Question: Chart in second pic:) WACC-Book weights Ridge Tool has on its books the amounts and speciic (ater tax) costs shown in the flowing table for

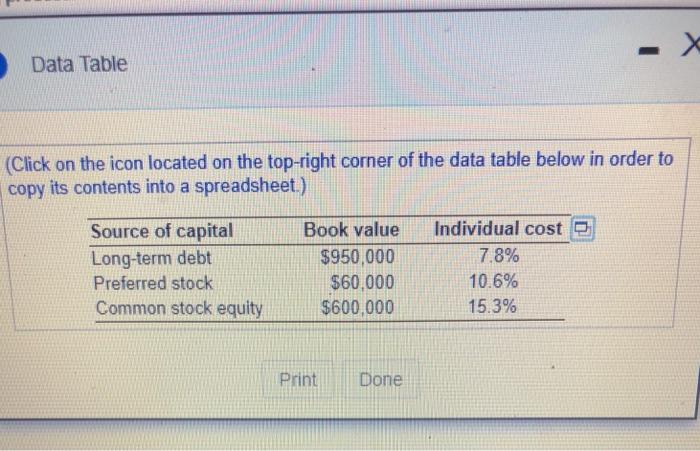

WACC-Book weights Ridge Tool has on its books the amounts and speciic (ater tax) costs shown in the flowing table for each source of capital a. Caloulate the firm's weighted average cosot of capital uing book value weights b. Explain how the 6rm can use this cost in the investment decision making process a. The fiem's weighted average cost of capitaluning book value weights is Round to teo decimal places) b. Explain hoer the firm can use this cost in the inestent decision-making process (Select the best answer below) O A. The WACC is the rate of return that the fem must exceed on long-serm peojects to maintaln the vakoe of the irm The cost of capltal can be compared to the dollar value for a project to determine whether the project s O B. The wAcc is the rate of retun mat the tem must onot exceed on long tem projects to maintaih tre vabe of the 8tm The cot of captal can be compared to the reum for a project to detemine hht rojet O C The WACC is the sate of return that the fem must recelve on long-term projects so maintalin the vakue of the fim The cost of capital can be compared to theetum for a project to determine whethrth project is acceptatie acceptable acceptabile O D. The WACC is the rate of retun that the m must receive on short-em projects to mantsin valee of the fem The cost of capital can be compared to the dolar value for a project to detemine whether the project is Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet) Source of capital Book value Individual cost Long-term debt Preferred stock Common stock equity $950,000 $60,000 $600,000 8% 10.6% 15.3% Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts