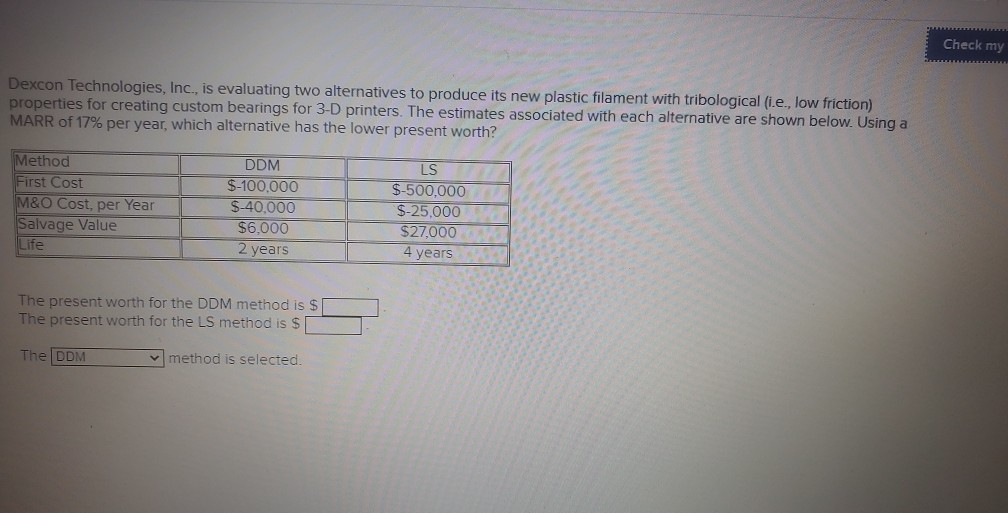

Question: Check my Dexcon Technologies, Inc., is evaluating two alternatives to produce its new plastic filament with tribological (i.e., low friction) properties for creating custom bearings

Check my Dexcon Technologies, Inc., is evaluating two alternatives to produce its new plastic filament with tribological (i.e., low friction) properties for creating custom bearings for 3-D printers. The estimates associated with each alternative are shown below. Using a MARR of 17% per year, which alternative has the lower present worth? Method First Cost M&O Cost, per Year Salvage Value Life DDM $-100,000 S-40.000 $6,000 2 years LS $-500.000 S-25.000 $27,000 4 years The present worth for the DDM method is $ The present worth for the LS method is $ The DDM method is selected

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock