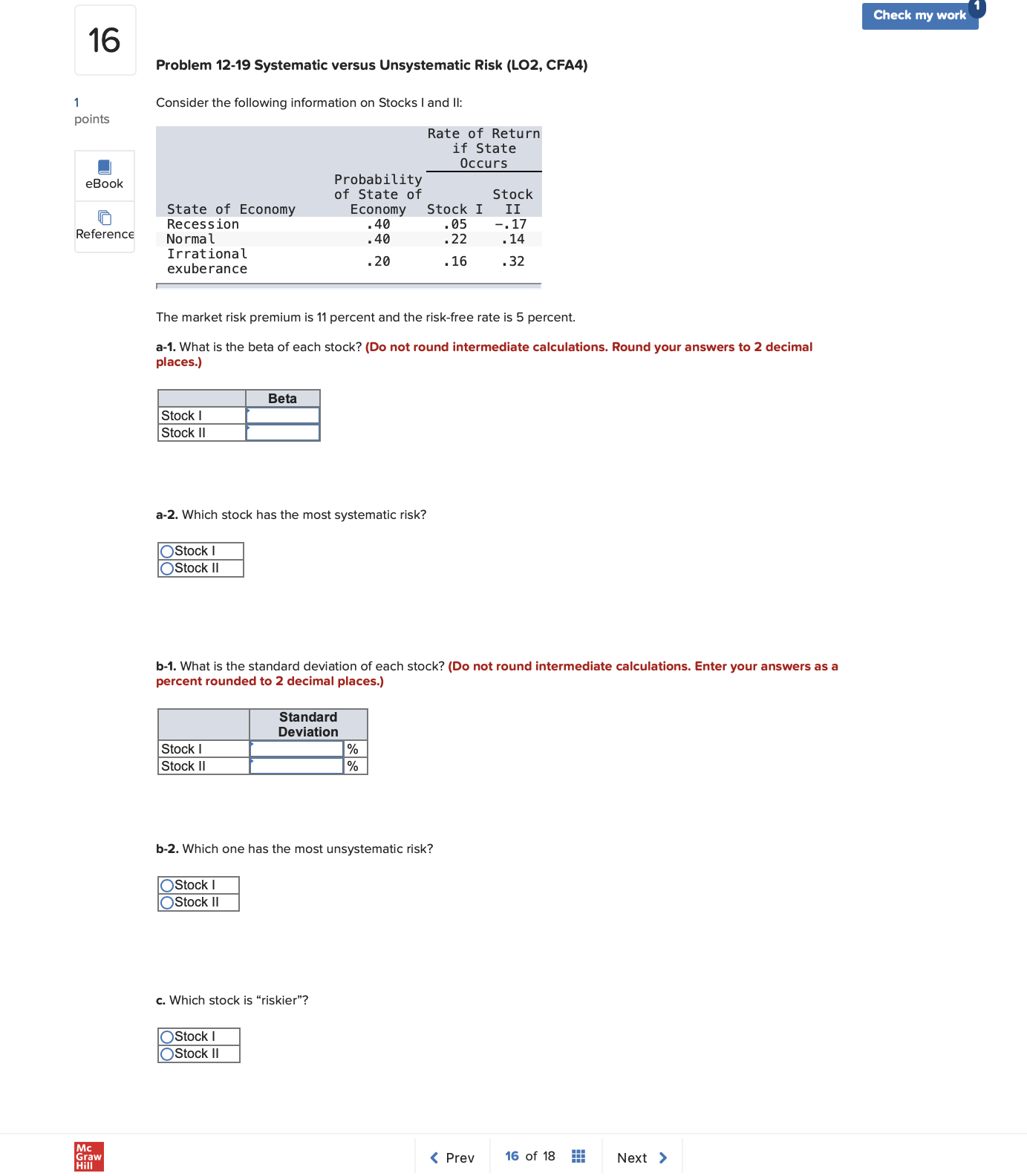

Question: Check my work 16 Problem 12-19 Systematic versus Unsystematic Risk (LO2, CFA4) Consider the following information on Stocks I and II: points Rate of Return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts