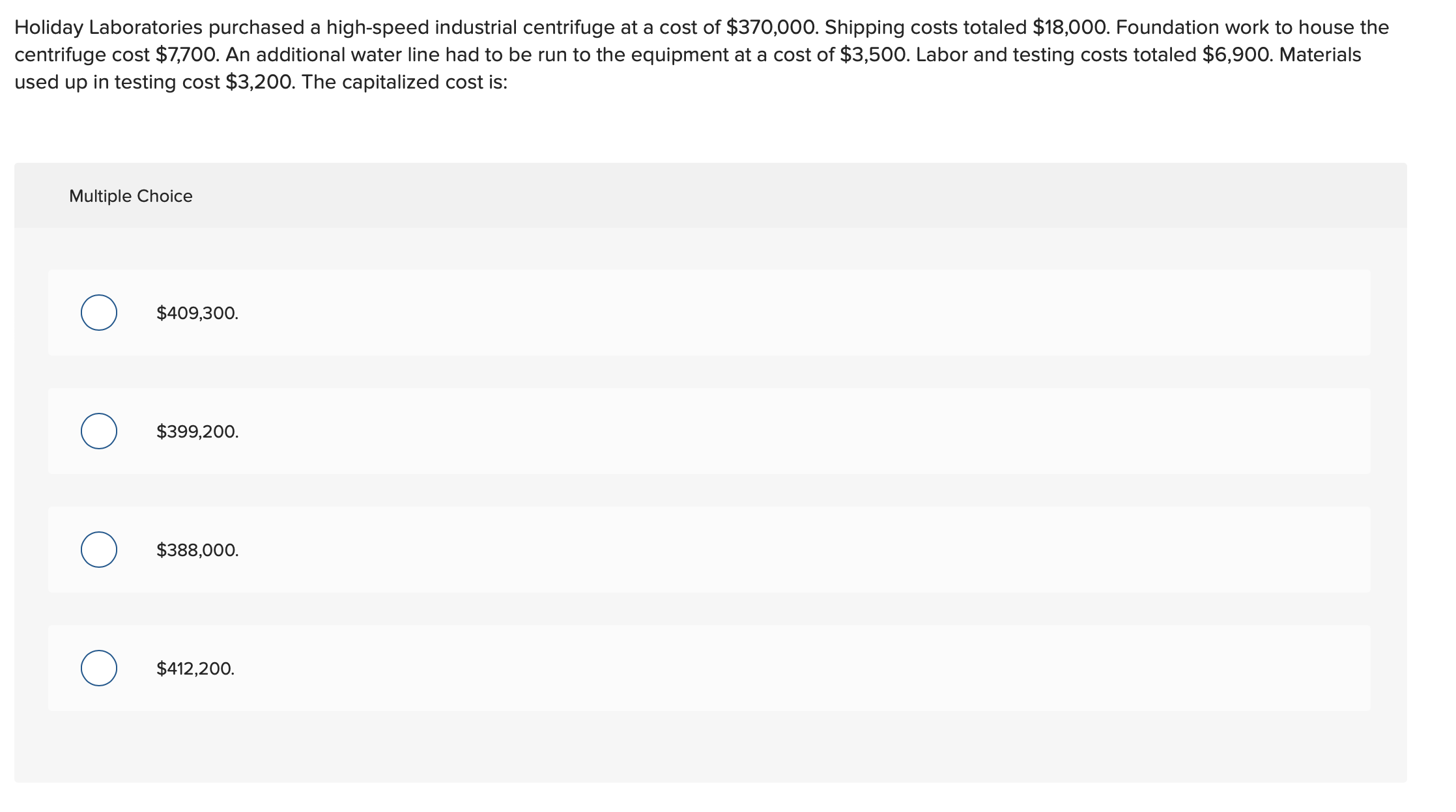

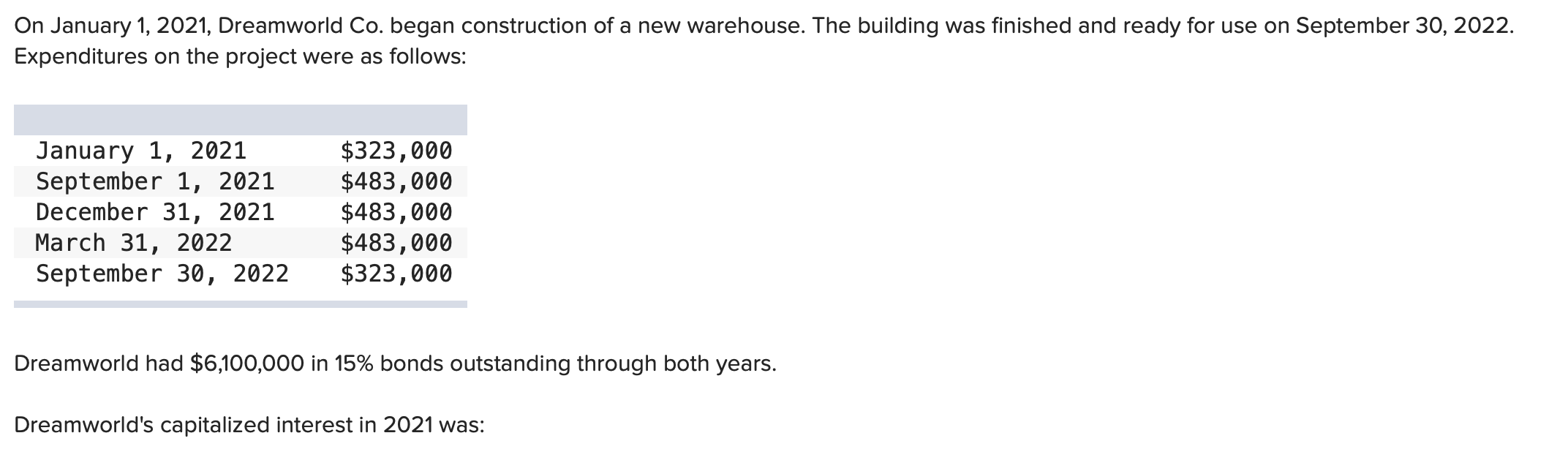

Marilee's Electronics uses a periodic inventory system and the average cost retail method to estimate ending inventory and cost of goods sold. The following data is available from the company records for the month of June 2021: Cost Retail Beginning inventory $130,000 $150,000 Net purchases 415,000 600,000 Net markups 35,000 Net markdowns 55,000 Net sales 620,000 \fData related to the inventories of Alpine Ski Equipment and Supplies is presented below: Skis Boots Apparel Supplies Selling price $179,000 $155,000 $119,000 $67,000 Cost 138,000 133,000 77,350 46,900 Replacement cost 132,000 116,000 97,350 42,900 Sales commission 109s 109s 109s 1096 In applying the lower of cost or net realizable value rule, the inventory of skis would be valued at: Multiple Choice 0 $132,000. $125,300. 0 0 $161,100. 0 $138,000. Data related to the inventories of Costco Medical Supply are presented below: Surgical Surgical Rehab Rehab Equipment Supplies Equipment Supplies Selling price $268 $137 $326 $161 Cost 153 93 282 163 Costs to sell 13 13 19 5 In applying the lower of cost or net realizable value rule, the inventory of rehab equipment would be valued at: Multiple Choice 0 $266. $282. 0 0 $209. O $307. Willie Nelson's Boots uses the conventional retail method to estimate ending inventory. Cost data for the most recent quarter is shown below: Cost Retail Beginning inventory $ 54,000 $ 71,000 Net purchases 162,000 231,000 Net markups 30,000 Net markdowns 43,000 Net sales 228,000 The conventional cost-to-retail percentage (rounded) is: Multiple Choice 0 71.5%. 74.7%. 83.7%. 0 O 65.1%. 0 Data related to the inventories of Alpine Ski Equipment and Supplies is presented below: Skis Boots Apparel Supplies Selling price $165,000 $143,000 $119,000 $61,000 Cost 130,000 142,000 77,350 42,700 Replacement cost 113,000 113,000 97,350 38,700 Sales commission 109a 109a 1095 1095 In applying the lower of cost or net realizable value rule, the inventory of boots would be valued at: Multiple Choice 0 $92,950. $142,000. 0 0 $113,000. 0 $128,700. Fad City sells novel clothes that are subject to a great deal of price volatility. A recent item that cost $21.50 was marked up $12.70, marked down for a sale by $7.00 and then had a markdown cancellation of $3.60. The latest selling price is: Multiple Choice 0 $28.50. $29.64. 0 O $37.80. 0 $30.80. Marilee's Electronics uses a periodic inventory system and the average cost retail method to estimate ending inventory and cost of goods sold. The following data is available from the company records for the month ofJune 2021: Cost Retail Beginning inventory $ 92,500 $135,000 Net purchases 295,000 525,000 Net ma rkups 27, 500 Net markdowns 40,000 Net sales 545,000 To the nearest thousand, estimated ending inventory is: Multiple Choice O $62,000. $59,000. O 0 $64,000. 0 None of these answer choices are correct. Benny's Bed Co. uses a periodic inventory system and the average cost retail method to estimate ending inventory and cost of goods sold. The following data is available from the company records for the month of September 2021. Cost Retail Beginning inventory $ 38,000 $ 58,000 Net purchases 165,000 260,000 Net markups 23,000 Net markdowns 10,000 Net sales 216,000 \fData related to the inventories of Alpine Ski Equipment and Supplies is presented below: Skis Boots Apparel Supplies Selling price $177,000 $153,000 $118,000 $68,000 Cost 135,000 135,000 82,600 44,200 Replacement cost 114,000 129,000 120,000 40,200 Sales commission 109s 109a 1095 1096 In applying the lower of cost or net realizable value rule, the inventory of apparel would be valued at: Multiple Choice 0 $120,000. $82,600. $106,200. 0 0 $110,720. 0 Montana Co. has determined its year-end inventory on a FIFO basis to be $635,000. Information pertaining to that inventory is as follows: Selling price $600,000 Costs to sell 39,000 Replacement cost 547,000 What should be the reported value of Montana's inventory? Multiple Choice 0 $583,000. $547,000. 0 O $561000. 0 $600,000. Home Stop sells two product categories, furniture and accessories. Information pertaining to its 2021 year-end inventory is as follows: Inventory, Per Unit by Product Category Quantity Cost Market Fu rnit u re: Chairs 50 $32 $38 Desks 40 80 65 Tables 50 91 99 Accessories: Rugs 80 67 55 Lamps 30 29 25 Required: 1. Determine the carrying value of inventory at year-end, assuming the lower of cost or market (LCM) rule is applied to (a) individual products, (b) product categories, and (c) total inventory. 2. Assuming inventory write-downs are common for Home Stop, record any necessary year-end adjustment amount for each of the LCM applications in requirement 1. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine the carrying value of inventory at year-end, assuming the lower of cost or market (LCM) rule is applied to (a) individual products, (b) product categories, and (c) total inventory. Furniture: Total furniture Accessories: Total accessories Total Required 2 > Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assuming inventory write-downs are common for Home Stop, record any necessary year-end adjustment amount for each of the LCM applications in requirement 1. (a) Individual products (b) Product categories (c) Total inventory Grand Department Store, Inc., uses the retail inventory method to estimate ending inventory for its monthly financial statements. The following data pertain to a single department for the month of October 2021: Inventory, October 1, 2021: At cost $ 22,000 At retail 32,000 Purchases (exclusive of freight and returns): At cost 104,546 At retail 148,500 Freightin 5,300 Purchase returns: At cost 2.300 At retail 3.000 Additional markups 2,700 Markup cancellations 275 Markdowns (net) 820 Normal spoilage and breakage 4,700 Sales 141.800 Sales returns 4,070 Required: 1. Using the conventional retail method, prepare a schedule computing estimated lower of cost or market (LCM) inventory for October 31, 2021. (Round your cost-to-retail percentage to 2 decimal places (i.e., 0.1234 should be entered as 12.34) and round your final answers to the nearest whole dollar.) Beginning inventory Goods available for sale (excluding net markdowns) Cost-to-retail percentage Goods available for sale (including net markdowns) Estimated ending inventory at retail _ Estimated ending inventory at cost _ Holiday Laboratories purchased a high-speed industrial centrifuge at a cost of $370,000. Shipping costs totaled $18,000. Foundation work to house the centrifuge cost $7,700. An additional water line had to be run to the equipment at a cost of $3,500. Labor and testing costs totaled $6,900. Materials used up in testing cost $3,200. The capitalized cost is: Multiple Choice 0 $409,300. $399,200. 0 0 $388,000. 0 $412,200. On January 1, 2021, Dreamworld Co. began construction of a new warehouse. The building was finished and ready for use on September 30, 2022. Expenditures on the project were as follows: January 1, 2021 $323 , 000 September 1, 2021 $483 , 000 December 31, 2021 $483 , 000 March 31, 2022 $483 , 000 September 30, 2022 $323, 000 Dreamworld had $6,100,000 in 15% bonds outstanding through both years. Dreamworld's capitalized interest in 2021 was:Multiple Choice O $72,600. O $48,450. O $84,712. O $96,900.On January 1, 2021, Laramie Inc. acquired land for $6.4 million. Laramie paid $1.3 in cash and signed a 6% note requiring the company to pay the remaining $5.1 million plus interest on December 31, 2022. An interest rate of 6% properly reflects the time value of money for this type of loan agreement. For what amount should Laramie record the purchase of land? Multiple Choice 0 $7.0 million. $5.1 million. $6.4 million. 0 O $5.8 million. O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts