Question: Check My Work (1 remaining) 1 eBook Problem Walk-Through amson Corporation is considering four average-risk projects with the following costs and rates of return: Project

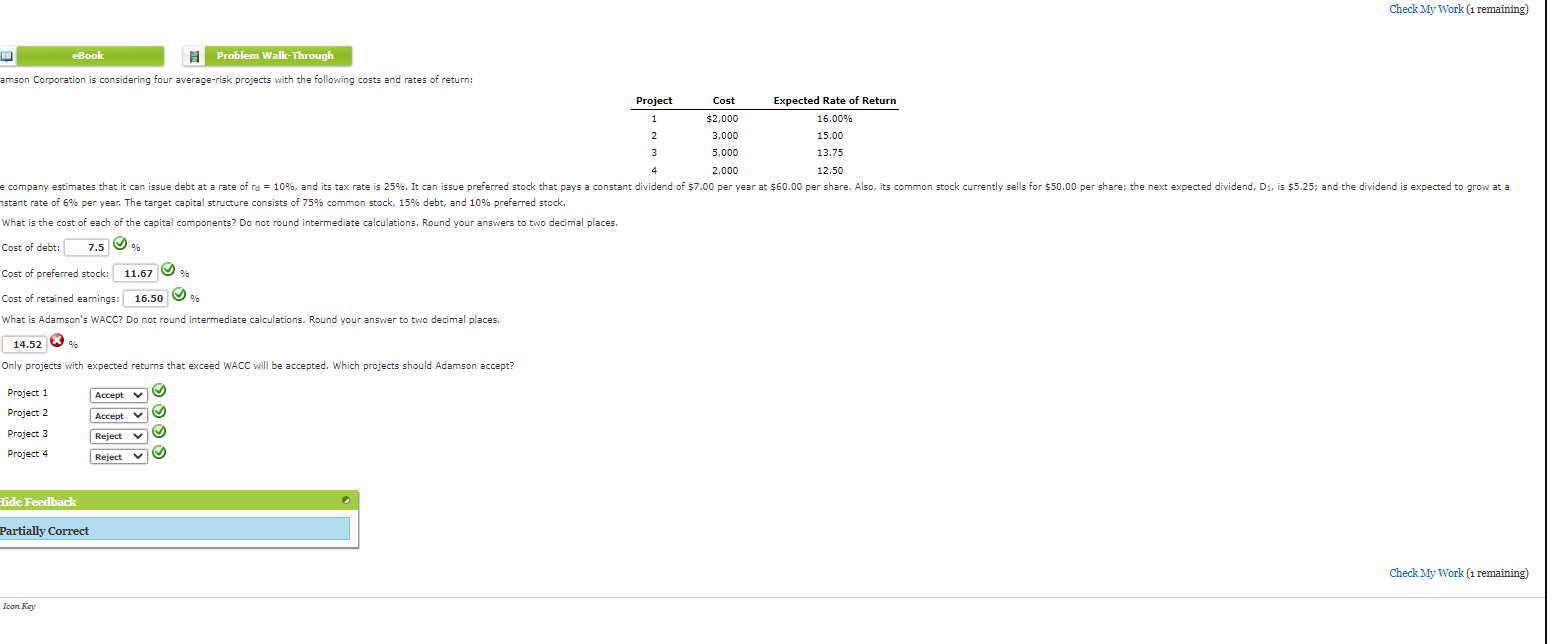

Check My Work (1 remaining) 1 eBook Problem Walk-Through amson Corporation is considering four average-risk projects with the following costs and rates of return: Project Cost Expected Rate of Return 1 $2.000 16.00 2 3,000 15.00 3 5,000 13.75 4. 2.000 e company estimates that it can issue debt at a rate of ra = 10%, and its tax rate is 25%. It can issue preferred stock that pays a constant dividend of $7.00 per year at $60.00 per share. Also, its common stock currently sells for $50.00 per share the next expected dividend, D1, is $5.25; and the dividend is expected to grow at a 12.50 nstant rate of 5% per year. The target capital structure consists of 75% common stock, 15% debt, and 10% preferred stock. What is the cost of each of the capital components? Do not round intermediate calculations. Round your answers to two decimal places. Cost of debt: 7.5 % Cost of preferred stock: 11.67 % Cost of retained earnings: 16.50 : g % What is Adamson's WACC? Do not round intermediate calculations. Round your answer to two decimal places. 14.52 % Only projects with expected returns that exceed WACC will be accepted. Which projects should Adamson accept? Project 1 Accept Project 2 Accept V Reject V Project 3 Project 4 Reject Hide Feedback Partially Correct Check My Work (1 remaining) Icon Key

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts