Question: Check my work 2 10 points Secure Homes is pondering an opportunity to produce and sell a new smart home monitoring system that can be

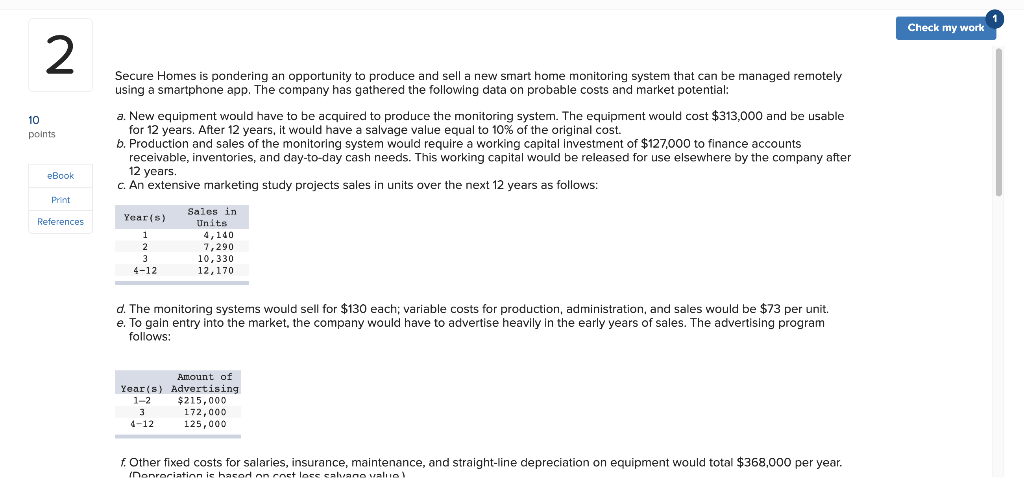

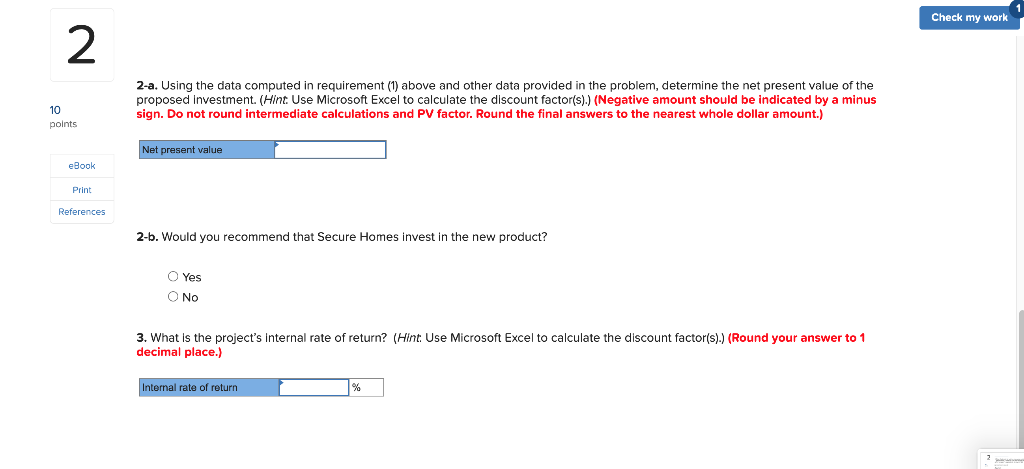

Check my work 2 10 points Secure Homes is pondering an opportunity to produce and sell a new smart home monitoring system that can be managed remotely using a smartphone app. The company has gathered the following data on probable costs and market potential: a. New equipment would have to be acquired to produce the monitoring system. The equipment would cost $313,000 and be usable for 12 years. After 12 years, it would have a salvage value equal to 10% of the original cost. b. Production and sales of the monitoring system would require a working capital investment of $127,000 to finance accounts receivable, inventories, and day-to-day cash needs. This working capital would be released for use elsewhere by the company after 12 years. c. An extensive marketing study projects sales in units over the next 12 years as follows: eBook Print Year(s) References 1 2 3 4-12 Sales in Units 4,140 7,290 10,330 12,170 d. The monitoring systems would sell for $130 each; variable costs for production, administration, and sales would be $73 per unit. e. To gain entry into the market, the company would have to advertise heavily in the early years of sales. The advertising program follows: Amount of Year(s) Advertising 1-2 $215,000 3 172,000 4-12 125,000 f. Other fixed costs for salaries, insurance, maintenance, and straight-line depreciation on equipment would total $368,000 per year. (Nonroriation is hacorl on cnct locs calvano valiol Check my work 2 2-a. Using the data computed in requirement (1) above and other data provided in the problem, determine the net present value of the proposed Investment. (Hint: Use Microsoft Excel to calculate the discount factor(s).) (Negative amount should be indicated by a minus sign. Do not round intermediate calculations and PV factor. Round the final answers to the nearest whole dollar amount.) 10 points Net present value eBook Print References 2-b. Would you recommend that Secure Homes invest in the new product? O Yes O No 3. What is the project's Internal rate of return? (Hint: Use Microsoft Excel to calculate the discount factor(s).) (Round your answer to 1 decimal place.) Internal rate of return % Check my work 2 10 points Secure Homes is pondering an opportunity to produce and sell a new smart home monitoring system that can be managed remotely using a smartphone app. The company has gathered the following data on probable costs and market potential: a. New equipment would have to be acquired to produce the monitoring system. The equipment would cost $313,000 and be usable for 12 years. After 12 years, it would have a salvage value equal to 10% of the original cost. b. Production and sales of the monitoring system would require a working capital investment of $127,000 to finance accounts receivable, inventories, and day-to-day cash needs. This working capital would be released for use elsewhere by the company after 12 years. c. An extensive marketing study projects sales in units over the next 12 years as follows: eBook Print Year(s) References 1 2 3 4-12 Sales in Units 4,140 7,290 10,330 12,170 d. The monitoring systems would sell for $130 each; variable costs for production, administration, and sales would be $73 per unit. e. To gain entry into the market, the company would have to advertise heavily in the early years of sales. The advertising program follows: Amount of Year(s) Advertising 1-2 $215,000 3 172,000 4-12 125,000 f. Other fixed costs for salaries, insurance, maintenance, and straight-line depreciation on equipment would total $368,000 per year. (Nonroriation is hacorl on cnct locs calvano valiol Check my work 2 2-a. Using the data computed in requirement (1) above and other data provided in the problem, determine the net present value of the proposed Investment. (Hint: Use Microsoft Excel to calculate the discount factor(s).) (Negative amount should be indicated by a minus sign. Do not round intermediate calculations and PV factor. Round the final answers to the nearest whole dollar amount.) 10 points Net present value eBook Print References 2-b. Would you recommend that Secure Homes invest in the new product? O Yes O No 3. What is the project's Internal rate of return? (Hint: Use Microsoft Excel to calculate the discount factor(s).) (Round your answer to 1 decimal place.) Internal rate of return %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts