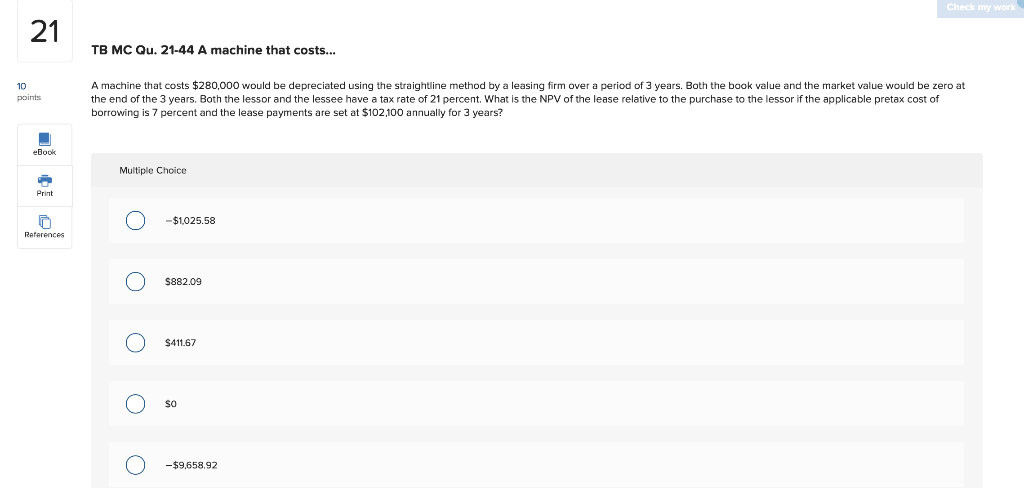

Question: Check my work 21 TB MC Qu, 21-44 A machine that costs... A machine that costs $280,000 would be depreciated using the straightline method by

Check my work 21 TB MC Qu, 21-44 A machine that costs... A machine that costs $280,000 would be depreciated using the straightline method by a leasing firm over a period of 3 years. Both the book value and the market value would the end of the 3 years. Both the lessor and the lessee have a tax rate of 21 percent. What is the NPV of the lease relative to the purchase to the lessor if the applicable pretax cost of borrowing zero at 10 points percent and the lease payments are set at $102,100 annually for 3 years? eBookd Multiple Choice Print -$1025.58 References $882.09 $411,67 SC -$9,658.92

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts