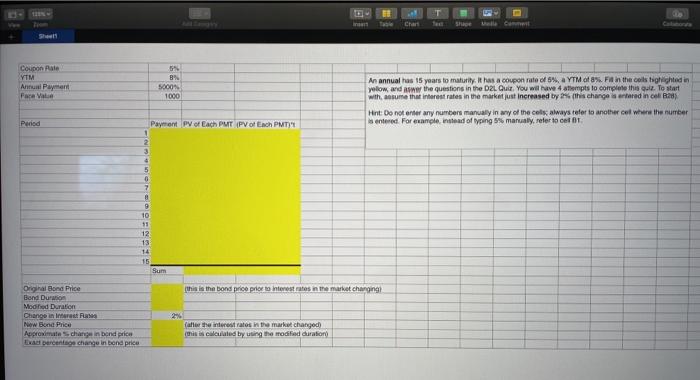

Question: Chart Se Coupon Rate YTM Annual Payment Face Value 5% B% 5600 1000 An annual has 15 years to maturity. It has a coupon rate

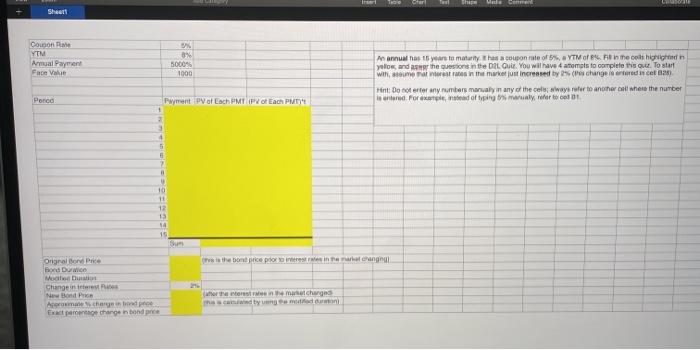

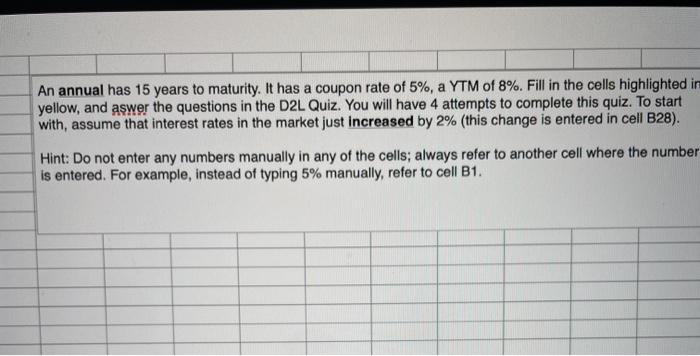

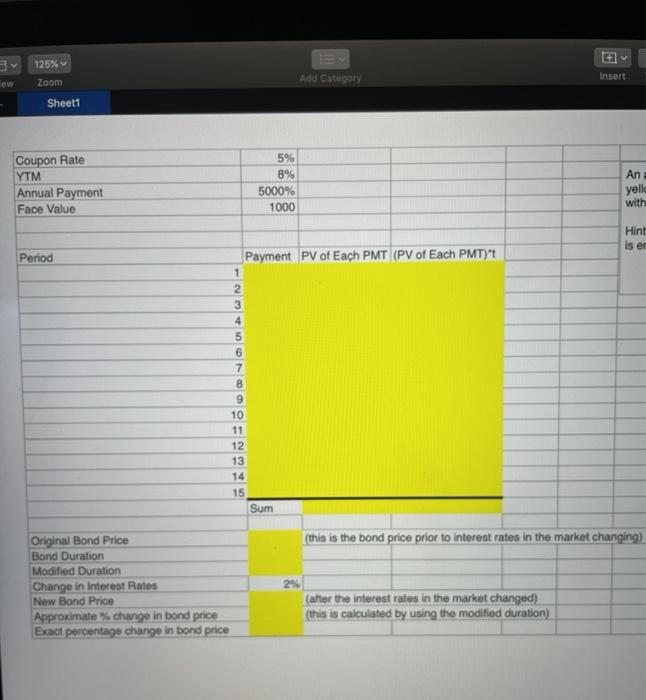

Chart Se Coupon Rate YTM Annual Payment Face Value 5% B% 5600 1000 An annual has 15 years to maturity. It has a coupon rate of 5% a YTM atas. Fill in the costilighted in yelow, and awer the questions in the D2 Quit You will have 4 tiempts to complete this quiz. To start with sume that interest rates in the market just increased by 2 (this changes entered in cola Hint: Do not enter any numbers manually in wy of the cel always refer to another cel where the number entered. For enample, instead of typing manually refer to ed or Period Payment Prof Each PMT (PV of Ench PMTI" 2 3 4 5 0 7 8 9 10 15 12 13 14 15 Sum this is the bond priceprice to interest rates in the market charging Original Bond Price Band Duro Modified Duration Change in ta New Bond Price Approximate change in bond price Eva Dercentage change in bond price 2% far the interest rates in the market changed (This is calculated by using the modified duration Te CE Comon Annual Payment Face Ville 0% SOLO 1000 An annual tears to maturity coupon rate of 5% VTM of the shinin yalios, and the song in the DLG. You will have 4 temos to complete this uz. To start with some time just increased by se changes in cele Hint Docterfer any numbers manual in any of the coway ruler to another call where the number is entered Ford of tingaly refer to od Porco Payment of Each PMI Potach PMD'S 1 5 5 7 19 TI 13 14 15 is the bone per ranging Origo P Boed Du Mucho Change in New Bond Prin charged Exac parte change in bond price she mache An annual has 15 years to maturity. It has a coupon rate of 5%, a YTM of 8%. Fill in the cells highlighted in yellow, and aswer the questions in the D2L Quiz. You will have 4 attempts to complete this quiz. To start with, assume that interest rates in the market just increased by 2% (this change is entered in cell B28). Hint: Do not enter any numbers manually in any of the cells; always refer to another cell where the number is entered. For example, instead of typing 5% manually, refer to cell B1. 125% Insert Add Category low Zoom Sheet1 Coupon Rate YTM Annual Payment Face Value 5% 8% 5000% 1000 An yello with Hint is er Period Payment PV of Each PMT (PV of Each PMT)'t 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Sum (this is the bond price prior to interest rates in the market changing) Original Bond Price Bond Duration Modified Duration Change in Interest Rates New Bond Price Approximate change in bond price Exact percentage change in bond price (after the interest rates in the market changed) (this is calculated by using the modified duration)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts