Question: Check All That Apply According to Markowitz portfolio optimization, if all investors use identical input lists, every investor will compute and hold the same total

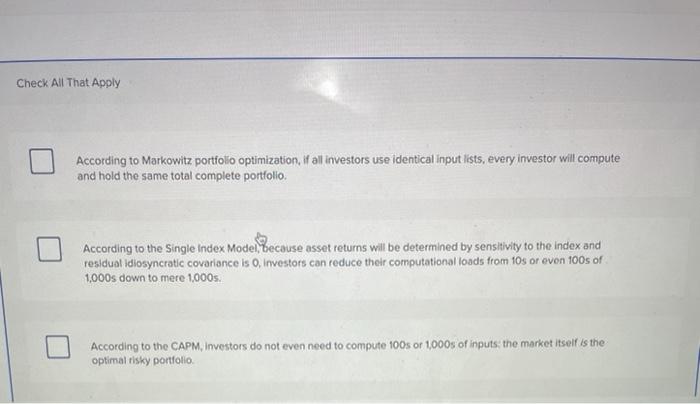

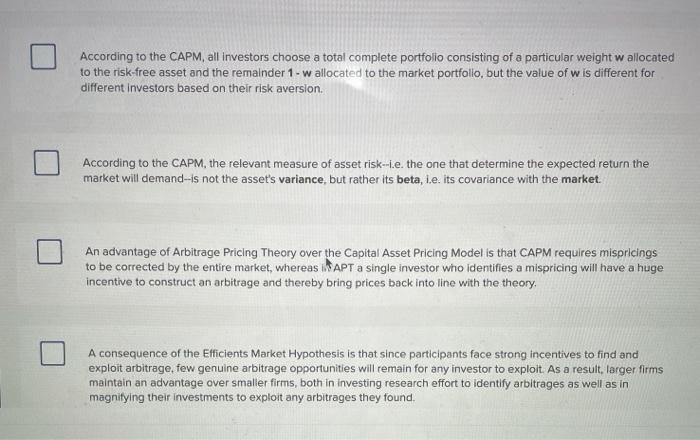

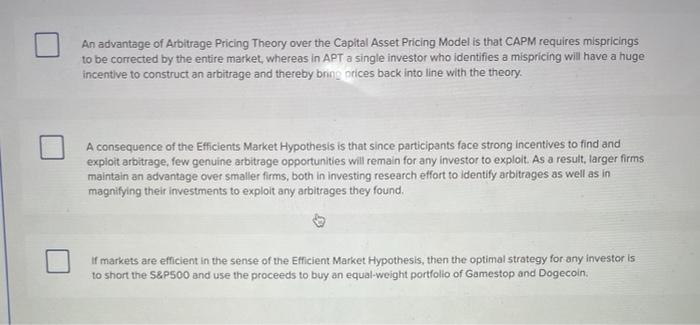

Check All That Apply According to Markowitz portfolio optimization, if all investors use identical input lists, every investor will compute and hold the same total complete portfolio According to the Single Index Model, because asset returns will be determined by sensitivity to the index and residual idiosyncratic covariance is O, investors can reduce their computational loads from 10s or even 100s of 1,000s down to mere 1,000s. According to the CAPM, Investors do not even need to compute 100s or 1000s of inputs: the market itself is the optimal risky portfolio According to the CAPM, all investors choose a total complete portfolio consisting of a particular weight wallocated to the risk-free asset and the remainder 1 - w allocated to the market portfolio, but the value of w is different for different investors based on their risk aversion. According to the CAPM, the relevant measure of asset risk--1.e. the one that determine the expected return the market will demand-is not the asset's variance, but rather its beta, i.e. its covariance with the market. An advantage of Arbitrage Pricing Theory over the Capital Asset Pricing Model is that CAPM requires mispricings to be corrected by the entire market, whereas APT a single investor who identifies a mispricing will have a huge incentive to construct an arbitrage and thereby bring prices back into line with the theory, A consequence of the Efficients Market Hypothesis is that since participants face strong incentives to find and exploit arbitrage, few genuine arbitrage opportunities will remain for any investor to exploit. As a result, larger firms maintain an advantage over smaller firms, both in investing research effort to identify arbitrages as well as in magnifying their investments to exploit any arbitrages they found. An advantage of Arbitrage Pricing Theory over the Capital Asset Pricing Model is that CAPM requires mispricings to be corrected by the entire market, whereas in APT a single investor who identifies a mispricing will have a huge incentive to construct an arbitrage and thereby bring prices back into line with the theory. A consequence of the Efficients Market Hypothesis is that since participants face strong incentives to find and exploit arbitrage, few genuine arbitrage opportunities will remain for any investor to exploit. As a result, farger firms maintain an advantage over smaller firms, both in investing research effort to identify arbitrages as well as in magnifying their investments to exploit any arbitrages they found if markets are efficient in the sense of the Efficient Market Hypothesis, then the optimal strategy for any investor is to short the S&P500 and use the proceeds to buy an equal weight portfolio of Gamestop and Dogecoin

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts