Question: Check if the answers on the Third image are correct. Make any adjustments ONLY IF necessary. (a) Cash .................................................................. 15,000 ...... Accounts Receivable......................................1:14,000 ...... lnventory..........................................................125,000

Check if the answers on the Third image are correct. Make any adjustments ONLY IF necessary.

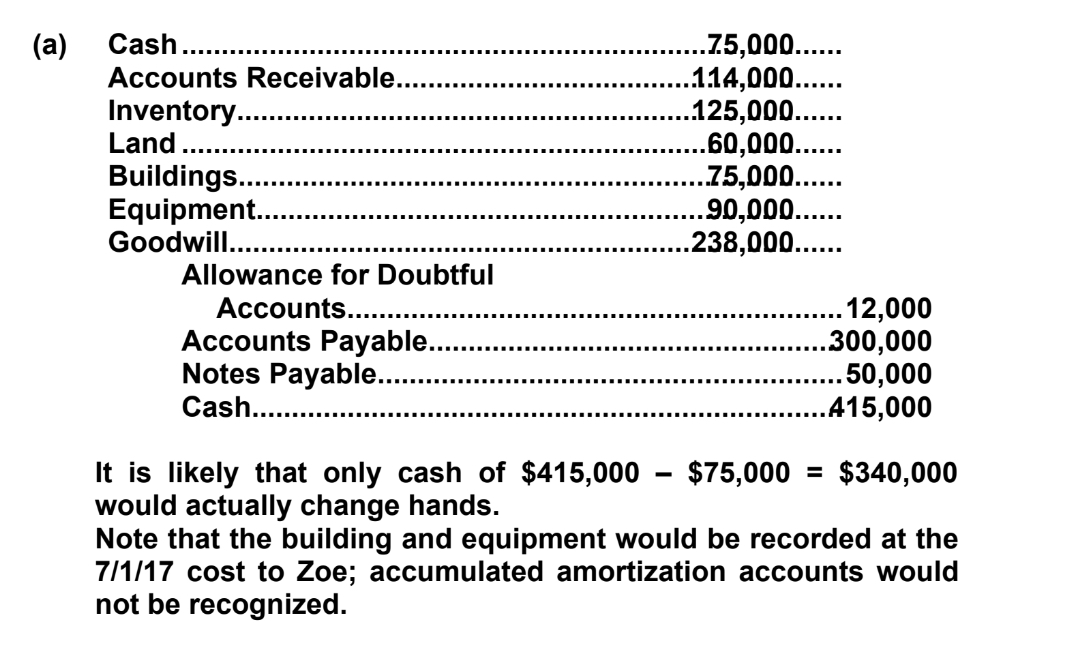

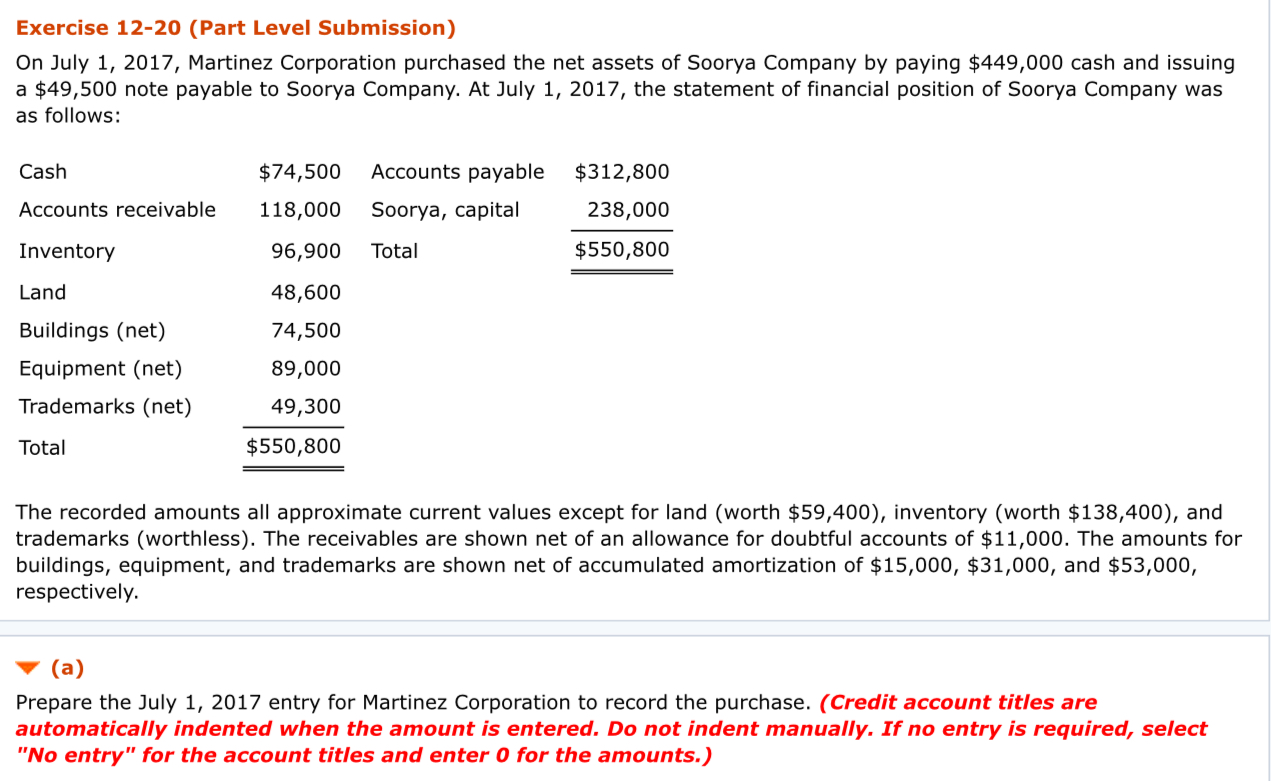

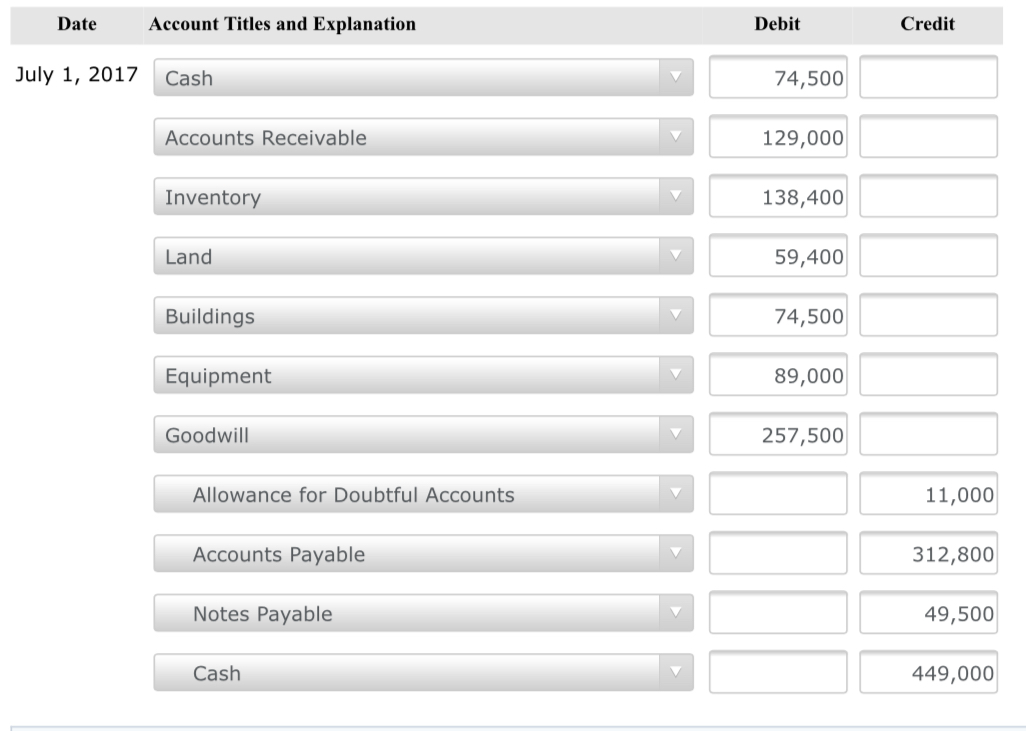

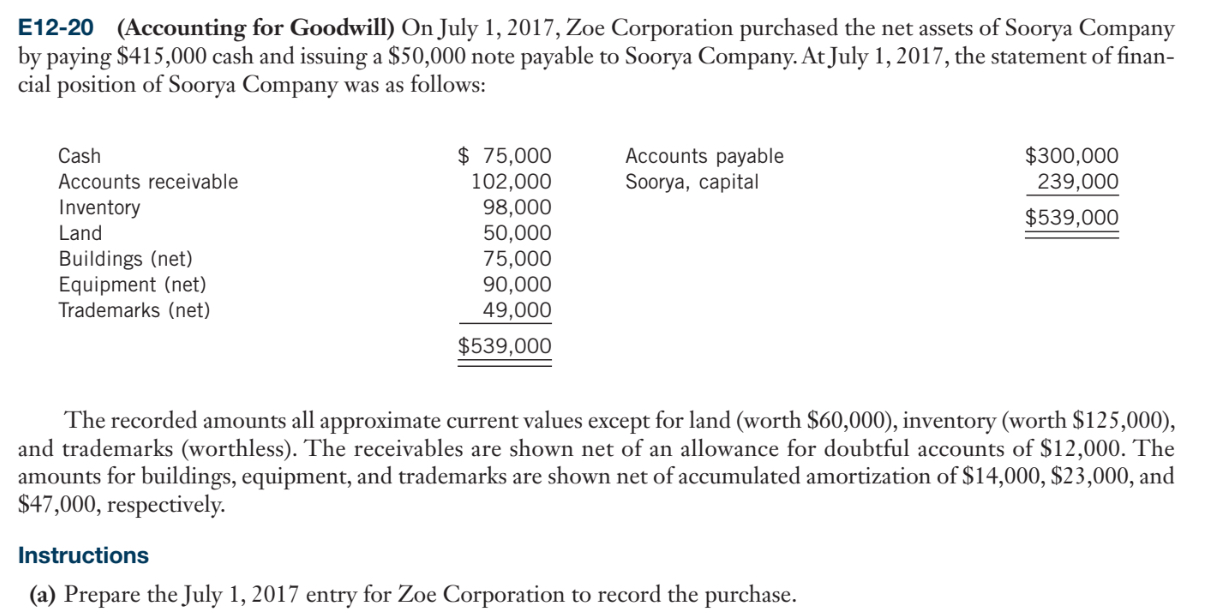

(a) Cash .................................................................. 15,000 ...... Accounts Receivable......................................1:14,000 ...... lnventory..........................................................125,000 ...... Land .................................................................. 50,000 ...... Buildings .......................................................... 15,000 ...... Equipment ........................................................ 90,000 ...... Goodwill .......................................................... 238,000 ...... Allowance for Doubtful Accounts .............................................................. 12,000 Accounts Payable .................................................. 300,000 Notes Payable .......................................................... 50,000 Cash ........................................................................ 415,000 It is likely that only cash of $415,000 - $75,000 = $340,000 would actually change hands. Note that the building and equipment would be recorded at the 7I1I17 cost to Zoe; accumulated amortization accounts would not be recognized. Exercise 12-20 (Part Level Submission) On July 1, 2017, Martinez Corporation purchased the net assets of Soorya Company by paying $449,000 cash and issuing a $49,500 note payable to Soorya Company. At July 1, 2017, the statement of nancial position of Soorya Company was as follows: Cash $74,500 Accounts payable $312,800 Accounts receivable 118,000 Soorya, capital 238,000 Inventory 96,900 Total $550,800 Land 48,600 = Buildings (net) 74,500 Equipment (net) 89,000 Trademarks (net) 49,300 Total $550,800 The recorded amounts all approximate current values except for land (worth $59,400), inventory (worth $138,400), and trademarks (worthless). The receivables are shown net of an allowance for doubtful accounts of $11,000. The amounts for buildings, equipment, and trademarks are shown net of accumulated amortization of $15,000, $31,000, and $53,000, respectively. V (a) Prepare the July 1, 2017 entry for Martinez Corporation to record the purchase. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit July 1, 2017 Cash 74,500 Accounts Receivable 129,000 Inventory 138,400 Land 59,400 Buildings 74,500 Equipment 89,000 Goodwill 257,500 Allowance for Doubtful Accounts 11,000 Accounts Payable 312,800 Notes Payable 49,500 Cash 449,000E12-20 (Accounting for Goodwill) On July 1, 2017, Zoe Corporation purchased the net assets of Soorya Company by paying $415,000 cash and issuing a $5 0,000 note payable to Soorya Company. AtJuly 1, 2017, the statement of nan- cial position of Soorya Company was as follows: Cash $ 75.000 Accounts payable $300,000 Accounts receivable 102.000 Soorya. capital 239.000 Inventory 98.000 Land 50.000 w Buildings (net) 75.000 Equipment (net) 90.000 Trademarks (net) 49.000 $539.00!) The recorded amounts all approximate current values except for land (worth $60,000), inventory (worth $12 5 .000), and trademarks (worthless). The receivables are shown net of an allowance for doubtful accounts of $12,000. The amounts for buildings, equipment, and trademarks are shown net of accumulated amortization of $14,000, $23 .000, and $47,000, respectively. Instructions (2) Prepare the July 1, 2017 entry for Zoe Corporation to record the purchase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts