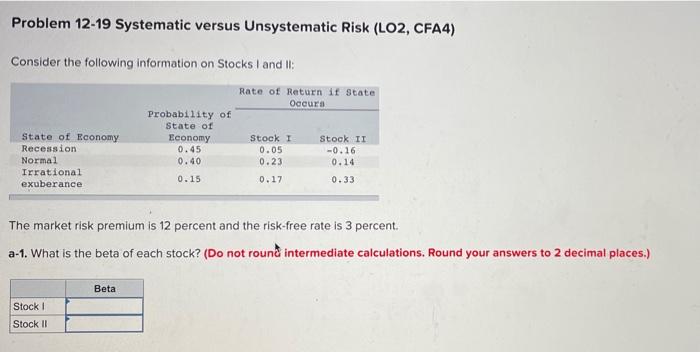

Question: Problem 12-19 Systematic versus Unsystematic Risk (LO2, CFA4) Consider the following information on Stocks I and II: Rate of Return if state Occura Probability of

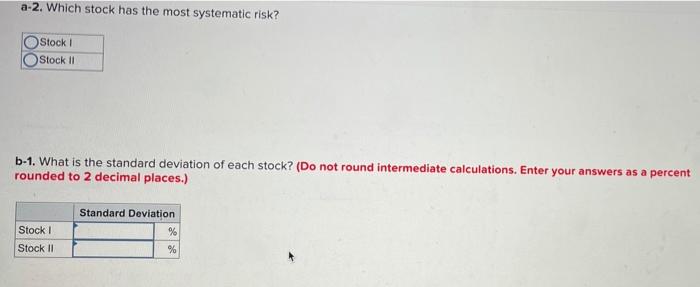

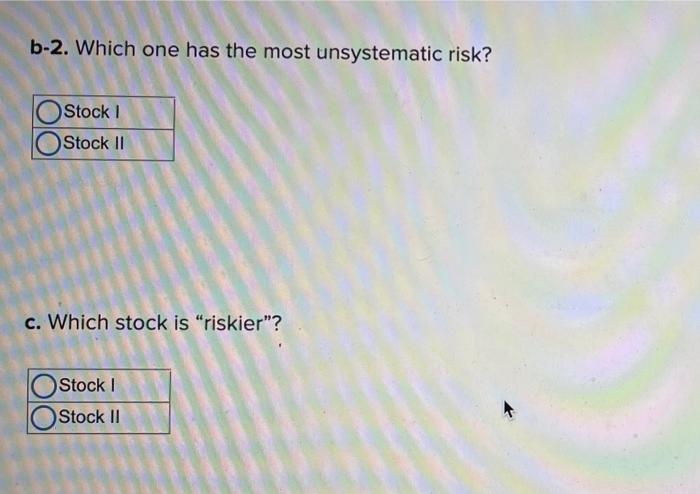

Problem 12-19 Systematic versus Unsystematic Risk (LO2, CFA4) Consider the following information on Stocks I and II: Rate of Return if state Occura Probability of State of State of Economy Economy Stock I Stock II Recession 0.45 0.05 -0.16 Normal 0.40 0.23 0.14 Irrational 0.15 0.17 0.33 exuberance The market risk premium is 12 percent and the risk-free rate is 3 percent. a-1. What is the beta of each stock? (Do not round intermediate calculations. Round your answers to 2 decimal places.) Beta Stock Stock 11 a-2. Which stock has the most systematic risk? Stock Stock 11 b-1. What is the standard deviation of each stock? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Stock 1 Stock 11 Standard Deviation % % b-2. Which one has the most unsystematic risk? Stock 1 Stock II c. Which stock is "riskier"? Stock ! Stock 11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts