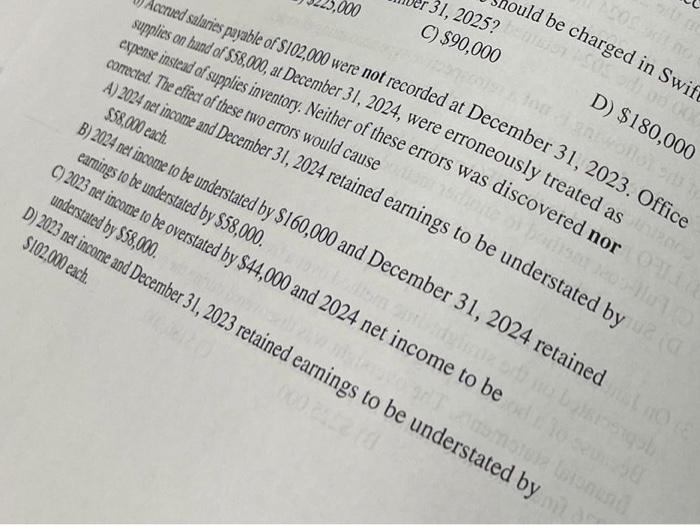

Question: chCredinSHif C) $90,000 D) $180,000 anedsalahespyableofS102.@were not recorded at December 3 1, 2023. Office sunliesonuod0fS58.@, at December 31, 2024, were erroneously treated as ex!rnseinstedofsumlies inventory.

chCredinSHif

C) $90,000 D) $180,000 anedsalahespyableofS102.@were not recorded at December 3 1, 2023. Office sunliesonuod0fS58.@, at December 31, 2024, were erroneously treated as ex!rnseinstedofsumlies inventory. Neither of these errors was discovered nor amted_ Tir effet ofttrse two errors would cause A)2024netimuandmember31, 2024 retained earnings to be understated by B)20NrtiE0toteunderstated by $160,000 and December 31, 2024 retained earnings to tr un&rstated by S58,OOO. and 2024 net income to be unrstated by 2023 retained earnings to be understated by

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts